The US$ index closed with a another bearish weekly candle, the third in a row, however Friday’s candle was green following nine bearish days. Friday’s bullish candle was in response to the surprise NFP results where 2 million US jobs were added where a loss of almost 8 million had been expected. Whilst this daily candle has a bullish-reversal Hammer appearance the small body of the candle should urge some caution here; if nothing else. Next week brings the FOMC rate update so watch to see how this impacts the US$ index.

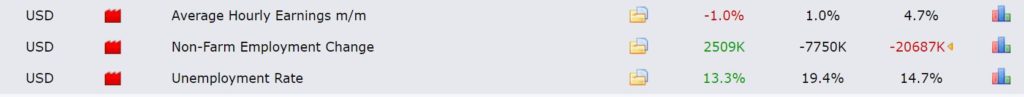

Friday’s NFP data: the jobs added and headline Unemployment rate were better than expected BUT not so for the wages component.

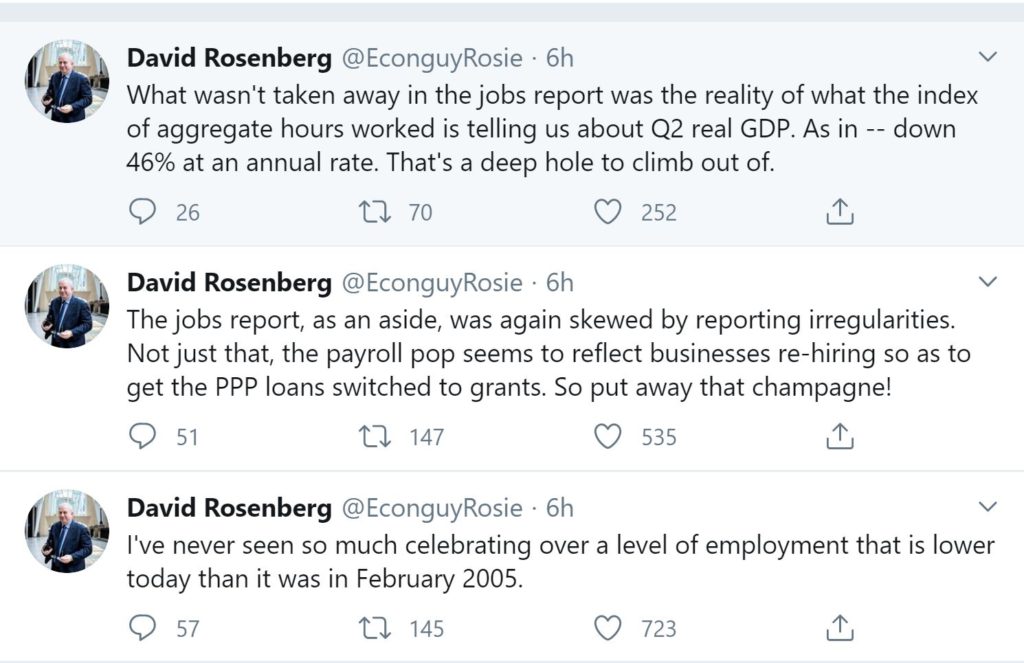

Economist David Rosenberg sums this NFP euphoria up best though, I think, in his third Tweet below:

DXY

DXY weekly: a bearish weekly candle so watch for any push down to the recent Low, circa 95:

DXY daily: Friday’s candle was a bullish-reversal Hammer candle in response to NFP. Watch for any potential pause or relief rally whilst markets digest this latest batch of NFP data:

DXY 4hr: watch for any triangle breakout:

EURX

EURX weekly: a bullish weekly candle and the potential for some further mean-reversion move higher remains here:

EURX daily: Friday’s candle was an indecision Inside candle but watch for any push to the recent High, circa 115.

EURX 4hr: watch for any trend line breakout:

FX Index Alignment: The FX Indices remain aligned for classic risk-on for the currencies. This alignment was in place last week as well and was a great indicator for last week’s bullish EUR/USD action:

- EURX: is above the 4hr Cloud and above the daily Cloud so aligned for LONG EUR$ price action.

- USDX: is below the 4hr Cloud and below the daily Cloud so aligned for SHORT US$ price action.

Calendar: the main event next week is the FOMC rate update.