Last week: I had mentioned over recent weeks that we would need to wait and see the impact of Coronavirus on countries outside of China and last week proved to be a defining and pivotal week in this regard. The risk-off flows out of stocks and into the Yen were akin to the opening of flood gates with the numerous trend line breakouts, from the previous featured patterns, delivering a staggering haul of pips and points. The shift lower for the US$ and Gold caught many by surprise though but, whilst I can’t explain the fundamental reasons for this flight to safety divergence, I can see that there were clear, technically-based trend line breakouts on both that evolved with increased momentum giving traders a warning about these directional moves. These markets remain very volatile and traders need to keep watch for momentum-based trend line breakouts as trading clues and to manage their trade size and risk appropriately.

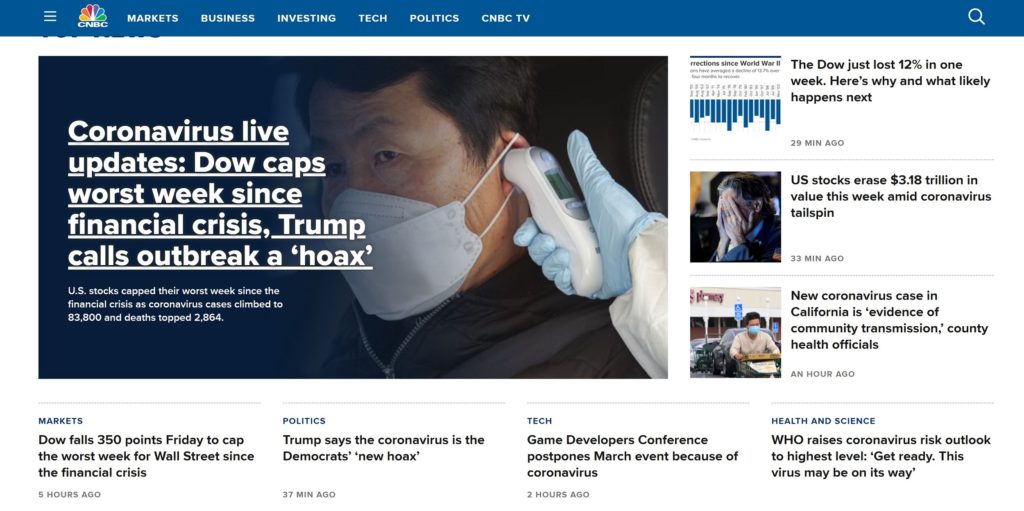

Coronavirus remains a most serious threat, note how Saturday’s CNBC front page was devoted entirely to this topic, but traders need to watch for any Central Bank intervention; the S&P500 actually printed a bullish-reversal Hammer candle for Friday following supportive comments from Fed Chair Powell. There have been further efforts to try to ‘dial down’ fear about the impact of the virus and even President Trump chimed in here. However, weekend reports of the first Covid-19 related death in the USA and Australia might not help abate market concern. With all of this uncertainty, traders need to keep an open mind about the potential for a relief rally, even if only short lived, and watch for momentum-based trend line breakouts;either up or down!

Saturday’s CNBC front page: every issue related to Coronavirus!

Technical Analysis: As noted over recent weeks, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade.

Trend line breakouts and TC signals: There were plenty of trend line breakouts last week although many involved decent gaps at market open. However, increasing Coronavirus fear spurred these on to deliver, in many cases, a staggering number of pips! Articles published during the week can be found here, here, here and here:

- S&P500: a TL b/o for 400 points.

- ASX-200: a TL b/o for 800 points.

- TLT: a TL b/o now up $15.

- Gold: a TL b/o for $35 and another TL b/o for $60 on Friday:

- Gold 4hr: Friday’s chart

- Gold 4hr: chart today

- USD/JPY: a TL b/o for 370 pips.

- AUD/JPY: a TL b/o for 350 pips.

- EUR/USD: a TL b/o for 240 pips.

- GBP/JPY: a TL b/o for 500 pips:

This Week: (click on images to enlarge):

-

- Next weekend: I am away next weekend so the analysis for that period will be brief.

-

- DXY: US$ Index: I had warned last week about the potential for some technical reversal on the US$ index and that is what evolved! The US$ index closed with a bearish weekly candle and and this has generated a bearish-reversal Evening Star formation. Note how price pulled back to the 98 level I had warned about so watch this level for any new make or break: Any US Central Bank Coronavirus-related intervention might help to drag the US$ lower so keep an open mind here:

DXY weekly: a bearish-reversal Evening Star pattern:

-

- EUR/USD: there has been a descending wedge brewing on this pair for many months and there have already been a couple of false breakouts. Is this a case of third time lucky though? The FX Indices both printed weekly chart reversal patterns so I think it might pay to keep an open mind especially, as noted above, if the US Central Bank follows through with any Coronavirus-related intervention.

-

- Central Banks: there are two Central Bank rate updates this week: RBA (AUD) and BoC (CAD).

-

- NFP: it is NFP this week on Friday.

-

- S&P500: A slightly different focus for this chart this week.

S&P500 yearly: keep this latest move lower in perspective:

-

- DJIA monthly: has closed with a bearish monthly candle and under the big 30,000 level and note the print of a bearish-reversal Evening Star pattern. Watch the ADX momentum indicator for clues:

DJIA monthly: a bearish-reversal Evening Star pattern:

-

- NASDAQ composite monthly: has closed with a bearish, essentially engulfing, monthly candle after completing a bullish ascending triangle / Cup breakout. This index has also formed up with a bearish-reversal Evening Star pattern:

NASDAQ monthly: a bearish-reversal Evening Star pattern:

-

- DAX monthly: The DAX closed with a bearish monthly candle. Note that momentum is still declining and converging though:

DAX monthly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index closed with a bearish monthly candle and has broken a 12-month support trend line. Watch for any push down to the 10-year support trend line;

RUT monthly:

-

- Bonds / TLT: The Bonds ETF, TLT, closed with a large bullish monthly candle and above the key 150 level. This marks new territory for the ETF so Elliott Wave extensions may be of use to identify future targets here:

TLT monthly:

-

- VIX: the Fear index closed with a a large bullish weekly candle, made a bullish trend line breakout and finished up near the weekly chart’s 100% Fibonacci and the monthly chart’s 50% Fibonacci. Watch for any push to to the monthly 61.8% level, near 60.

VIX weekly:

VIX monthly:

Calendar: Courtesy of Forex Factory:

Earnings: Courtesy of Earnings Whispers:

Markets:

S&P500: SPX: The S&P500 closed with a large bearish weekly candle following the accelerated risk-off shift that started at market open on Monday. Price gapped lower at open and finished the week down by around 400 points:

S&P500 4hr: this TL b/o gave around 400 points!

The monthly candle had been bullish-coloured at the start of the week but look below to see how this week’s price action impacted here. The resultant large, bearish monthly candle helped to shape up a bearish-reversal Evening Star style pattern here so watch for any follow-through:

S&P500 monthly: note the bearish-reversal style Evening Star pattern here:

It was certainly a bad week for the index with a daily and weekly support trend line being broken. Some perspective is needed though as price, although falling sharply, has only pulled back to the 50% Fibonacci of the 14-month (2019-2020) swing High move (see daily chart). Technical theory suggests the current uptrend would remain intact until the 61.8% fib is breached, and this is down near 2,750 so this will be the level to watch in coming sessions, should price action remain bearish (see daily and weekly charts).

The daily chart also shows how last week’s bearish flow stalled on Friday with the print of a bullish-reversal Hammer candle. This bullish daily candle evolved after supportive comments from US Fed Chair Powell so traders should keep an open mind about the chance of some bullish relief rally, even if only short lived.

Bullish targets: any recovery above 2,950 / 3,000 would bring 3,200 into focus as this is near the 4hr chart’s 61.8% fib.

Bearish targets: any bearish continuation below 2,950 / 3,000 would bring 2.750 into focus as this is near the daily / weekly 61.8% fib.

- Watch 2,950 / 3,000 S/R for any new make or break:

ASX-200: XJO: The ASX-200 closed with a large bearish weekly candle following the accelerated risk-off shift that started on Monday. Price gapped lower at market open and finished down for the week by around 800 points:

ASX-200 4hr: this TL b/o gave around 800 points!

The monthly candle was large and bearish as well, and almost ‘engulfing’, and price action broke below a 12-month support trend line and pulled down to the 6,400 region making this the one to watch for any new make or break.

The move last week was large and bearish and there may be more to come but it is worth keeping this move, as fast as it was, in some perspective. Price action has not quite pulled back to the 50% Fibonacci of the recent 14-month swing High move (2019-2020), circa 6,300, and technical theory would suggest the current uptrend remains intact unless the 61.8% Fibonacci is breached (see daily chart). This daily chart 61.8% level is down near 6,100 so this will be the level to watch in coming sessions, should price action remain bearish.

Bullish targets: Any bullish recovery above 6,400 will bring the pre-GFC High, circa 6,851.50, back into focus as this is up near the 4hr chart’s 61.8% fib level.

Bearish targets: Any bearish break and hold below 6,400 would bring the daily chart’s 61.8% fib, circa 6,100, followed by 6,000 S/R into focus.

- Watch 6,400 for any new make or break:

Gold: What a surprise Gold was last week! With accelerating flight to safety and a retreating US$, Gold not only failed to catch a bid but the price dropped quite heavily. The precious metal closed with a bearish, almost engulfing, weekly candle and a bearish-coloured Spinning Top monthly candle and back below $1,600 S/R. Price closed the week just below thr 4hr chart’s 200 EMA making this the level to watch for any new make or break.

Daily chart Bull Flag details: Recall that there is a broader Bull Flag breakout in progress on Gold (see daily chart below) and this remains at a total gain, thus far, of around $155. The length of the Daily chart’s Bull Flag pole is about $300 and, according to technical theory, this could be the expected move on any bullish Flag breakout (see daily chart). This Bull Flag breakout remains in progress and brings the $1,790 region into focus; this being the target of the $300 Flag pole above the $1,490 breakout level, and this target is up near previous S/R at $1,800 for added confluence.

Bullish targets: any bullish break above the 4hr chart’s 200 EMA would bring $1,600 into focus followed by the 4hr chart’s 61.8% fib, circa $1650.

Bearish targets: any bearish retreat from 4hr chart’s 200 EMA would bring $1,550 S/R into focus.

- Watch the 4hr chart’s 200 EMA for any new make or break:

Oil: Oil price plummeted last week with the accelerated Coronavirus-related risk-off shift printing bearish weekly and monthly candles. Price action ended up back down near $45 S/R making this the level to watch for any new make or break

Bullish targets: any hold above $45 would bring a new 4hr chart bear trend line followed by the recently broken 4-yr TL and, then, $50 S/R into focus as the latter is near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: any bearish break below $45 would bring $40 back into focus.

- Watch $45 for any new make or break:

EUR/USD: The EUR/USD closed with a large bullish weekly candle that helped to shape up bullish-reversal Morning Star weekly pattern; this followed on from last week’s bullish-reversal Hammer weekly candle. The 4hr chart’s trend line channel breakout move, that started late in the previous week, ended up giving a maximum haul of 240 pips:

EUR/USD 4hr: this TL b/o gave 290 pips!

EUR/USD weekly: note the print of a bullish-reversal Morning Star pattern:

Remember that price action is still tracking in a descending wedge on the weekly / daily chart time frame and is currently edging back towards the upper trend line here so watch for any new make or break at this resistance zone. Note how the 24-month wedge trend line aligns near the daily 200 EMA and the 1.11 S/R level for added confluence! For the time being though, watch the 1.10 for any new make or break.

Bullish targets: any bounce up from 1.10 would bring the 24-month wedge TL, daily 200 EMA and 1.11 into focus.

Bearish targets: any bearish break back below 1.10 would bring the 4hr chart’s support TL into focus followed by 1.09 S/R.

- Watch 1.10 S/R for any new make or break:

AUD/USD: The Aussie had another bearish week and closed back down near the 0.65 S/R level making this the one to watch for any new make or break.

The AUD/USD is now only 50 pips above the 0.60 Lows last seen during the 2008-2009 Global Financial Crisis (GFC) so a test of this key support is not out of the question.

Bullish targets: Any bullish bounce off 0.65 S/R would bring 0.66 and the nearby bear trend line followed by 0.67 and, then, the 4hr chart’s 61.8% fib, near 0.68, into focus.

Bearish targets: Any bearish break below 0.65 would bring the bottom weekly wedge TL followed by 0.60 into focus.

- Watch 0.65 S/R for any new make or break:

AUD/JPY: The AUD/JPY closed with a large bearish weekly candle and the trend line breakout move, from the last week’s featured triangle pattern, gave up to 350 pips:

AUD/JPY 4hr: this TL b/o gave 350 pips!

The risk-off shift into the Yen and out of stocks took this pair along for a long ride and all the way down to the 70 S/R level making this the main horizontal level to watch for any new make or break. Price action is also down near an 11-year support trend line so this is a major region to watch for any new shift.

NB: as per previous weeks, AUD/JPY traders should keep an eye on the broader stock market as this currency pairs often trades in tandem with stock market sentiment. A stock market pullback might take the AUD/JPY along for the ride: how true this warning ended up being!

Bullish targets: Any bullish bounce up from 70 S/R and the 11-yr TL would bring the 4hr chart’s 50% fib of the recent swing Low, near 72, into focus followed by 73 S/R.

Bearish targets: Any bearish breakout below 70 S/R and the 11-yr TL would bring whole-number levels on the way down to 60 S/R into focus.

- Watch 70 S/R and the 11-yr TL for any new make or break:

NZD/USD: The Kiwi closed with bearish weekly and monthly candles and back down near the 0.625 S/R level and the 20-yr support trend line making these the levels to watch for any new make or break.

Unlike the Aussie however, the Kiwi is a fair way above its GFC Lows, circa 0.50, so watch this region if price action continues to fall.

Bullish targets: any bullish bounce up from 0.625 S/R would bring 0.63 and 0.64 into focus followed by 0.65, the daily 200 EMA and 0.66 S/R level.

Bearish targets: Any bearish break below 0.625 S/R would bring 0.60 S/R into focus followed by 0.50 S/R.

- Watch 0.625 S/R for any new make or break:

GBP/USD: The Cable closed with a bearish weekly candle and back down near 1.28 S/R. I’m struggling to read any decent technical set up on this pair so think it might be better left until one develops. The best I can offer at the moment is to monitor key horizontal S/R levels.

Bullish targets: Any bullish bounce up from 1.28 would bring 1.30 into focus.

Bearish targets: Any bearish break below 1.28 would bring 1.27 and 1.26 into focus.

- Watch 1.28 for any new make or break:

USD/JPY: The USD/JPY closed with a large bearish, almost engulfing, weekly candle and, in doing so, gave a trend line breakout move out of last week’s posted chart pattern worth up to 370 pips:

- UJ 4hr: last week’s chart pattern

- UJ 4hr: a 370 pip b/o move!

Price action ended the week back near 108 S/R making this the level to watch for any new make or break.

Bullish targets: Any bullish bounce up from 108 would bring 110 into focus as this is near the 4hr chart’s 50% fib and 5-year trend line. After that, watch other whole number levels on the way up to 115 S/R.

Bearish targets: Any bearish break below 108 would bring an 8-yr support trend line followed by 105 into focus (see weekly chart).

- Watch 108 for any new make or break: