Last week: US$ weakness evolved last week and this underpinned some trend-line breakout trades. Any developing US$ weakness would help to support the risk-on style shift seen across numerous Forex pairs and Gold. There were plenty of decent-sized bullish weekly candles printed across a range of stock indices and Forex pairs and it seems that the broader markets might be adjusting to the prospect of either political party taking the White House in the upcoming US Presidential election. US stimulus remains a vexed issue though so traders should keep abreast of any related news as this may greatly impact the US$ and risk sentiment. US Earnings season gets under way this week so keep an eye on the big names as they report.

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts summary: US$ weakness continued last week and accelerated on Friday to trigger some decent trend-line breakout trades. Articles published during the week can be found here, here, here and here:

- EUR/USD: a TL b/o from for 40 pips.

- GBP/JPY: a TL b/o from for 70 pips.

- ASX-200: a TL b/o from for 160 points.

- S&P500: a TL b/o from for 60 points.

- AUD/USD: a TL b/o from for 60 pips:

- GBP/USD: a TL b/o from for 90 pips:

- NZD/USD: a TL b/o from for 50 pips:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The index closed with a bearish weekly candle and continues to hold below the recently broken 10-yr support trend line. There has been a recent break below a daily-chart support trend line so watch for any further weakness and break below the daily Ichimoku Cloud. Any US$ index break and hold below the daily Cloud would help to underpin the moves that recently started on Gold, AUD/USD, NZD/USD, GBP/USD and other commodities:

DXY daily: watch for any momentum-based break of the daily Cloud:

-

- Schedule for weekend Market Update posts: The Weekly Market update has, to date, been posted on a Sunday, Australian time. I am looking to delay the release of this update to a Monday, Australian time, which is still a Sunday in many other parts of the world. My analysis takes a full day to complete and I am attempting to shift this load away from my weekend time.

-

- Multi-year trend lines: As noted recently and the caution remains valid: multi-year trend lines have been tested / broken on a number of instruments: The FX Indices (DXY and EURX) and the EUR/USD, AUD/USD, NZD/USD, AUD/JPY, GBP/USD and GBP/JPY. Caution is still required here though as trend lines of such duration are often not given up easily so traders should watch for any potential choppiness / consolidation as these levels are negotiated. Many of these levels are still back being tested and some have been tested and recovered.

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

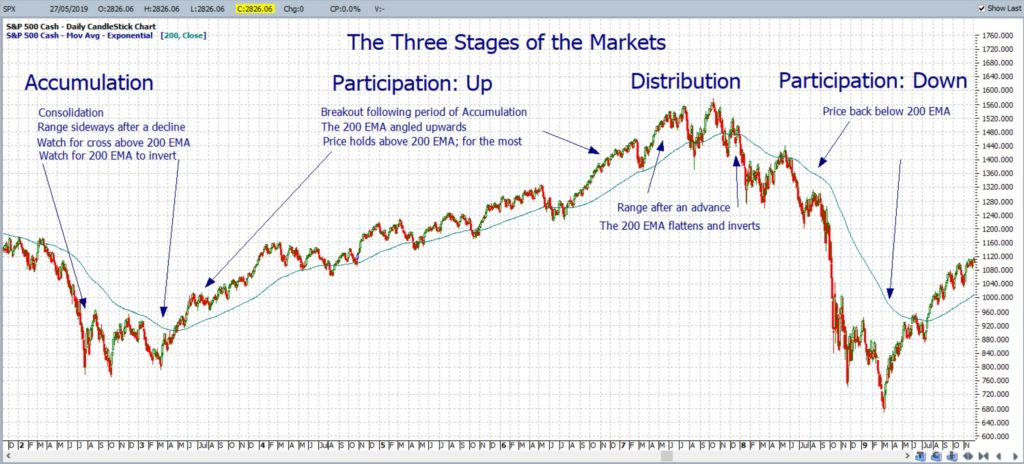

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 has pulled back from its latest all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed with a bullish weekly candle and back above the 3 level. Price action also continues holding above the 10-year bear trend line:

Copper weekly: back above the 3 level;

-

- Emerging Markets: The Emerging market ETF, EEM, has closed with a large bullish weekly candle and looks to have made a Bull Flag: breakout:

EEM weekly: back above 45 level AND looks to have made a Bull Flag breakout:

-

- DJIA: The DJIA closed with a bullish weekly candle supporting the Bull Flag breakout. Watch for any continuation here as the key 30,000 level lies just ahead:

DJIA weekly: watch for any continued Bull Flag:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bullish weekly candle and the Bull Flag looks to have won out. Watch for any test of the recent High, near 12,000.

NASDAQ weekly: the Bull Flag seems to have won out:

-

- DAX weekly: The DAX closed with a bullish weekly candle so watch for any push to the recent High.

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and closed with a bullish weekly candle and looks to have made a Bull Flag breakout. Watch for any push to the all-time High region, circa 1,720.

RUT weekly: watch for any push to 1,720:

-

- Bonds / TLT: The Bond ETF, TLT, gapped down and closed with a bearish weekly candle. The Elliott Wave indicator is still suggesting an uptrend from here for the time being:

TLT weekly: drifting lower:

-

- VIX: the Fear index closed with a bearish weekly candle and remains below the key 30 level. Watch for any new momentum-based trend line breakout.

VIX weekly: watch for any new trend line breakout:

Calendar: Courtesy of Forex Factory: Note the holiday Monday for the USA and Canada:

Earnings: Courtesy of Earnings Whispers: Earnings season starts this week:

Market Analysis:

S&P500: The S&P500 index closed with a bullish weekly candle and looks to have made a bullish breakout from the weekly chart’s Bull Flag. Trading volume was lower last week and remains below the 200 SMA and trend line so watch for any uptick here; either up or down:

S&P500 ETF: SPY weekly: Watch for any uptick with Volume:

Price action on the S&P500 closed just below 3,500 so that will be the horizontal level in focus for any new make or break.

As noted recently: The weekly S&P500 chart below shows that the 61.8% Fibonacci level of this recent swing-High move (March 2020- September 2020) is down near the 2,700 region. Technical analysts would suggest that a pullback to this 61.8% level would be in order; even if there is to be ultimate bullish continuation. Trends do not travel in straight lines unabated so traders should be aware of this zig-zag potential.

Bullish targets: any bullish 4hr chart trend line breakout above 3,500 would bring the whole-number 3,600 level, just above the all-time High, into focus.

Bearish targets: any bearish 4hr chart trend line breakout would bring 3,400 back into focus followed by whole number levels on the way down to the weekly chart’s 61.8% Fibonacci, near 2,700.

- Watch the 4hr chart’s triangle trend lines for any new breakout:

ASX-200: XJO: The ASX-200 closed with a bullish ‘engulfing‘ weekly candle and back up under the weekly 61.8% Fibonacci; a resistance level that has been in force now since June 2020. Trading volume remains subdued though and below the trend line and 200 SMA moving average for the time being.

XJO weekly: trading volume remains subdued:

Price action broke up through the psychological 6,000 level last week and looks to be headed to test the recent High region, near 6,200 and weekly 61.8% Fibonacci, so this will be the resistance zone in focus this week. The index closed right near the 6,100 level so this will be the proximal level to watch for any new make or break.

Bullish targets: Any bullish 4hr chart trend line breakout above 6,100 will bring the recent High, near 6,200, followed by whole number levels on the way back to the previous all time High, circa 7,200, into focus.

Bearish targets: Any bearish 4hr chart break below the support trend line would bring 6,000, 5,900 and 5,800 into focus.

- Watch 6,100 S/R and for any new 4hr chart trend line breakout:

Gold: Gold closed with a bullish weekly candle and back above the key $1,900 level. There has been a bullish breakout from the daily chart’s Bull Flag so watch for any continuation to test the key $2,000 level.

As mentioned over recent weeks: the weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is back trading above this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any hold above $1,900 would support the Cup pattern thesis.

- Any new move move back below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming days / weeks especially as the US$ index hovers near the recently broken 10-year support trend line:

- any US$ move and hold back below the multi-year support trend line could help send Gold higher.

- any US$ hold back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

Bullish targets: any continued bullish 4hr chart trend line breakout would bring $2,000 S/R into focus.

Bearish targets: any bearish 4hr chart retreat from current levels would bring $1,900 back into focus followed by the daily chart’s bottom Flag trend line and, then, $1800.

- Watch for any continued 4hr chart trend line breakout:

EUR/USD: The EUR/USD closed with bullish weekly candle and continues to hold above the recently broken 13-year bear trend line.

Price action closed the week just below 1.1835 making this the horizontal region to keep watch for any new make or break.

As mentioned last week: I have been warning for weeks that these major trend lines are not given up easily and so traders need to watch this region closely in coming sessions as it looks to be forming up into some decent support.

Bullish targets: Any bullish 4hr chart breakout above 1.1835 would bring 1.19 into focus followed by whole-number levels on the way up to the previous weekly chart High, circa 1.26.

Bearish targets: Any bearish 4hr chart break of support would bring the 13-year bear trend line back into focus.

- Watch 1.1835 for any new make or break:

AUD/USD: The Aussie closed with a bullish weekly candle and still has the look of a Bull Flag on the daily chart.

There are revised 4hr chart triangle trend lines to monitor for any new momentum-based trend line breakout.

Keep in mind, too, that price action continues to hold above the recently broken upper trend line of the multi-year bullish-reversal Descending Wedge.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 0.73 and 0.74 into focus.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 0.72, 0.71, 0.70 and, then, the recently broken 9-11 year bear trend line into focus.

- Watch for any new 4hr chart trend line breakout:

AUD/JPY: The AUD/JPY closed with a bullish weekly candle and there is still the look of a Bull Flag on the weekly chart. Price action is back up near the the multi-year trend line so this will be in focus in coming sessions.

There are also revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart trend line breakout above the 7-yr trend line would bring 77 and 78 S/R into focus.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 76 and 75 into focus followed by whole-numbers on the way down to 65 S/R.

- Watch for any new 4hr chart trend line breakout;

NZD/USD: The Kiwi closed with a small bullish weekly candle having a long lower shadow revealing that buyers stepped in here after the initial selling. Price action also continues to hold above the recently broken 7-yr trend line for now.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr trend line breakout above 0.67 would bring 0.68 into focus.

Bearish targets: Any bearish 4hr chart break of the support trend line would bring 0.66 into focus followed by the 7-yr TL.

- Watch 0.67 and for any 4hr chart trend line breakout:

GBP/USD: The Cable closed with a bullish weekly candle and seems to have embarked on a bullish 4hr chart triangle breakout. Price action is just below the 1.305 level so this is the one to watch for any new make or break.

Bullish targets: Any continued bullish 4hr chart triangle breakout above 1.305 would bring 1.32 into focus as this is near the 4hr chart’s 61.8% Fibonacci. After that, the recent High, near 1.35, would come back into focus.

Bearish targets: Any bearish 4hr chart respect of 1.305 would bring 1.30 into focus followed by the 7-month support trend line.

- Watch for any continued 4hr chart triangle breakout above 1.305:

USD/JPY: The USD/JPY closed with a small bullish weekly candle and there are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout, above 106, would bring 107 into focus followed by whole-number levels on the way up to the recent High, near 112.

Bearish targets: Any bearish 4hr trend line breakout would bring 105 and 104 S/R into focus followed by whole-number levels on the way down to 100 S/R.

- Watch for any new 4hr chart triangle breakout:

GBP/JPY: The GBP/JPY closed with another bullish weekly candle and looks to be embarking on a bullish 4hr chart triangle breakout. The bigger level to keep in focus here, though, is the looming 40-year trend line that lies just above current price.

Bullish targets: Any continued bullish 4hr chart triangle breakout above 138 would bring 139 into focus as this is near the 4hr chart’s 61.8% Fibonacci. After that, watch the 140 level and 40-yr trend line region.

Bearish targets: Any bearish 4hr retreat from 138 would bring whole-numbers on the way down to 130 S/R into focus.

- Watch for any continued 4hr chart triangle breakout above 138: