The US monthly jobs report is not released until Friday but the ADP private sector report released last session showed a significant decline and this has resulted in a weaker US$. This shift helped to boost the commodity currencies and develop the descending wedge b/o on the EUR/USD. Caution is needed ahead of Friday’s NFP though.

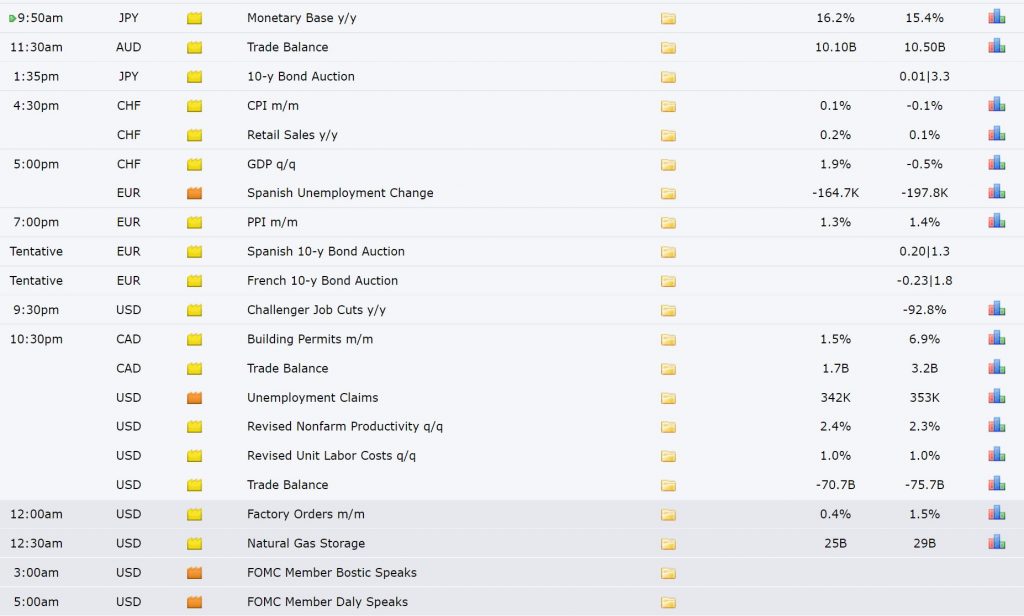

Data:

DXY weekly: revised trend lines due to declining and converging momentum:

Trend line breakouts:

EUR/USD:

EUR/USD 4hr: this wedge b/o seems to be unfolding. It has been messy though! It might sail better IF / WHEN the 1.19 level can be cleared???

EUR/USD 30 min: no system is perfect and a range b/o trade would have failed here last session. Closely followed by a better signal though FWIW.

AUD/USD:

AUD/USD 4hr: a new TL b/o for up to 50 pips:

AUD/USD 30 min: note how this TL b/o triggered in the early European session for a great short-term trade; by those who trade this session that is!

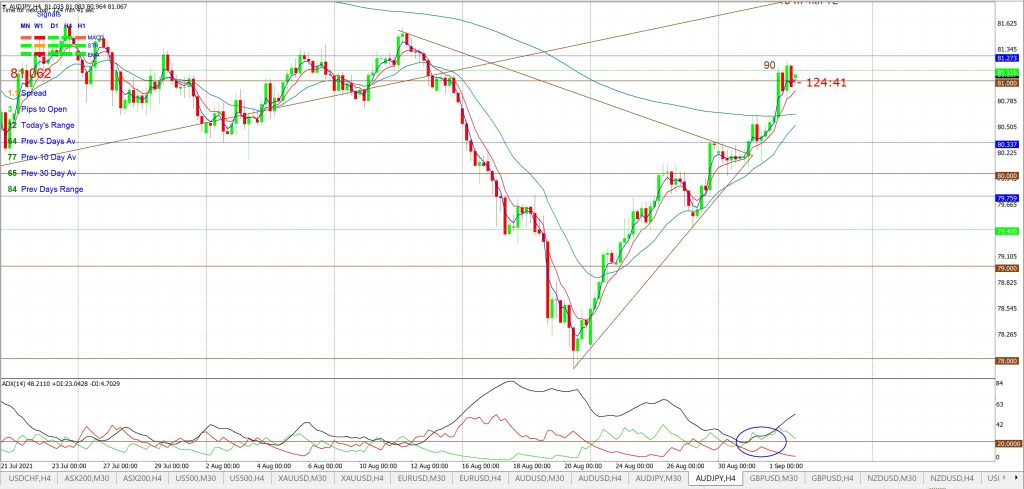

AUD/JPY 4hr: this TL b/o is now up to 90 pips:

NZD/USD 4hr: this TL b/o is now up to 90 pips:

Other markets:

S&P500 4hr: watch for any new TL b/o:

ASX-200 4hr: watch for any new TL b/o:

Gold 4hr: watch for any new TL b/o:

GBP/USD 4hr: watch for any new TL b/o:

USD/JPY 4hr: very choppy BUT watch for any new TL b/o:

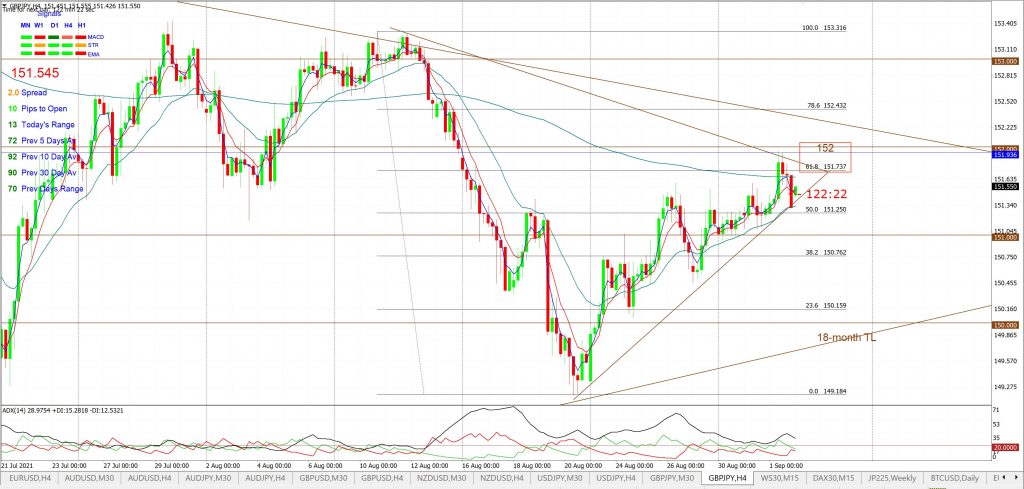

GBP/JPY 4hr: this has also been very choppy BUT watch for any new TL b/o: