The US$ continues to struggle under the 100 level and the index will close with a large and bearish weekly candle. Risk appetite remains buoyed for the time being so it is not enjoying any flight to safety movement. Watch to see how this week’s ECB rate update impacts the FX indices.

Data: I see technical reasons for a dip with the US$ BUT recent data is helping that cause too:

DXY

DXY monthly: this chart has not updated for Friday’s data but the monthly candle will close as bearish and below the key 100 level. This remains a HUGE barrier for the index:

DXY weekly: note the large bearish weekly candle and triangle breakout:

DXY daily: Price action has pulled back to the 61.8% fib near 98 so watch this level for any new make or break:

DXY 4hr: any relief rally from the 98 level would bring 99 into focus:

EURX

EURX weekly: the index closed with a large bullish weekly candle but watch to see how this week’s ECB rate update might impact here:

EURX daily: note how price action has reached up to the 61,8% fib so watch this level for any new make or break:

EURX 4hr: any pause or pullback here could bring the 110 S/R level back into focus:

FX Index Alignment: The FX Indices are aligned for classic risk-on for the currencies BUT watch for any shift after this week’s ECB:

- EURX: is above the 4hr Cloud and above the daily Cloud so aligned for LONG EUR$ price action.

- USDX: is below the 4hr Cloud and below the daily Cloud so aligned for SHORT US$ price action.

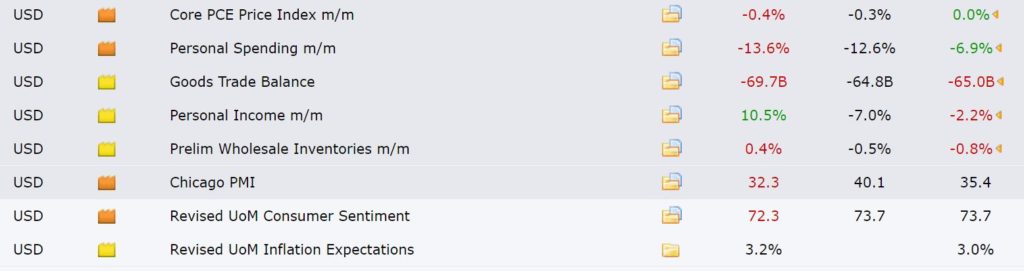

Calendar: note there are three Central Bank rate updates ( RBA, BoC & ECB) and NFP to monitor in the coming week: