Fri 1st Aug (5.40 pm)

There were significant losses across US stocks last night but I want to put these moves into greater perspective. There was a warning even before last night’s carnage with one of the ‘bellwether’ stocks, UPS, falling below a weekly support trend line. The week has still not closed for this stock but it looks likely to close the week out below this support:

Of interest is that another ‘bellwether’, the Russell 2000 ‘small cap’ index, has managed to hold up so surprisingly well. The 1,100 level will be key to watch here tonight:

S&P500: this fell heavily BUT is still above daily and weekly support trend lines:

S&P500 daily:

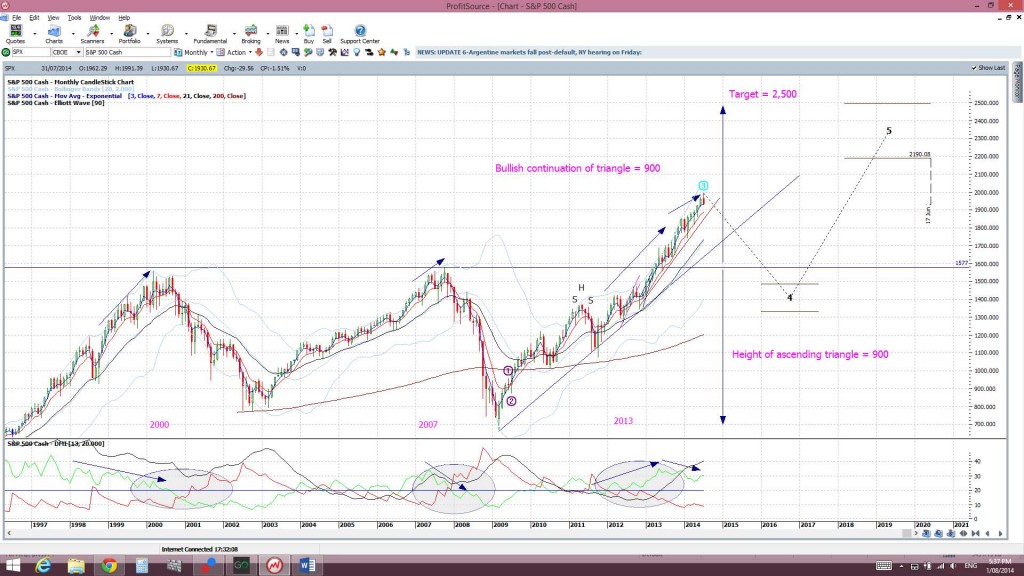

S&P500 monthly: Note the bearish July monthly candle, the first after 5 bullish months. There may well be a pull back before bullish continuation though, as Elliott Wave Theory suggests:

S&P500 Daily Cloud: the Tenkan/Kijun lines have now fused and price has dipped into the Cloud. The question here now is will the Cloud act as any support for this index?

DJIA: this fell heavily too but, like the S&P500, is holding above daily and weekly support for now:

DJIA daily:

DJIA monthly: this, too, has printed the first bearish candle after 5 bullish months.

DJIA monthly Cloud: Unlike the S&P500 this index is actually back below the Cloud but no bearish Tenkan/Kijun cross just yet:

NASDAQ: this has slipped below the 4,400 support level and is a warning:

VIX: this index has attempted to break up through the weekly bear trend line. It is still below the 20 level for now but the chart pattern does not bode well for stocks:

USDX: the USD index is currently attempting the 81.50 level and a break and hold above this level to see out the week would be very bullish:

There is crucial NFP data later tonight and good news there might help to achieve this USD index breakout. It remains to be seen if any such good news will be read and processed that way with stocks though!