The US$ index has closed with a bullish weekly candle despite the miss the NFP. Momentum remains low on the weekly and daily charts though so watch upper resistance levels for further clues. The FX Indices are aligned for risk-off though so this is worth noting.

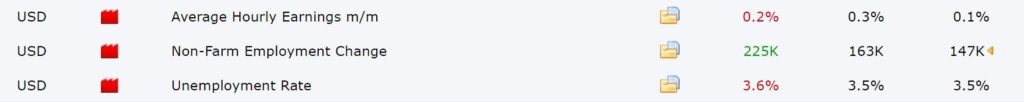

NFP: the jobs added component was strong but the headline rate and the wages components were disappointing:

DXY

DXY weekly: a bullish weekly candle but note the low momentum:

DXY daily: watch for any resistance at the recent High, circa 96.65, and note the low momentum here too:

DXY 4hr: any weakness would bring the 98 level back into focus as this is near the 50% fib:

FX Index Alignment: The FX Indices are aligned for classic risk-of for currencies:

- EURX: is below the 4hr Cloud and below the daily Cloud so aligned for weak EUR$ price action.

- USDX: is above the 4hr Cloud and above the daily Cloud so aligned for strong US$ price action.

Calendar: US Retail Sales will be in focus next week: