The daily shift between risk-on to risk-off only reinforces that watching for trend line breakouts is the best strategy for traders to use. There was a perfect example of this last session with the GBP/USD. Recall that Friday is a holiday in the US.

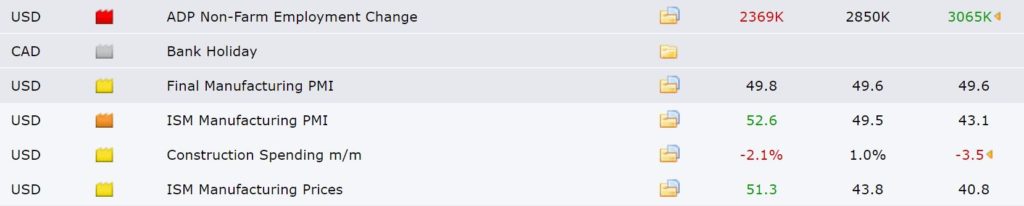

Data: Watch today with US NFP.

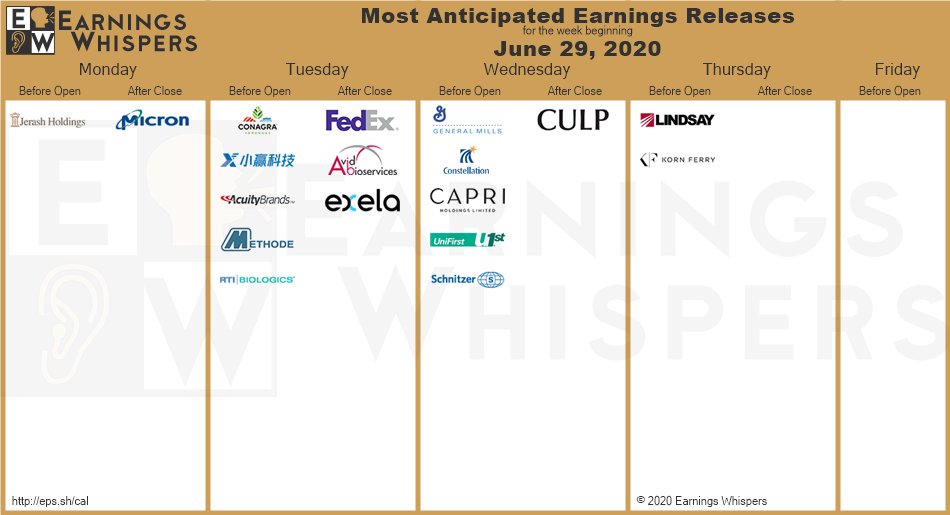

Earnings:

DXY daily: the US$ is a bit lower with the risk-on shift as overnight US Manufacturing data surprised to the upside:

Trend line breakouts:

GBP/USD: the Descending Wedge breakout has triggered!

GBP/USD 4hr: the chart set up pre B/O:

GBP/USD 4hr: the TL b/o has given around 90 [pips:

GBP/USD 15 min: watching for a bullish momentum close above the Cloud AFTER the Asian session would have been the best play. There was a TC signal as well!

ASX-200 4hr: Futures activity encouraging here so watch 6,000 for any new breakout:

Oil daily: this has been doing little of late BUT watch the $40 level for any new b/o:

Other markets:

S&P500 4hr: watch for any new breakout:

EUR/USD 4hr: watch 1.13 for any new breakout:

AUD/USD 4hr: watch trend lines for any new breakout:

AUD/JPY 4hr: watch revised trend lines and 75 for any new breakout:

NZD/USD 4hr: watch trend lines and 0.65 for any new breakout:

USD/JPY 4hr: watch the 4hr 200 EMA for any new breakout: