Trading at the moment is more like a Treasure Hunt. There are opportunities around but they have to be scoured for and sought out carefully! One such example might present today with Gold and, also, with the ASX-200 and AUD currency pairs ahead of today’s Australian Employment data update amidst Covid-19.

Data: Watch for any impact from Australian Employment data, a BoE Gov Bailey speech and US weekly Unemployment data.

Earnings:

DXY 4hr: the US$ index continues to hover near 100 but remains range-bound on low momentum:

Trend line breakouts and TC signals:

Gold: watch for any 4hr chart wedge breakout and, recall, I’m on the lookout for a test of $1,800 with the weekly chart’s bullish Inverse H&S pattern.

Gold 4hr: watch for any wedge breakout:

Gold 15 min: short term momentum traders would have an opportunity during the early US session to catch this trading range breakout. The first candle close above the High of the Asian range gave an entry with a Stop of 35 pips. The gain is already near 3 R but the target would be $1,800.

Gold weekly: Recall that I am on the lookout for any bullish Inverse H&S here so watch for any push to $1,800:

S&P500 4hr: lower again on the day but watch 2,800 for any new make or break:

GBP/USD 4hr: the GBP continues to suffer along with the UK Prime Minister. The Cable is now back near the bottom of the trading channel at 1.22 so watch this level for any new make or break:

GBP/JPY 4hr: watch for any push to 130 S/R:

Other Markets:

ASX-200 4hr: holding up rather well considering so watch for any momentum-based trend line breakout; especially with today’s AUD Employment data update:

ASX-200 versus S&P500: recall though that I am on the lookout for any shift in the balance between the S&P500 versus the ASX-200. The chart below shows the performance of the XJO versus the SPX and, whilst the current trend remains down, the chart pattern is that of a bullish-reversal Descending Wedge and price action is bouncing up off the bottom trend line. Australia, as well as New Zealand, are proving to be world leaders in the management of Covid-19 and this could well underpin this power shift.

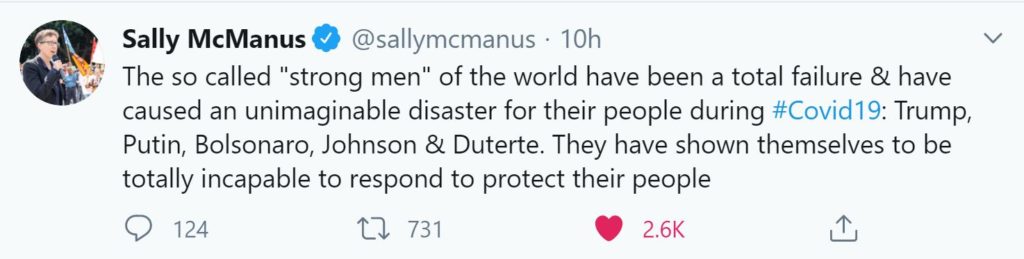

Note this Tweet from the Secretary of the Australian Council of Trade Unions. By contrast, the Australian National Cabinet is doing a wonderful job:

AUD/USD 4hr: also holding up rather well considering so watch for any momentum-based Flag trend line breakout; especially with today’s AUD Employment data update:

AUD/JPY 4hr: also holding up rather well considering so watch for any momentum-based trend line breakout; especially with today’s AUD Employment data update:

S&P500 v AUD/USD weekly: for those of you who are perplexed by how well the AUD/USD is holding up then this chart might be of interest. This chart shows the S&P500 versus the AUD/USD and the uptrend reflects that the index has greatly outperformed the currency since 2012. However, trends do not travel in straight lines for ever so some mean reversion could well be in store. So, keep an open mind and trade what you see and not what you think!

EUR/USD 4hr: watch for any momentum-based trend line breakout:

NZD/USD 4hr: watch for any momentum-based Flag trend line breakout:

USD/JPY 4hr: watch for any momentum-based trend line wedge breakout: