TMV is a triple leveraged ETF, released in 2009, that tracks 3 x the inverse performance of the NYSE 20 Year Plus Treasury Bond Index. I came across this ticker today and, whilst very cautious with leveraged ETFs, it was the technical pattern I saw on the chart that drew me right in.

There are a few trends and relationships worth remembering here. Firstly, as yields or interest rates rise then Bond prices would be expected to fall as per the relationship shown in this schema:

Thus, in the current environment where US interest rates are expected to normalise and increase then one might expect Bond prices would decline.

Thus, if we are expecting Bond prices to decline, then an ETF that trades inverse to Bond price, like TMV, might be expected to increase. So, it would not be out of order to expect that TMV might be headed for higher pricing once there is a clear program of increasing / normalisisng US interest rates.

I found an article from back in 2010 that backs up my line of thinking but it also emphasises the risk involved with leveraged ETFs. This on-line and freely available article by Ron Rowland can be found through the following link (link no longer active and article not found :-(. The relevant part of the article that interested me is copied below though:

Rising Rate Protection ETF #3:

Direxion Daily 30-Year Treasury Bear 3x Shares (TMV)

If you believe long-term rates are headed up, and soon, TMV could be your ticket to major profits. It’s an inverse ETF that tracks 30-year bond prices with 3x leverage.

Suppose, for instance, interest rates spike higher and the 30-year bond price index falls 5 percent in a day … you can expect TMV to rise 15 percent on that same day. Yowza!

This leverage could also be a ticket to major losses. For example, if your timing is off, even by a few days, you could get your head handed to you. That’s why leveraged ETFs are intended only for the most aggressive investors.

Another thing to consider is the “Daily” part of the name. Leverage in TMV and similar ETFs is reset every day. Over time, this means the leverage factor on your shares could be much more than 300 percent — or much less. I explained how this works in more detail in my Understanding Leveraged ETFs column last year.

Am I telling you not to buy TMV? No, not at all. I’m just telling you to be very, very careful when trading leveraged and inverse ETFs. I don’t want you to learn this lesson the hard way. TMV can be a great tool when used correctly — and at the right time.

However, I am a humble chartist and, as mentioned earlier, it was the chart and chart pattern that appealed to me. However, the pattern that I’m seeing is supported by the logic expressed within this article.

TMV monthly: the ETF has declined in value since 2010 and this makes sense to me. Interest rates have been declining-low during this period which would mean Bond prices would be trading higher. The chart of TLT, the Bond ETF, shows a fairly complementary increasing trend for Bond price. Thus, the inverse of Bond prices, TMV, would be expected to decline and that is exactly what this chart reveals:

TLT monthly: This chart of the Bond ETF shows a complementary increase in price action:

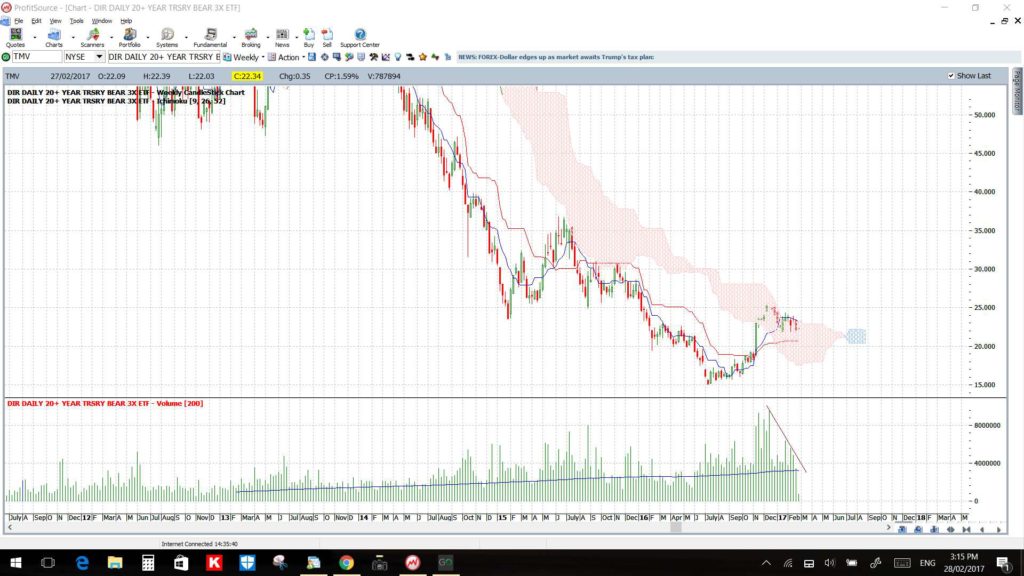

TMV weekly: it is the weekly chart that most caught my attention though. The chart below shows that, since around 2012, TMV price action has been trading within a descending wedge and these patterns are generally considered as bullish-reversal patterns. Note also how price is becoming increasingly squeezed towards the apex and with declining momentum; all key ingredients that I like to see before any potential breakout trading opportunity:

TMV weekly Cloud: Price action is currently being held in check by the resistance of the weekly Ichimoku Cloud as well:

TMV daily: note the lack of ADX momentum here just now.

TMV daily Cloud: You can see that price is constrained in the daily Cloud as well and note also how trading Volume has been declining. I’ll be watching for any trend line and Ichimoku Cloud breakout that evolves with increased momentum and Volume.

Summary: TMV may provide a trading opportunity once there is a clearer pathway of normalising US interest rates. To this end I’ll be watching for any alignment of the following factors on the TMV chart:

- A wedge trend line breakout.

- Daily and weekly Ichimoku Cloud breakout.

- Increased momentum.

- Increased trading Volume.