The last trading session saw a more aligned shift to risk-off as concern about the impact of Covid-19 on global economies resurfaced. However, most chart patterns are in a time-out kind of mode with price action consolidating on low momentum. President Trump is just out claiming the peak of the virus has passed in the USA so let’s hope he is right! The S&P500 is still lurking under the 2,900 – 3,000 level which I see as the make or break level for recovery / decline with the index.

Data: watch today with AUD Employment and US Unemployment Claims Building Permits and Philly Fed Manufacturing Index data.

Earnings:

DXY 4hr: note how the index is trying to get back up through the 4hr Cloud. Consolidating for now though on low momentum:

Markets:

S&P500 4hr: lower on the day but still above a 4hr support trend line but note the declining momentum:

ASX-200 4hr: also lower on the day but still above a 4hr support trend line and with declining momentum:

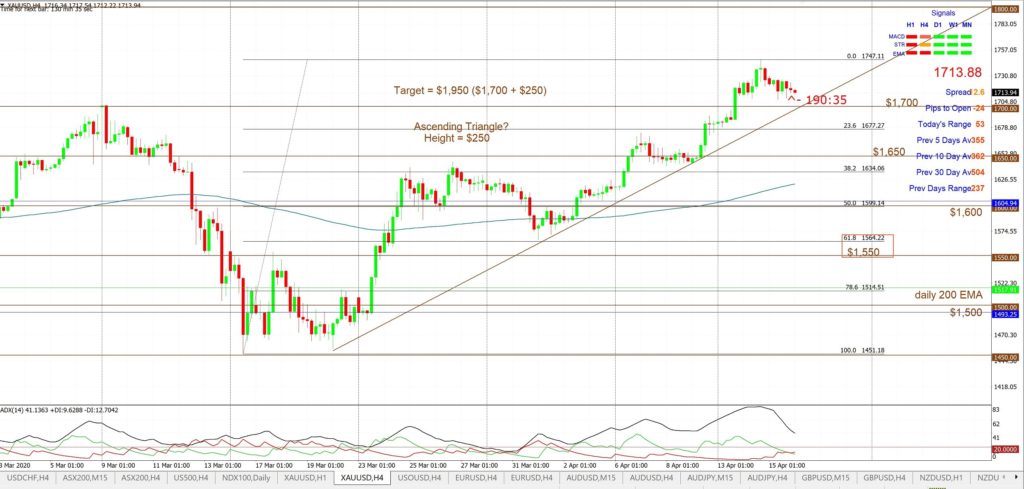

Gold 4hr: still above $1,700 but this is the level to monitor but note the declining momentum here too:

Oil 4hr: revised trend lines but the $20 remains in focus:

EUR/USD 4hr: consolidating on low momentum:

AUD/USD 4hr: trading lower on declining momentum but still above trend line support BUT watch today for any reaction to the, anticipated, large jump in Unemployment:

AUD/JPY 4hr: also trading lower but still above trend line support BUT watch today for any reaction to the, anticipated, large jump in Unemployment:

NZD/USD 4hr: trading lower and back near 0.60 S/R:

GBP/USD 4hr: trading lower and back near 1.25 S/R on declining momentum:

USD/JPY 4hr: holding above 107 S/R on declining momentum:

GBP/JPY 4hr: still trading under 136 and S/R on low momentum: