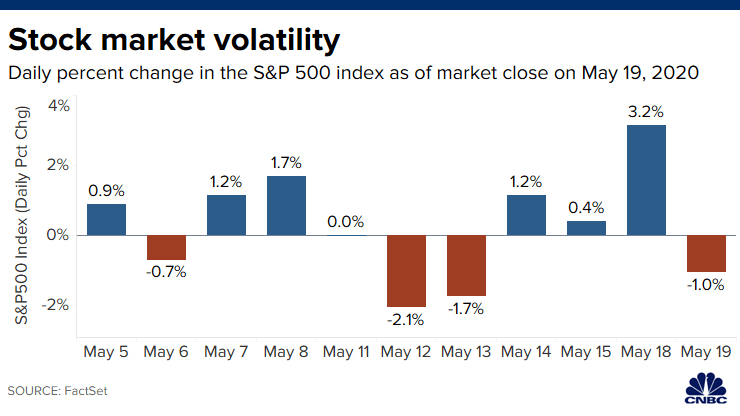

Volatility and swings continue as the theme for these markets with the SPX up 3.2% on Monday and down 1.0% Tuesday. The SPX remains below the key weekly 61.8% Fib and this will be in focus until the end of the week. The US$ remains below 100 and this has kept Monday’s breakout trades supported but momentum remains low so caution is needed. Traders should manage trade size and risk appropriate to these choppy market conditions.

Data: watch today with the BoE Gov Bailey speech and the batch of second tier data.

Earnings:

DXY daily: breaking below the bottom trend line BUT momentum remains low so caution is needed:

Trend line breakouts:

S&P500:

S&P500 weekly: the bigger picture to keep in focus is where the index trades with respect to the weekly 61.8% fib

S&P500 4hr: this b/o stalled under the 3,000 level:

S&P500 4hr: watch the 3,000 level:

EUR/USD 4hr: this TL b/o has given up to 100 pips BUT watch the 1.10 level for any momentum breakout:

AUD/USD 4hr: this TL b/o has given up to 100 pips as well BUT watch the 0.66 level for any momentum breakout:

NZD/USD 4hr: this TL b/o has given up to 130 pips:

GBP/USD 4hr: a new TL b/o that has given up to 60 pips:

USD/JPY 4hr: a new TL b/o that has given up to 60 pips BUT watch the 108 level for any momentum breakout:

Other markets:

AUD/JPY 4hr: a new TL b/o so watch for any push higher:

GBP/JPY 4hr: a new TL b/o BUT watch the 132 level for any momentum breakout: