Last week: Technical analysis continues to offer one of the easiest paths to trading success. Trading in this market can pose a challenge for many; especially as some stock indices trade at all-time Highs against a backdrop of Covid-19 ravaged economies; having conviction with any trading decision can be problematic. However, watching for momentum-based trend line breakouts (or reaction) has proved to be very profitable once again. Breakouts from focus levels profiled in last week’s analysis yielded over 1,000 pips and 100 points: 100 points on the S&P500 (break of 3,400), 180 pips on the AUD/USD (TL b/o), almost 200 pips on AUD/JPY (break of 76), 190 pips on the NZD/USD (TL b/o), 250 pips on the GBP/USD (a TL b/o above 1.31) and up to 240 pips on the GBP/JPY ( a bounce off TL support). Many of these breakout moves were aligned and so there is no suggestion that all trades would have been taken concurrently but, you surely get the picture? There was a bag of pips and points available from a variety of different trend line breakout opportunities. The good news for you all is that there are more trend lines and levels noted on the charts this week so you can monitor for further momentum breakout-trading opportunities. And, if you thought the markets were already frothy and toppy, you should take note that there have been new bullish breakout moves on Copper and Emerging markets and the bullish moves on the commodity currencies keep going too suggesting there is increasing breadth in the current move. Now, more than ever, it is important to trade what you see and not what you think!

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts summary: There were plenty of trend line breakout opportunities last week. Articles published during the week can be found here, here, here, and here:

- AUD/USD: a TL b/o for 180 pips:

- NZD/USD: a TL b/o for 190 pips:

- GBP/JPY: a bounce off last week’s support TL for up to 240 pips.

- S&P500: a 100 point breakout from last week’s 3,400 level:

- ASX-200: a 90 point pullback on Friday and note the move down to the 61.8% Fibonacci!

- Friday mornings 4hr chart

- Note the pullback to the 61.8% Fib!

- GBP/USD: a TL b/o away from 1.31 for up to 250 pips:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ closed with a bearish weekly candle and continues to struggle under the recently broken 10-year support trend line. There is the look of a bullish-reversal Descending Wedge here though so watch for any relief rally; even if it’s only temporary. Also keep watch of the 10-yr bear trend line as this previous Support will likely become Resistance. This week brings US NFP so watch to see how this data update might impact the US$:

DXY weekly:

-

- Schedule for weekend Market Update posts: The Weekly Market update has, to date, been posted on a Sunday, Australian time. I am looking to delay the release of this update to a Monday, Australian time, which is still a Sunday in many other parts of the world. My analysis takes a full day to complete and I am attempting to shift this load away from my weekend time.

-

- Multi-year trend lines: As noted recently and the caution remains valid: multi-year trend lines have been tested / broken on a number of instruments: The FX Indices (DXY and EURX) and the EUR/USD, AUD/USD and NZD/USD. This week the AUD/JPY and GBP/JPY have joined this group and the GBP/USD isn’t dar behind either. Some of these pairs look like they’re about to move but caution is still required; trend lines of such duration are often not given up easily so traders should watch for any potential choppiness / consolidation as these levels are negotiated.

-

- GBP/JPY: I profiled this pair during the week in a video update that can be found through this link. In the video I suggested watching for a momentum-based bounce or break of a support trend line and, in the end, it was a bounce that evolved. This move delivered up to 240 pips though and I think offers a good example of how to stalk an instrument from a technical charting perspective. The GBP/JPY is now nearing a bear trend line of 40 year duration so this might be something worth watching!

-

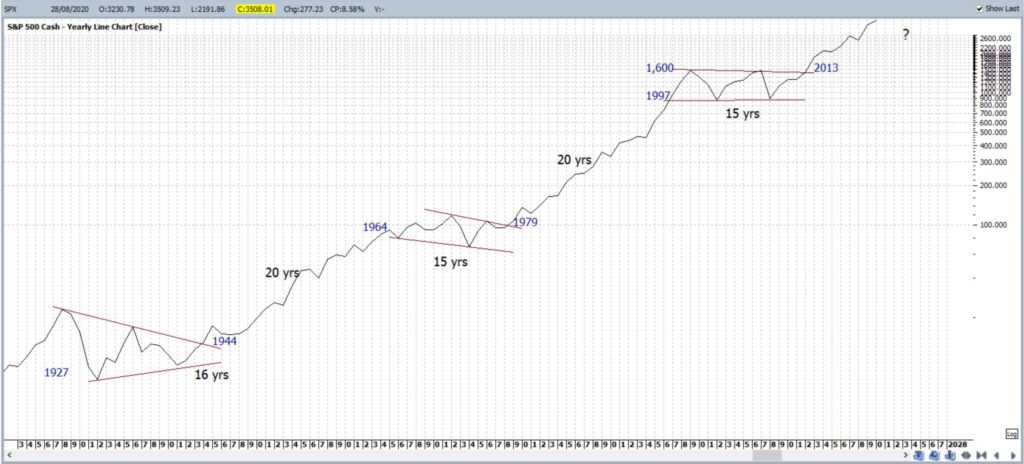

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 has printed a new weekly closing all-time High above 3,500: The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and has closed with a bullish weekly candle above the 3 level for the first time since June 2018. The break above the 10-year bear trend line is holding as well:

Copper weekly: now above the 3 level:

-

- Commodities: The Commodities ETF, DBC, continues shaping up in a bullish-reversal descending wedge so watch for any momentum-based trend line breakout:

DBC weekly: watch for any momentum-based trend line breakout:

-

- Emerging Markets: one could be forgiven thinking that Emerging markets would hold little appeal in a Covid ravaged world but, not so it seems. The Emerging market ETF, EEM, has made a new weekly close above the 45 level; a level of some S/R importance.

EEM weekly: a bullish candle close above the 45 level:

-

- DJIA weekly: The DJIA closed with a bullish weekly candle and note the continued triangle breakout. Watch for any push to the previous all-time High:

DJIA weekly:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bullish weekly candle and at a new all-time High. However, a test of the psychological 10,000 level would still not surprise. Watch for any push to the 12,000 region though if bullish sentiment continues as this is near the 161.8% Fibonacci Extension:

NASDAQ weekly:

NASDAQ weekly + Fibonacci Extension:

-

- DAX weekly: The DAX closed with a bullish weekly candle so watch for any push to the recent High:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and closed with a bullish-coloured Inside weekly candle. Note the continued bullish trend line breakout so watch for any push to recent High, circa 1,720:

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bearish Engulfing weekly candle and note the pullback that is still being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a bullish-coloured Doji weekly candle and the Index is still below the 30 level so watch this region for any new momentum based make or break.

VIX weekly: watch the key 30 level for any new momentum based make or break:

Calendar: Courtesy of Forex Factory:

Earnings: Courtesy of Earnings Whispers:

Market Analysis:

S&P500: The S&P500 gapped higher last week to close with a large, bullish weekly candle and at a new all-time High above 3,500. Bullish momentum is trending higher on the 4hr, daily and weekly charts suggesting there could be more upside ahead; in the short term at least. Trading volume still remains relatively low BUT there has been a third candle print above the bear trend line so watch for any continued uptick with volume:

S&P500 ETF: SPY weekly: Volume is still relatively low BUT note the third candle print above the bear trend line:

As noted over recent weeks: Given this new all-time High I have added an Elliott Wave (EW) Extension tool to my charts to explore bullish targets above 3,400; should price action keep running. This EW tool was applied to the swing High move from 2009 – 2020 and traders should note that whole-number regions would be in focus above 3,400 on the way to the 161.8% extension that lies near 5,000:

S&P500 weekly + Elliott Wave Extension:

Price action is trading near the whole-number 3,500 so this will be the level to monitor for any new make or break.

Bullish targets: any bullish 4hr chart continuation above 3,500 would bring whole number levels into focus on the way to 5,000 S/R.

Bearish targets: any bearish 4hr chart retreat from 3,500 would bring the support trend line followed by 3,400 and 3,300 / 3,200 back into focus.

- Watch 3,500 for any new make or break:

ASX-200: XJO: The ASX-200 closed with another bearish-coloured Spinning Top style weekly candle and Futures action shows that price pulled back to test the psychological 6,000 level on Friday (see the 4hr chart). The bullish momentum seen across the S&P500 is not evident here but watch for any shift in this space, especially if US stocks keep moving higher. Trading volume looks to be edging higher though with a cleaner trend line breakout obvious this week. Watch the 6,000 level for any new volume and momentum breakout.

XJO weekly: trading Volume is holding above the bear trend line:

The 6,000 level remains as the support to watch and 6,200 is the whole-number level resistance to watch for any new make or break.

Bullish targets: Any bullish 4hr chart hold above 6,000 would bring the recent High, near 6,200, into focus followed by whole number levels on the way back to the previous all time High, circa 7,200.

Bearish targets: Any bearish 4hr chart break below 6,000 would bring the recent Low, near 5,850, into focus.

- Watch 6,000 for any new make or break:

Gold: There has not been a lot of change here given Gold closed with a bullish-coloured Spinning Top style weekly candle reflecting continued indecision as the precious metal holds above the key $1,900 level.

As mentioned over recent weeks: As mentioned over recent weeks, the weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is trading above this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any hold above $1,900 would support the Cup pattern thesis.

- Any new move move back below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming days / weeks especially as the US$ index is struggling under the recently broken 10-year support trend line:

- any US$ hold below this multi-year support trend line could help send Gold much higher.

- any US$ recovery above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

There are revised 4hr chart triangle trend lines to monitor for any new breakout. Traders should watch for any increased bullish flows into stocks as this could compete against flows into Gold.

Bullish targets: any bullish 4hr chart triangle breakout would bring $2,000 into focus as this is still near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: any bearish 4hr chart triangle breakout would bring $1,900 back into focus.

- Watch for any new 4hr chart triangle breakout:

EUR/USD: The EUR/USD closed with a large, bullish weekly candle and continues to hold above the recently broken 13-year bear trend line.

There looks to be a new 4hr chart triangle breakout so watch 119 for any new make or break.

Bullish targets: Any bullish 4hr chart triangle continuation above 1.19 would bring 1.20 S/R into focus followed by whole-number levels on the way up to the previous weekly chart High, circa 1.26.

Bearish targets: Any bearish 4hr chart triangle retreat from 1.19 would bring the 13-year bear trend line into focus followed by 1.15 and, then, whole-numbers on the way down to 1.12 S/R.

- Watch 1.19 for any new make or break:

AUD/USD: The Aussie closed with a bullish weekly candle and has made the first weekly candle close above the weekly 200 EMA since January 2018. Recall that this bullish activity had been warned about over recent months following the earlier breakout above the upper trend line of the multi-year bullish-reversal Descending Wedge. There is an RBA rate update this week so watch to see how this impact current bullish price action.

There are revised trend lines on the 4hr chart to monitor for any new momentum-based breakout.

Bullish targets: Any bullish trend line breakout above 0.74 would bring whole-number levels on the way up 0.90 into focus.

Bearish targets: Any bearish breakout below the 4hr chart support trend line would bring 0.73 into focus followed by 0.70 and, then, the 9-11 year bear trend line.

- Watch for any new 4hr chart triangle breakout; especially with the RBA rate update:

AUD/JPY: The AUD/JPY closed with a large, bullish weekly candle and is attempting to breakout above a 7-year bear trend line. The AUD/JPY opened the week on a positive note and never really looked back; only coming to a pause under 78 S/R after adding on over 200 pips for the week.

As mentioned over recent weeks: How the AUD/JPY reacts at the 7-year bear trend line above might depend on how the S&P500 reacts as it nears its all-time High so keep an eye on both!

Monday marks the end of month so watch to see where the monthly candle closes; with respect to this multi-year bear trend line. The monthly chart reveals that 80 S/R is the next main level to watch with any continuation move. There are also revised 4hr chart triangle trend lines to monitor for any new momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 78 into focus followed by 79 and, then, 80 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout below the 7-yr bear trend line would bring 77 into focus followed by whole-numbers on the way down to 65 S/R.

- Watch for any new 4hr chart triangle breakout; especially with the RBA rate update:

NZD/USD: The Kiwi went on a huge run last week and closed with a large, bullish weekly candle and also made its first bullish weekly candle close above the weekly 200 EMA since April 2018. Also of note is that price action also continues to hold above the recently broken 7-year bear trend line.

Price action closed just below 0.675 so this will be the one to watch for any new make or break.

Bullish targets: Any bullish 4hr chart breakout above 0.675 would bring 0.68 and, then, 0.70 S/R into focus.

Bearish targets: Any bearish 4hr chart retreat from 0.675 would bring a support trend line and the weekly 200 EMA into focus followed by whole numbers on the way down to the recently broken 7-yr trend line.

- Watch 0.675 for any new make or break:

GBP/USD: The Cable also had a good week and closed with a large, bullish weekly candle. The earlier breakout from the daily / weekly chart triangle has now added on over 700 pips and is nearing the the 1.35 target. Any close above 1.35 would then bring a 12-yr bear trend line into focus.

Price action closed the week just below 1.335 so this is the level to watch for any new make or break.

Bullish targets: Any bullish 4hr chart trend line breakout above 1.335 would bring the weekly chart’s triangle breakout target of 1.35 into focus followed by the 12-yr bear trend line.

Bearish targets: Any bearish 4hr chart retreat from 1.335 would bring the support trend line into focus followed by the weekly 200 EMA and 1.30 and, then, whole-number levels on the way down to 1.26.

- Watch 1.335 for any new make or break:

USD/JPY: The USD/JPY closed with a small, bearish weekly candle having a long upper shadow: the sell off coming on Friday after news about the resignation of Japan’s Prime Minister was announced. Once again though, the monthly 200 EMA came in as support.

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr triangle breakout would bring 107 into focus followed by 107.5 as the latter is still near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr triangle breakout would bring 105 back into focus followed by the recent Low, near 104.

- Watch for any new 4hr chart triangle breakout:

GBP/JPY: What a week for this currency pair! A huge move and a significant breakout above 140 S/R; a level that has pegged it all year! No need to say that it closed with a bullish weekly candle and is now up testing near the region of the 40-year bear trend line.

Bullish targets: Any bullish 4hr chart hold above 140 back would bring 141 followed by the 40-yr bear trend line into focus.

Bearish targets: Any bearish 4hr breakout below 140 would bring the support trend line into focus followed whole-numbers on the way down to 135.5 as this is near the 4hr chart’s 61.8% Fibonacci.

- Watch 140 for any new make or break: