Rising yields continue to rattle stock market investors and the NASDAQ led the sell-off last session. The US$ is higher as a consequence but, rather surprisingly, the EUR/USD and AUD/USD are holding up rather well. There is a speech today from Fed Chair Powell so watch this for any new impact on market sentiment.

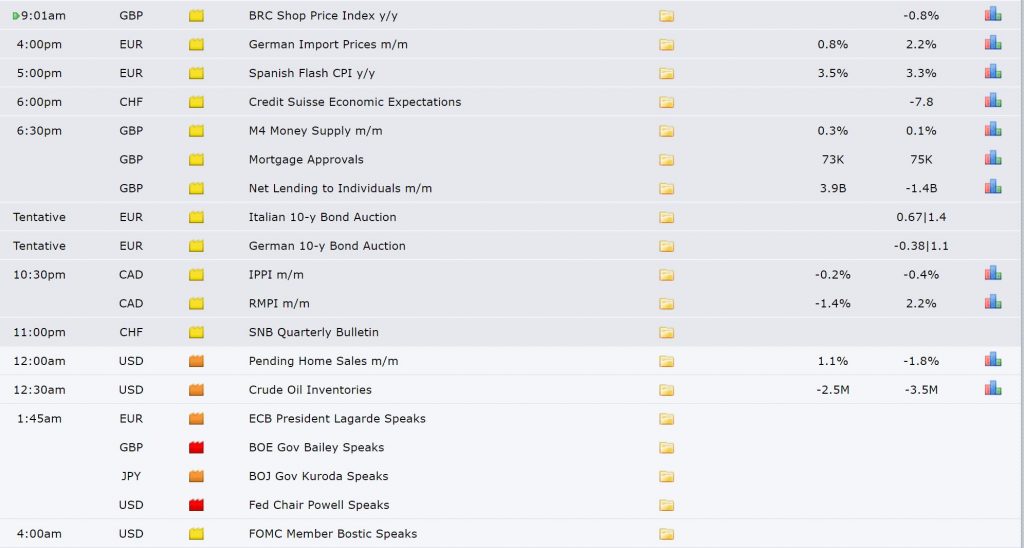

Data:

DXY weekly: higher still for the week:

TNX weekly: note the new breakout so watch for any continuation.

Trend line breakouts:

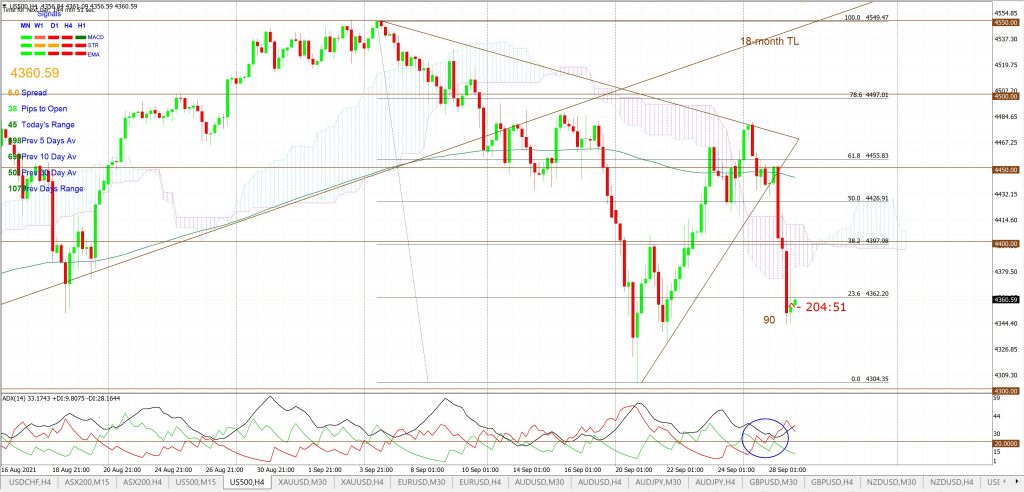

S&P500:

S&P500 4hr: lower on the back of the rise with yields:

S&P500 30 min: a decent Asian range b/o here:

ASX-200 4hr: a TL b/o for 140 points but watch the 7,200 region for any new make or break:

Gold 4hr: a TL b/o for $18:

GBP/USD: I suspect the UK petrol issue helped drive this move.

GBP/USD 4hr: a sharp sell off here:

GBP/USD 30 min: a failed b/o fast followed by a successful one:

NZD/USD 4hr: a TL b/o for 50 pips but watch the 61.8% Fib region for any new make or break:

USD/JPY 4hr: still going up and now 50 pips above the 111 level:

Other markets:

EUR/USD 4hr: still below 1.17 BUT holding up rather well considering. Note the look of a 4hr descending wedge here so keep an open mind:

AUD/USD 4hr: holding up rather well here too considering.

AUD/JPY 4hr: also holding up rather well considering.

GBP/JPY 4hr: what a mess! Watch 151 for any new make or break: