Last week: There weren’t too many breakout trade opportunities in the shortened Easter week and so it was no surprise to see so many small and indecision-style weekly candles printed. However, just as Easter symbolizes rebirth, the NASDAQ channelled this theme to bounce back from its recent slump and was the best performing stock index of the US majors. All four US stock index majors closed higher though with the S&P500 and DJIA closing at new all-time Highs. The US$ Index closed a bit higher for the week but, somewhat surprisingly, didn’t get much of a boost from the better than expected US monthly jobs numbers. It will likely be a slow start to the week due to some Easter Monday market closures.

Technical Analysis: It is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Covid-19, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts: Just a few small breakout trades in the shortened Easter week. Updates posted throughout last week can be found through the links here, here and here:

- Gold: a TL b/o for $40.

- EUR/USD: a TL b/o for 50 pips.

- USD/JPY: a TL b/o for 80 pips.

- GBP/JPY: a TL b/o for 100 pips.

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bullish-coloured Spinning Top weekly candle but didn’t receive much of a boost from the better than expected US monthly jobs report. However, the DXY continues to hold up and out from the recently broken 12-month bearish-reversal descending wedge. so watch for any push up to the previously broken 10-yr trend line. Note how the weekly Cloud aligns near this 10-yr trend line so this region might offer some considerable resistance. Weekly ADX momentum is still declining but note, also, the look of a Bull Flag on the 4hr chart so watch for any Flag breakout here: either up or down!:

DXY weekly: watch for any push to the previously broken 10-yr TL:

DXY 4hr: watch for any Bull Flag activity:

-

- Indecision-style weekly candles: indecision-style weekly candles were printed on a number of instruments last week: the DXY, DJIA, ASX-200, Russell-2000, Gold, EUR/USD, AUD/USD, NZD/USD and GBP/USD.

-

- NASDAQ: I wrote an article during the week about the recent pause on the NASDAQ and this can be found through the following link.

-

- Euro, Aussie, Kiwi and Cable: The AUD/USD, NZD/USD and GBP/USD are all still shaping up in potential bullish-reversal 4hr chart Descending Wedge patterns and these form the ‘Flag’ of potential weekly chart ‘Bull Flags’. The EUR/USD also has a Descending Wedge pattern on the 4hr chart.

-

- Central Bank Update: There is one Central Bank update this week: RBA (AUD).

-

- 10-yr T-Note Interest rate: The chart of the 10-yr Treasury Interest rate shows the recent bullish breakout from the triangle congestion pattern remains paused near the weekly 200 EMA region. Watch this region for any new make or break and for any consequential impact on stock sentiment:

- 10-yr T-Note Interest rate: watch for any pullback:

-

- % Stocks above their 200 Day Moving Average Index: The Percentage of stocks above their 200 Day Moving Average remains above the 85% region. The first chart below gives a perspective of this current level and shows the previous peaks near 92.50% and how there often tends to be some mean-reversion once such lofty levels are reached. The second, expanded, chart shows the continued struggle under the 92.50% level.

% of US Stocks above the 200 Day Moving Average: watch for any further reaction at the 92.50% region:

% of US Stocks above the 200 Day Moving Average (expanded): holding below 92.50%:

-

- S&P500: Keep the bigger picture in perspective with the recent moves as this chart suggests there is a lot more room to move with the overall bullish run. However, this does not discount the odd pullback along the way as trends do not travel in straight lines forever; they tend to zig and zag their way along either bullish or bearish paths. Note how the recent Covid dip does not even figure on this chart!

S&P500 yearly: keep this latest move in perspective:

-

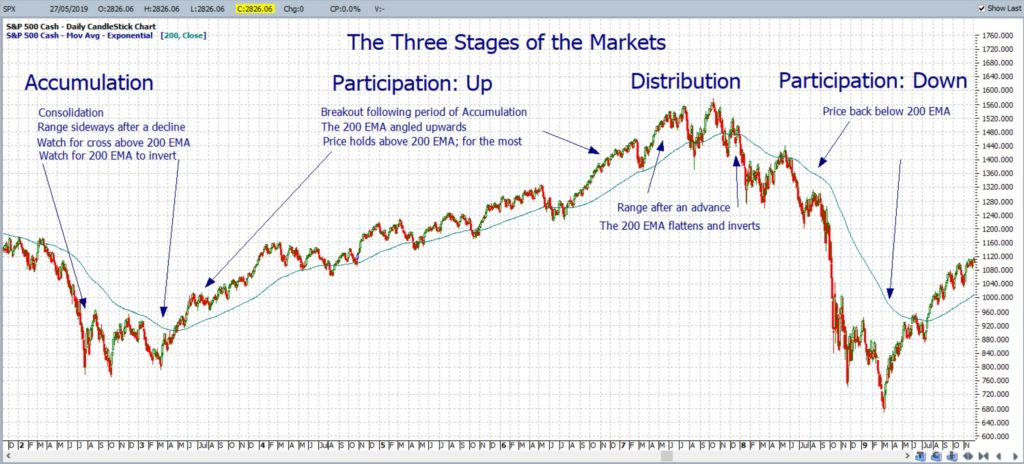

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 trades up at an all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed with a bearish weekly candle but is still shaping up in a potential Bull Flag so watch for any new breakout: up or down.

Copper weekly: another bearish weekly candle BUT watch for any Bull Flag:

-

- Emerging Markets: The Emerging market ETF, EEM, closed with a bullish weekly candle and, whilst still below the 12-month support trend line, note the look of a new Bull Flag breakout so watch for any push higher.

EEM weekly: a new Bull Flag here?

-

- DJIA: The DJIA closed with a bullish-coloured Spinning Top weekly candle and at a new all-time High above 33,000.

DJIA weekly: keep watch of 33,000 for any new make or break.

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bullish, almost ‘engulfing’ weekly candle but is still holding below the recently broken 12-month support TL. However, note the look of a new Bull Flag breakout so watch for any push higher.

NASDAQ weekly: watch for any developing Bull Flag:

-

- Growth versus Value: the strong performance with the NASDAQ last week is reflected in the bullish weekly candle seen on the Growth versus Value comparison chart:

Growth versus Value: a bullish week here:

-

- DAX weekly: The DAX closed with a bullish weekly candle and at a new all-time High and above 15,000. Note how bullish momentum is now ramping upwards.

DAX weekly: watch 15,000 for any new make or break:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index closed with a bullish-coloured Inside weekly candle reflecting indecision. The Index continues to hold above the 61.8% Fibonacci extension of the Covid-induced Swing Low so watch for any push to the 100% level, circa 2,500.

RUT weekly: keep watch for any hold above the 61.8% Fibonacci Extension:.

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish weekly candle following last week’s bullish-reversal Morning Star pattern. My Elliott Wave indicator is still suggesting a potential uptrend.

TLT weekly: holding above the 135 level:

-

- USD/CAD and USD/CNY: keep an eye on these two weekly chart Descending Wedge patterns for any bullish follow-through.

USD/CAD weekly: watch for any new breakout:

USD/CNY weekly: the TL b/o keeps going:

-

- VIX: the Fear index closed with a bearish weekly candle and is holding below the 20 S/R level so keep watch to see if this marks a return to a new and lower trading range for the index.

VIX weekly: watch the 20 S/R level for any new make or break:

Calendar: Courtesy of Forex Factory: a fairly quiet week:

Earnings: Courtesy of Earnings Whispers: slowing right down:

Market Analysis:

S&P500: The S&P500 closed with a bullish weekly candle, at a new all-time High and above the whole-number and psychological 4,000 level and was no doubt helped along by the better than expected US jobs report.

Trading volume was a little lower last week with Easter and was back below the 200 MA and bear trend line so watch for any new breakout.

S&P500 ETF: SPY weekly: watch for any new breakout.

:

The 4,000 level will be the support to watch for any new make or break but there are revised 4hr chart trend lines to assess with any new momentum breakout as well.

NB: The second weekly chart shows how the 61.8% Fibonacci extension of the Covid-induced Swing Low is up near 4,150. This would be one target for any bullish continuation move.

Bullish targets: any bullish 4hr chart trend line breakout above 4,050 would bring 4,100 into focus.

Bearish targets: any bearish 4hr chart retreat from 4,050 would bring a recent support trend line back and 4,000 into focus. After that, watch 3,950, 3,900 and the revised 12-month support trend line followed by whole-numbers on the way down to the weekly chart’s 61.8% Fibonacci retracement level, near 2,800. Traders still need to watch for any potential weekly chart Bull Flag activity around this 12-month support trend line.

- Watch 4,050 and 4hr chart trend lines for any new breakout:

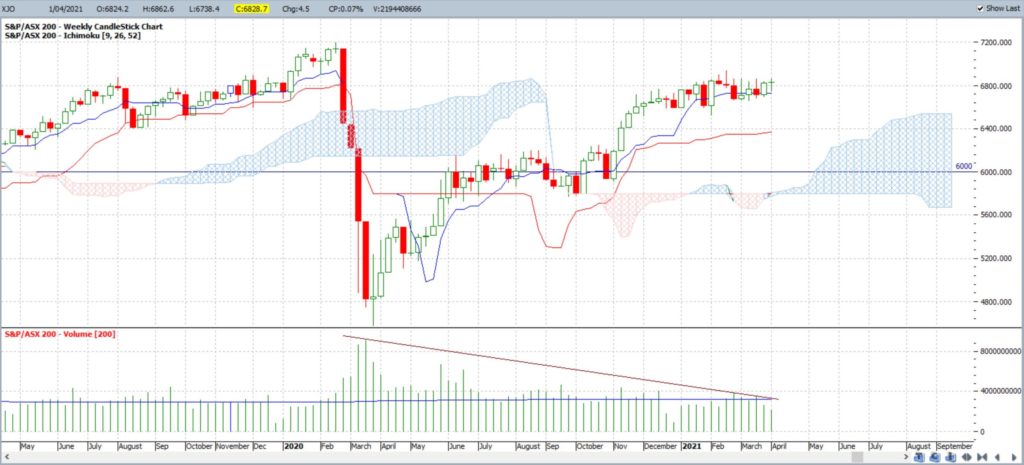

ASX-200: XJO: The ASX-200 closed with a bullish-coloured Doji weekly candle and back below the pre-GFC High of 6,851.50 making this the resistance level to monitor for any new make or break.

The pre-2020 High of 6,893.70 and 2020 High of 7,197.20 still loom large and ahead of current price action and might offer considerable resistance levels for the index.

Trading volume was even lower last week with Easter so watch for any new break back above the 200 MA and the bear trend line.

XJO weekly: watch for any new b/o above the 200 MA and bear TL:

Keep in mind that the recent Golden Cross still remains valid. The Golden Cross is a bullish signal where the 50 SMA crosses above the 200 SMA. Such crosses are often, but not always, followed by a decent bullish run so these crosses are worth noting:

XJO daily: the recent Golden Cross remains valid for the time being:

There are revised 4hr chart trend lines and horizontal levels to monitor for any new breakout.

Note how ADX momentum still remains low on the daily chart and declining on the weekly chart.

Bullish targets: Any bullish 4hr chart breakout above the pre-GFC High of 6,851.50 would bring the pre-2020 High of 6,893.70, the whole-numbers 6,900 and 7,000 and, then, the 2020 High of 7,197.20 into focus.

Bearish targets: Any bearish hold below the pre-GFC High of 6,851.50 and break of a recent support trend line would bring 6,800 and 6,700 into focus.

- Watch the pre-GFC High of 6,851.50 for any new 4hr chart make or break:

Gold: Gold closed with a bearish-coloured Doji weekly candle but the long lower shadow reflects that buyers stepped in to help the metal recover off the $1,760 support level.

There are revised 4hr chart Descending Wedge trend lines to monitor BUT there is the look of bullish pressure at the upper wedge trend line so watch for any continued recovery here.

As mentioned over recent months: This price action and hold below $1,900 acts as further evidence in support of the longer-term Inverse H&S thesis that I have been discussing as an option here for many months.

The weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is trading below this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any hold above $1,900 would support the Cup pattern thesis.

- Any move back below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming sessions especially as the US$ index is still below the recently broken 10-year support trend line:

- any US$ hold below the multi-year support trend line could help send Gold higher.

- any US$ move back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

As per recent weeks: the daily chart reveals the importance of the $1,670 level so this continues to be a ‘line in the sand’ support level to monitor. Any new weekly close below the $1,670 level would bring $1,500 into greater focus. The two weekly charts show that $1,500 is:

- near the 61.8% Fibonacci of the Aug 2018 – Aug 2020 swing High move.

- forms the lower boundary of the Inverse H&S pattern I have had on my charts for many months.

The weekly ADX momentum remains above the 20 threshold level AND the bearish DMI is now also above 20 and trending up so keep an open mind here.

Bullish targets: any sustained bullish 4hr chart upper wedge trend line breakout would bring $1,750 and $1,770 back into focus followed by $1,800, the daily 200 EMA, $1,850 and $1,900.

Bearish targets: any bearish retreat from the 4hr chart’s upper wedge trend line would bring $1,700 and the bottom wedge trend line into focus followed by the $1,670 support level.

- Watch for any 4hr chart wedge breakout:

EUR/USD: The EUR/USD closed with a bearish-coloured Doji weekly candle reflecting indecision but held above the 1.17 level making this the support level to monitor for any new make or break.

There is still the look of a descending wedge on the 4hr chart.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

NB: Note that the longer-term target for any continued bullish movement following the previous break of the 13-yr trend line is the monthly chart’s 61.8% Fibonacci, near 1.40. This trend line breakout was flagged back in a post on August 2nd 2020. Price at the breakout was around 1.17 and has reached up as far as 1.23, a move of around 600 pips, so this has been a breakout worth monitoring.

Bullish targets: Any bullish 4hr chart breakout above 1.18 and the 4hr chart’s upper wedge trend line would bring 1.19, 1.20 and 1.21 into focus followed by the monthly 200 EMA and 1.22 level. After that, watch whole-numbers on the way up to a previous weekly chart High, circa 1.26 and, for any continued push up to 1.40.

Bearish targets: Any bearish 4hr chart breakout below 1.17 and the bottom 4hr chart wedge trend line would bring 1.16 and 1.15 into focus.

- Watch for any new 4hr chart momentum-based descending wedge breakout;

AUD/USD: The Aussie closed with a bearish-coloured Spinning Top weekly candle, reflecting indecision and remains below the recently broken 12-month support trend line.

However, there is still the look of a larger wedge on the 4hr chart; which is the potential Bull Flag on the weekly time frame.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

NB: The longer-term target for any bullish continuation from the weekly/monthly chart’s Descending Wedge breakout is the weekly 61.8% Fibonacci, near 0.90. This monthly wedge trend line breakout was also flagged back in the post on August 2nd 2020. Price at the breakout was around 0.71 and has reached up as far as 0.80, a move of around 900 pips, so has been another breakout worth monitoring.

Bullish targets: Any bullish 4hr chart hold above 0.76 would bring 0.77 and the 4hr chart’s upper wedge trend line into focus. After that, watch for any push back to the 12-month TL and, then, whole-number levels on the way up to the weekly chart’s Descending Wedge breakout target of 0.90.

Bearish targets: Any bearish break below 0.76 would bring the bottom 4hr chart wedge trend line into focus. After that, watch 0.75 and whole-number levels on the way down to 0.65 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch 0.76 for any new make or break:

AUD/JPY: The AUD/JPY closed with a bullish weekly candle shaking off, and likely invalidating, last week’s bearish-reversal Evening Star pattern. Price action is still near the 23-week support trend line and consolidating just above the 84 level making this the region to watch for any new make or break.

As noted over recent weeks:

- The weekly chart reveals that the 85 level has been a significant reaction zone for the AUD/JPY and has been resistance for the last three years; this level was peppered many times throughout 2018 but could not be broken. The next major level above 85 is 90 so watch this target level if 85 is broken.

- AUD/JPY traders also need to keep an eye on the sentiment with stocks though, especially the S&P500 index, as the two are generally highly aligned; as the chart below reveals. Any pause or serious pullback with stocks might render similar for the AUD/JPY:

AUD/JPY versus S&P500 (gold line): a high degree of positive correlation:

There are revised 4hr chart trend lines to monitor for any new breakout.

I have included a daily chart again here this week with a reminder to note how the 72 level is down near a previous reaction zone and not too far from 61.8% Fibonacci of the March 2020 – March 2021 swing High move; so it might be a target to aim for if risk appetite turns very sour.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 85 S/R back into focus followed by whole numbers on the way to 90 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 83 and 82 into focus followed by the the monthly 200 EMA and 12-month support trend line. After that, watch whole-numbers on the way down to 76 as this is still near the recently broken 7-yr bear trend line, and then 72 as this is near the 61.8% Fibonacci of the March 2020 – March 2021 swing High move.

- Watch 84 and for any new 4hr chart triangle breakout:

NZD/USD: The Kiwi closed with a bullish-coloured, almost Inside, weekly candle, reflecting indecision, but managed to hold the week just above 0.70 keeping this as the level to watch for any new make or break.

Like with the Aussie, there is still the look of a larger descending wedge / channel on the 4hr chart which is the potential Bull Flag on the weekly time frame.

Bullish targets: Any bullish 4hr chart hold above 0.70 would bring 0.71 and the upper wedge / channel trend line into focus. After that, watch 0.72, 0.73, the recently broken 12-month support trend line, 0.74 and 0.75 as the latter is the next major horizontal S/R zone (see weekly chart).

Bearish targets: Any bearish 4hr chart break below 0.70 would bring the monthly 200 EMA, 0.69 and bottom wedge / channel trend line into focus. After that, watch whole-number levels on the way down to 0.63 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch 0.70 and for any 4hr chart wedge / channel breakout:

GBP/USD: The Cable closed with a bullish-coloured, almost Inside, weekly candle reflecting indecision and closed just above 1.38 keeping this as the level to watch for any new make or break.

Like with the Aussie and Kiwi, there is still the look of a larger descending wedge on the 4hr chart which is the potential Bull Flag on the weekly time frame.

NB: The longer-term target for any bullish continuation above the previously broken 14-yr trend line, noted here in my article on December 20th, is the monthly chart’s 61.8% Fibonacci, near 1.75. Price action at the initial breakout was around 1.35 and has reached to 1.42, a move of 700 pips, so this trend line breakout was a great clue about things to come and the target for this move has not even been reached yet!

Bullish targets: Any bullish 4hr chart wedge trend line breakout would bring 1.39 and the recently broken 12-month support trend line into focus. After that watch whole-number levels on the way up to 1.50 as this is a previous S/R region on the weekly chart. Any bullish continuation after that would bring whole-number levels on the way up to 1.75 into focus.

Bearish targets: Any bearish 4hr chart break back below 1.38 would bring a recent support trend line, 1.37 and, then, the lower wedge trend line into focus. After that, watch whole-number levels on the way down to 1.25 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch the 4hr chart trend lines for any new breakout:

USD/JPY: The USD/JPY closed with a large, bullish weekly candle and just under 111 making this the one to watch for any new make or break.

NB: The bullish weekly descending wedge breakout continues here and this was first noted in my article of January 31st. Price action at the initial breakout was around 104.5 and has reached to near 111, a move of around 650 pips, so this trend line breakout was a great clue about things to come!

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart breakout above 111 would bring whole-numbers on the way up to 115 into focus.

Bearish targets: Any bearish 4hr hold below 111 and break of the recent support trend line would bring 110, 109, and 108 back into focus. After that, watch whole-number levels on the way down to 105 as this is near the 61.8% Fibonacci of the Jan-March 2021 swing High move.

- Watch 111 and for any new 4hr chart trend line breakout.

GBP/JPY: The GBP/JPY closed with a bullish weekly candle and right on 153 S/R making this the level to watch for any new make or break.

NB: The longer-term target for any bullish continuation above the previously broken 40-yr trend line, noted in my post of January 3rd, is the weekly chart’s 61.8% Fibonacci, near 170. Price action at the time of this breakout was near 141 and has reached up to 153, a move of around 1,200 pips, and so is another trend line breakout that has proven to be worthwhile monitoring.

Bullish targets: Any bullish 4hr chart hold above 153 would bring 154 followed by whole-number levels on the way up to the weekly chart’s 61.8% Fibonacci, near 170, into focus.

Bearish targets: Any bearish 4hr chart trend line break back below 153 and a recent support trend line would bring the 15-week trend line back into focus. After that, watch whole-number levels on the way down to 135 as this is near the 61.8% Fibonacci of the March 2020 – March 2021 swing High move.

- Watch 153 and the 4hr chart trend lines for any new breakout: