Last week: The heightened market volatility continued last week and this helped to deliver another huge batch of great trend-line breakout trades. Significant among these was the Cable for around 500 pips and Gold for $140! There were many more though and these are summarised later within this post. The anticipated US$ weakness developed but the DXY is now back at a key support level so bearish continuation is certainly not guaranteed. Stock markets in the US and Australia carved out a risk-on relief rally last week but I do see this as a bit of swimming against the tide as the Covid-19 situation is likely to get much worse in both countries, and others, before it gets better. A widely accepted view is that markets are forward looking but I think they still have an awful long way to look!

Technical Analysis: As noted over recent weeks, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions. Coronavirus remains the dominant market theme at the moment and this can be seen from CNBC’s Saturday front page where each headline was related to the topic:

Trend line breakouts and TC signals: There were many great trend line breakouts during the week from chart patterns profiled in last week’s analysis. The before and after charts for most of these successful breakout trades are shown in the later Market Analysis section. Articles published during the week can be found here, here, here and here:

- Gold: a TL b/o move for $140.

- S&P500: a TL b/o for 230 points.

- ASX-200: a TL b/o for 450 points.

- EUR/USD: a TL b/o that gave 230 pips.

- AUD/USD: a TL b/o that gave 200 pips.

- GBP/USD: a TL b/o that gave 500 pips.

- NZD/USD: a TL b/o that gave 200 pips.

- GBP/JPY: a TL b/o that gave 350 pips.

- USD/JPY: a TL b/o that gave 160 pips.

This Week: (click on images to enlarge):

-

- New Member-Only pages: Please note that I have published new member only pages to help with trying to catch trend line breakout trades off lower time frame charts. These two pages are linked below:

-

- DXY: US$ Index: The US$ index closed with a large bearish weekly candle and back near the 98 S/R level so watch this for any new make or break:

DXY weekly:

-

- End of Month and Quarter: Tuesday marks the end of month and end of quarter.

-

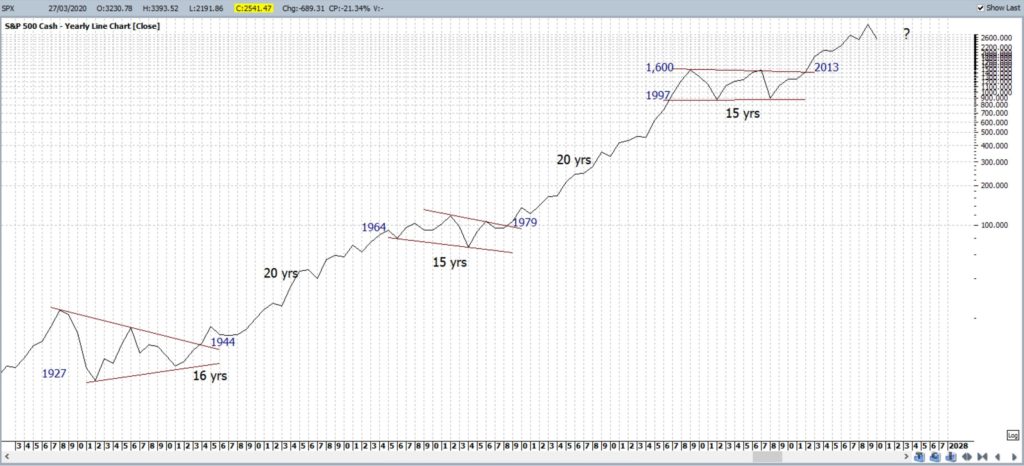

- S&P500: Keep the bigger picture in perspective with this pullback:

S&P500 yearly: keep this latest move lower in perspective:

-

- DJIA weekly: The DJIA closed with a bullish, almost ‘engulfing’, weekly candle and back above the 2009-2020 support trend line. The Index tested to down near the 50% Fibonacci of this swing High move BUT watch for any test of the 61.8% level.

DJIA weekly:

-

- NASDAQ composite: closed with a bullish, almost ‘engulfing’, weekly candle and back near the weekly 61.8% fib of the 2019-2020 swing High so watch this level for any new make or break. Also, note how the index has only pulled back to near the 38.2% fib of the 2009-2020 swing High and remains above the longer-term support trend line:

NASDAQ weekly:

NASDAQ weekly condensed:

-

- DAX weekly: The DAX closed with a bullish, almost ‘engulfing’, weekly candle after bouncing off the test of the key 8,000 S/R level.

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks. The Index is still trading below the longer-term 2009-2020 support trend line but bounced back up from the whole-number 1,000 level and printed a bullish-coloured Inside weekly candle. These candles reflect indecision so watch for any push to the key 880 level, near the 61.8% fib, if weakness continues.

RUT weekly:

-

- Bonds / TLT: The Bonds ETF, TLT, closed with a bullish weekly candle. Note the pullback being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a bearish weekly candle but well off its Low giving the candle a long lower shadow / wick.

VIX weekly: note how the Elliott Wave tool on my software is suggesting a pullback!

Calendar: Courtesy of Forex Factory: It is NFP week:

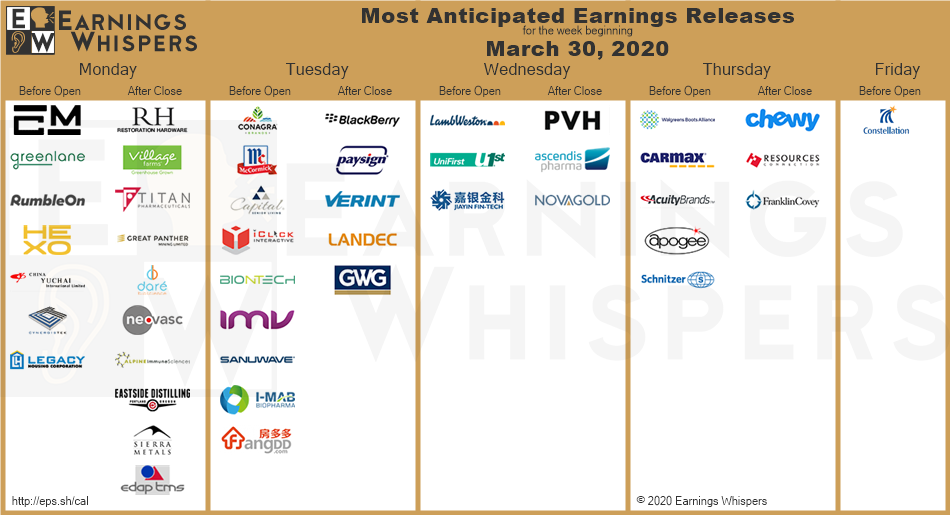

Earnings: Courtesy of Earnings Whispers: a fairly quiet week:

Market Analysis:

S&P500: SPX: The S&P500 closed higher for the week and this move triggered a great trend line breakout trade from the chart pattern profiled last weekend as the following two charts reveal:

S&P500 4hr: chart from last weekend’s analysis:

S&P500 4hr: chart following the 230 point breakout:

The weekly candle closed as a bullish coloured almost engulfing candle and back above the recently broken 2009-2020 support trend line. However, note the pattern on the revised daily and 4hr charts (below) that show a channel around last week’s bullish recovery effort. These charts can be viewed in either of two ways:

- Bullish: any breakout to the upside from the channel pattern would support a V-shaped recovery. This seems unlikely but that is what the chart would then reflect.

- Bearish: These trend lines could also be viewed as shaping up in a Bear Flag so keep an open mind for any breakout: up or down! The Flag pole here predicts the index falling to down near 1,300 so let’s hope this pattern fails! However, the impact from the economic fallout due to Covid-19 is still uncertain but could take an enormous toll if the situation continues to worsen. In fact, one Australian journalist noted, with some very sobering comments this morning, that the Covid-19 situation is much worse than the Great Depression and this would support this Bear Flag scenario.

As mentioned last week: I am still watching for any pullback to the 61.8% Fibonacci of this 2009-2020 swing High move and this level is down near 1,700 / 1.600. This is a region of some confluence as it is the previous upper level from the 2013 channel breakout; a region noted on the yearly and monthly charts. The 61.8% Fibonacci zone was also tested in the 1987 and GFC market pullbacks, as described in this post. For the moment though, the index has only pulled back to around 40% of this 2009-2020 swing High move so keep this move in perspective as technical theory would suggest the uptrend is intact until the 61.8% fib is broken!

Bullish targets: any bullish 4hr chart Flag breakout would bring 3,000 into focus as this is near the 4hr chart’s 61.8% fib. Note the Gap fill level on the daily chart as well and this near 2,900 so this may be a target as well.

Bearish targets: any bearish 4hr chart Flag breakout would bring the recent Low, near 2,200 into focus followed by whole-numbers on the way down to 1,700 S/R.

- Watch for any 4hr chart Flag breakout:

ASX-200: XJO: The ASX200 gave a great trend line breakout trade, from the chart pattern profiled last Monday, for up to 450 points as the following two charts reveal:

ASX200 4hr: chart from last Tuesday’s analysis (very similar to the Sunday’s chart):

ASX200 4hr: chart following the 230 point breakout:

The index ended up closing with a bullish-coloured Long Legged Doji weekly candle reflecting a great amount of indecision which is hardly surprising. I had warned that traders should watch for any pause or bounce at the major 61.8% fib of this 2009-2020 swing High move, circa 4,700 / 4,600, and this is what we got last week.

As per my notes last week, this 4,700 / 4,600 region was my worst case scenario support that I wrote about in this article and is a level I consider being of significant support, and a potential turning point, for Aussie stocks. However, given Australia is still at a relatively early stage with Coronavirus infections, I struggle to see any reason for a market turn around just yet and wonder, therefore, if there is even more retracement to come? The reality of this virus situation is still only starting to be felt in our community and I can’t see how last week’s market enthusiasm can be sustained. Whether the Index holds above this support or chops sideways for a while or slices right through remains to be seen.

There are revised daily and 4hr chart trend lines, which are similar to that seen on the S&P500, and these show a channel around last week’s bullish recovery effort. As with the S&P500 above, these charts can be viewed in either of two ways:

- Bullish: any breakout to the upside from the channel pattern would support a V-shaped recovery. This seems unlikely but that is what the chart would reflect.

- Bearish: these trend lines are also shaping up in a Bear Flag so keep an open mind for any breakout: up or down! The Flag pole here is large and would predict the index falling to down near 2,000 so let’s hope this pattern fails! However, the impact from the economic fallout due to Covid-19 is still uncertain but could take an enormous toll if the situation continues out to the end of the year. In fact, one Australian journalist noted, with some very sobering comments this morning, that the Covid-19 situation is much worse than the Great Depression and this would support this Bear Flag scenario.

Bullish targets: Any bullish 4hr chart Flag breakout would bring the 4hr chart’s 61.8% fib level, near 6,125, into focus.

Bearish targets: Any bearish 4hr chart Flag breakout would bring the recent Low, near 4,400, into focus followed by 4,000 and, after that, the GFC Low near 3,120.

- Watch for any 4hr chart Bear Flag breakout:

Gold: Gold closed higher for the week and this move triggered a great trend line breakout trade for up to $140 and this was from the chart pattern profiled last weekend; as the following two charts reveal:

Gold 4hr: chart from last week’s analysis:

Gold 4hr: chart following the $140 breakout:

The metal ended up closing with a bullish, almost ‘engulfing’, weekly candle and and back above $1,600 making this the level to watch for any new make or break.

I have captured recent price action on the 4hr chart with new trend lines so watch these for any new breakout.

Bullish targets: any bullish triangle breakout would bring $1,650 S/R into focus followed by $1,700.

Bearish targets: any bearish triangle breakout would bring $1,550, into focus as this is near the 4hr chart’s 50% Fibonacci level.

- Watch for any new 4hr chart trend line breakout:

Oil: Oil closed with a bearish-coloured Spinning Top weekly candle reflecting indecision as demand worry lingers.

Price action continues to hover just above $20 support keeping this the level to watch for any new make or break.

Bullish targets: any bullish 4hr chart trend line breakout would bring $30 S/R into focus followed by the $42 region as the latter represents the gap fill from a previous weekly close.

Bearish targets: any bearish 4hr chart triangle breakout below $20 would bring whole-number levels on the way to $10 into focus.

- Watch the 4hr chart trend lines for any new breakout:

EUR/USD: The EUR/USD closed with a large, bullish weekly candle and this move gave a great trend line breakout trade, from the chart pattern profiled in last weekend’s analysis, worth up to 280 pips as the following before and after shots reveal:

EUR/USD 4hr: chart from last weekend’s analysis:

EUR/USD 4hr: chart after the 280 pip breakout move:

Price action bounced off the 1.065 Low and ended the week just below 1.115 S/R and last week’s 4hr chart 61.8% Fibonacci level making this the main region to watch for any new make or break.

Bullish targets: Any bullish 4hr chart breakout above 1.115 would bring 1.144, near the weekly 200 EMA, into focus.

Bearish targets: Any bearish hold below 1.115 and break of trend line support would bring 1.10 into focus followed by the 20-yr TL, and, after that, the recent 1.065 Low.

- Watch 1.115 for any new breakout:

AUD/USD: The Aussie closed with a large bullish weekly candle, with the body of the candle engulfing the body of last week’s candle.

Price action continued on with the bounce up from 0.55 S/R and made it to near the 4hr chart’s 61.8% fib, circa 0.625, making this the level to watch for any new make or break.

Bullish targets: Any bullish breakout above 0.625 would bring 0.65 S/R into focus.

Bearish targets: Any hold below 0.625 and break of trend line support would bring 0.60 S/R into focus followed by whole-numbers on the way down to 0.50 S/R.

- Watch 0.625 and for any 4hr chart trend line breakout:

AUD/JPY: The AUD/JPY closed with a bullish weekly candle but the placement, shape and the longish upper and lower shadows/wicks makes this look like an indecision style candle.

Price action chopped around last week, primarily, under the 67 whole-number S/R level making this the level to watch for any new make or break.

There is a bit of a look of a bullish-reversal Inverse Head and Shoulder pattern but caution is needed if stocks resume any sell-off as I suspect they would drag this pair lower as well. Conversely, any bullish continuation with stocks would help to underpin this pattern.

Bullish targets: Any bullish 4hr chart triangle breakout above 67 would bring 70 S/R into focus followed by 71 and 72 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 65 S/R back into focus and, after that, 60 S/R.

- Watch 67 S/R and for any 4hr chart triangle breakout:

NZD/USD: The Kiwi closed with a large, bullish weekly candle and this move gave a great trend line breakout trade, from the chart pattern profiled in last Tuesday’s analysis, worth up to 290 pips as the following before and after shots reveal:

NZD/USD 4hr: chart from last Tuesday’s analysis (similar to the weekend chart):

NZD/USD 4hr: chart after the 290 pip breakout move:

Price action continued the bounce off the 0.55 Low and ended the week just below 0.605 S/R and last week’s 61.8% Fibonacci level making this the main region to watch for any new make or break.

Bullish targets: Any bullish 4hr chart breakout above 0.605 would bring whole-numbers on the way to 0.64 S/R into focus.

Bearish targets: Any bearish hold below 0.605 and break of support trend line would bring 0.57 S/R back into focus as this is near the revised 4hr chart’s 61.8% Fibonacci level

- Watch 0.605 for any breakout:

GBP/USD: The GBP/USD closed with a large, bullish weekly candle and this move gave a great trend line breakout trade, from the chart pattern profiled in last weekend’s analysis, worth up to 750 pips as the following before and after shots reveal:

GBP/USD 4hr: chart from last weekend’s analysis:

GBP/USD 4hr: chart after the 750 pip breakout move:

Price action bounced off the 2016 Low of 1.145 S/R and ended the week just below 1.25 S/R and the 4hr chart’s 61.8% Fibonacci level making this the main region to watch for any new make or break.

Bullish targets: Any bullish 4hr chart breakout above 1.25 would bring 1.28 and, then, whole-numbers on the way to 1.32 S/R into focus.

Bearish targets: Any bearish hold below 1.25 and break of trend line support would bring 1.20 into focus as this is previous S/R and near the 4hr chart’s 50% Fibonacci.

- Watch 1.25 for any new breakout:

USD/JPY: The USD/JPY closed with a large, bearish weekly candle and this move gave a great trend line breakout trade, from the chart pattern profiled in last weekend’s analysis, worth up to 300 pips as the following before and after shots reveal:

USD/JPY 4hr: chart from last weekend’s analysis:

USD/JPY 4hr: chart after the 300 pip breakout move:

Price action has pulled back to to near 108 S/R making this the region to watch for any new make or break in coming sessions.

Bullish targets: Any bullish 4hr chart recovery back above 108 would bring 108.5, 109 and, then, whole-numbers on the way to 112 into focus.

Bearish targets: Any bearish hold below 108 and break of support trend line would bring 105 S/R back into focus as this is near the 4hr chart’s 61.8% Fibonacci and the monthly 200 EMA.

- Watch 108 for any breakout:

GBP/JPY: The GBP/JPY closed with a large bullish weekly candle and this move gave a great trend line breakout during the week worth up to 350 pips:

GBP/JPY 4hr: chart after the 350 pip breakout move:

Price action continued the bounce up from 125 S/R and ended the week just below 135 S/R and the 4hr chart’s 50% Fibonacci level making this the main region to watch for any new make or break.

Bullish targets: Any bullish 4hr chart breakout above 135 would bring whole-numbers on the way to 140 and 150 into focus.

Bearish targets: Any bearish hold below 135 and break of support trend line would bring 130 S/R back into focus and, after that, the 125 level.

- Watch 135 for any breakout: