The S&P500 tested the 14-month trend line again last session but recovered somewhat following the release of the Fed Minutes. The potential for tapering may have been what helped the US$ to bounce off a recent S/R level. Many instruments continue to hover near key S/R levels but the AUD/JPY is looking vulnerable to some further weakness so watch today with AUD Employment data.

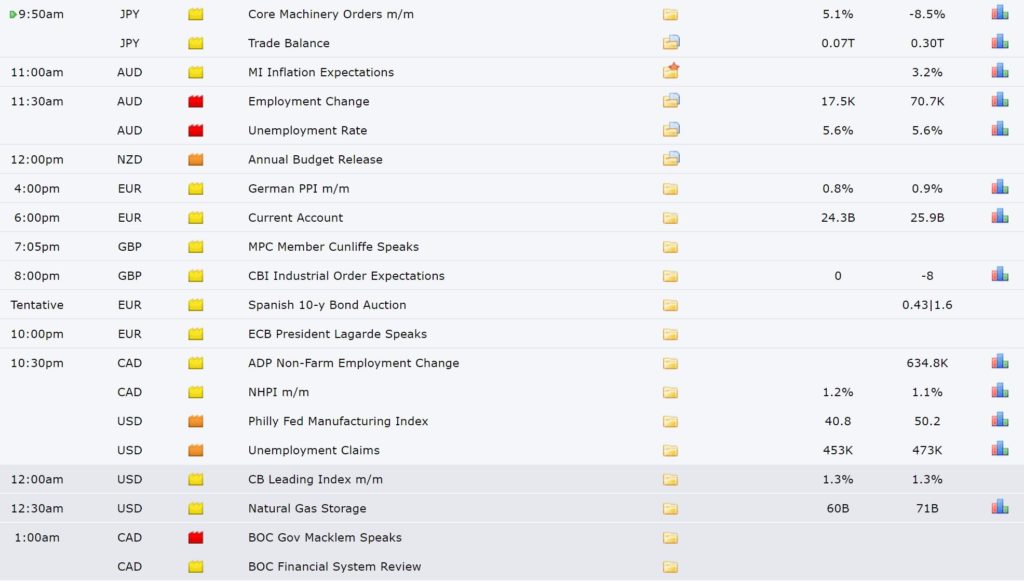

Data:

Earnings:

DXY daily: bounced off the recent Low:

Trend line breakouts:

S&P500 4hr: the recent TL b/o gave up to 30 points BUT note the hold above the 14-month TL:

ASX-200 4hr: the recent TL b/o gave up to 120 points BUT note the hold above the Pre-GFC High:

Gold 4hr: the recent TL b/o gave up to $38 points BUT note the hold below the $1,900 level:

AUD/JPY 4hr: looking a bit vulnerable as it failed to hold 85 and has now broken the 14-month support TL BUT watch the 4hr 200 EMA with today’s AUD Employment data:

Other markets:

EUR/USD 4hr: watch for any new TL b/o:

AUD/USD 4hr: watch for any new TL b/o; especially with today’s AUD Employment data:

NZD/USD 4hr: watch for any new TL b/o:

GBP/USD 4hr: watch 1.41 for any new make or break:

USD/JPY 4hr: watch for any new TL b/o:

GBP/JPY 4hr: watch 154 for any new make or break: