Last week: September and October are renown as being seasonally weak for stocks and, as if right on cue, that was the theme for last week. The end of the the northern summer doldrums period was also marked by a decent uptick with volatility. The four major US stock indices; S&P500, DJIA, NASDAQ and Russell-2000, all closed with bearish weekly candles and the DJIA broke below an 18-month support trend line. My Currency Strength Indicator reveals that were was some mean-reversion last week, something I had cautioned about in my previous weekly update, and many of the Forex pairs I monitor closed with indecision-style weekly candles. There were two bits of divergence to this overall bearish theme worth noting however and this was the bullish close on the risk-metric Copper and the lack of significant weakness displayed on the Kiwi. So, as I always urge, keep an open mind and trade what you see and not what you think.

Technical Analysis: It is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Covid-19, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts: Some of the Forex pullbacks were rather choppy and not as conducive for catching smooth, momentum-based trend line breakouts. The move on the ASX-200 was one exception and is profiled below. Articles released during the week can be found here, here, here and here.

- ASX-200: a TL b/o, below the 18-month support TL, for up to 110 points. This breakout triggered on Thursday 9th August as the 30 min chart reveals:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The DXY closed with a bullish-coloured, essentially Inside, weekly candle reflecting indecision as price action remains in a weekly triangle on low and contracting momentum. There is US CPI and Retail Sales data to monitor this week so watch to see if either of these can trigger a DXY breakout:

DXY weekly: watch for any new momentum-based TL b/o:

-

- Currency Strength Indicator: The 4hr chart of my CSI shows some recent mean reversion, something that I had warned about last week, so watch for any new breakouts (click on chart to expand and enhance view).

Currency Strength Indicator 4hr: note the mean reversion:

-

- % Stocks above their 200 Day Moving Average Index: The Percentage of stocks above their 200 Day Moving Average continues to trade below the all time High region. The first chart, below, gives a perspective of this current level and shows the previous peaks near 92.50% and how there often tends to be some mean-reversion once such lofty levels are reached. The second, expanded, chart shows the continued struggle under the 92.50% level. It is interesting to see the decent pullback here now despite the fact that the S&P500 is trading up near an all-time High.

% of US Stocks above the 200 Day Moving Average: still retreating after peaking at the 92.50% region:

% of US Stocks above the 200 Day Moving Average (expanded): holding below 92.50%:

-

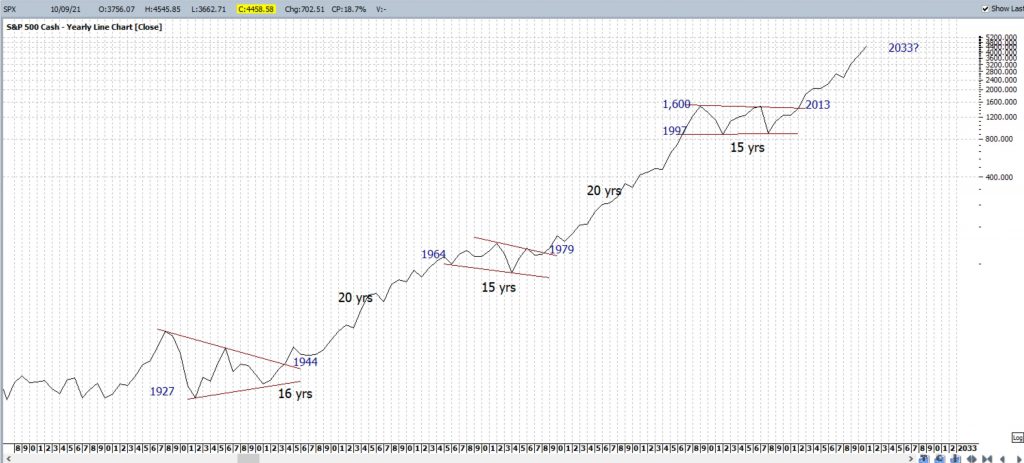

- S&P500: Keep the bigger picture in perspective with the recent moves as this chart suggests there is a lot more room to move with the overall bullish run. However, this does not discount the odd pullback along the way as trends do not travel in straight lines forever; they tend to zig and zag their way along either bullish or bearish paths. Note how the recent Covid dip does not even figure on this chart!

S&P500 yearly: keep this latest move in perspective:

-

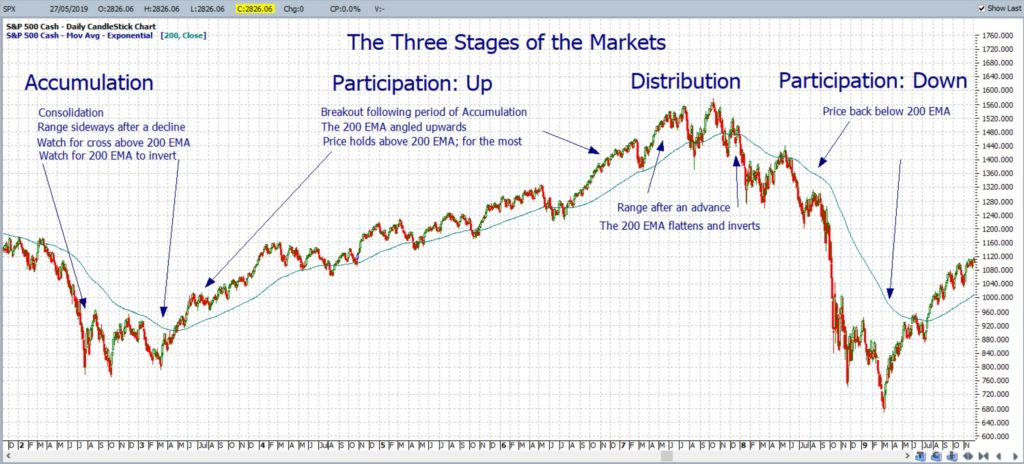

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 trades up near an all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed, somewhat surprisingly, with a bullish weekly candle. It still looks like Copper is consolidating after its recent bullish run so watch the Bull Flag trend lines for any new breakout: up or down.

Copper weekly: Watch for any new breakout:

-

- Emerging Markets: The Emerging market ETF, EEM, closed with a bearish weekly candle BUT there is still the look of a Bull Flag here. Watch for any trend line breakout: up or down.

EEM weekly: watch for any trend line breakout: up or down:

-

- DJIA: The DJIA closed with a bearish weekly candle and has now broken below the key 35,000 level and 18-month support trend line. Any failure at this key level, if bearish momentum develops, would bring the weekly 61.8% Fibonacci, near 25,000, into focus.

DJIA weekly: keep watch of 35,000:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bearish Engulfing weekly candle but still above the key 15,000 level and 18-month support trend line. Watch for any uptick with the ADX above 20 and for any push to the 16,000 level.

NASDAQ weekly: keep an eye on ADX momentum here:

-

- DAX weekly: The DAX closed with a bearish weekly candle and has broken below the 18-month support trend line. Momentum remains low so watch for any new Flag breakout: up or down.

DAX weekly: watch 16,000 for any new make or break:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index closed with a bearish weekly candle but continues to chop sideways within a trading channel so watch for any new breakout: up or down.

RUT weekly: watch the Flag for any new b/o:

-

- 10-yr T-Note Interest rate / TNX: This has closed with a bearish-coloured Spinning Top weekly candle. Watch for any new trend line breakout.

- 10-yr T-Note Interest rate (weekly): watch for any trend line breakout:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish-coloured Spinning Top weekly candle BUT watch for any bullish continuation from the recent trend line breakout.

TLT weekly: watch for any push to the 61.8% Fibonacci:

-

- BTC/USD: I had warned to watch for any new reaction at the daily 61.8% Fibonacci, near $51,000, and this proved to be rather prudent advice! Note the reversal from this region! Any new bullish close above $51,000 would, however, bring the previous High, circa $65,000, back into focus.

BTC/USD: keep watch of the daily 61.8% Fibonacci, near $51,000, for any new reaction:

BTC/USD: any further weakness would bring $38,000 into focus as near the 61.8% of this recent swing High:

-

- VIX: the Fear index closed with a large, bullish weekly candle and back above 20 S/R.

VIX weekly: watch for any hold above 20 S/R:

Calendar: Courtesy of Forex Factory:

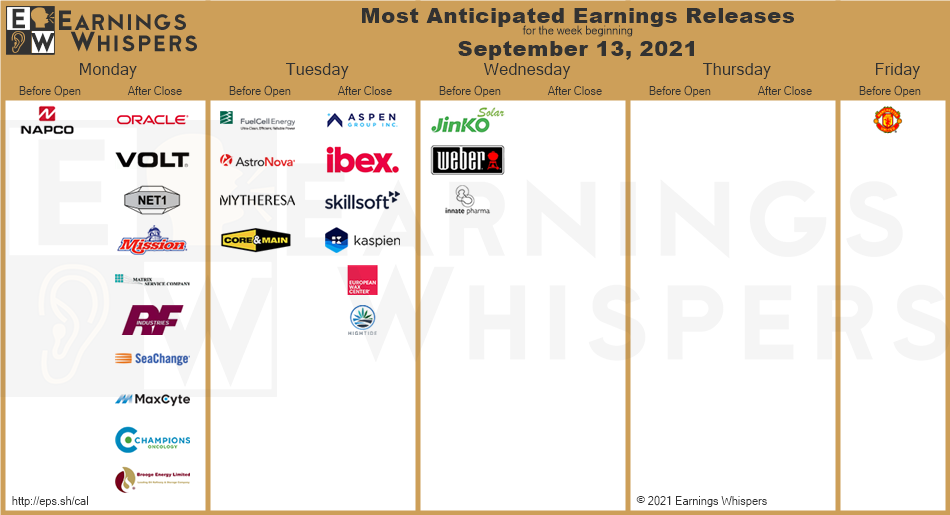

Earnings: Courtesy of Earnings Whispers: winding down:

Market Analysis:

S&P500: The S&P500 closed with a bearish, almost Engulfing, weekly candle and back down at the 18-month support trend line. I had warned last week about the 4,600 resistance level and this has featured strongly over the last few weeks. Recall that 4,600 is the region of the 200% Fibonacci retracement of the Covid swing Low move and remains the resistance to monitor.

Traders should also monitor the 18-month support trend line for any bearish break and, if this support does give way, they should then take care to watch for any potential sideways consolidation that might form a Bull Flag.

Trading volume was similar to the previews week but has edged above the bear trend line BUT watch for any 200 MA breakout.

S&P500 ETF: SPY weekly: watch for any new 200 MA b/o:

There are revised 4hr chart trend lines to monitor.

Bullish targets: any bullish bounce up from the 18-month support trend line would bring 4,500 and a recent bear trend line into focus. After that, watch 4,550 and 4,600 as the latter is near the 200% Fibonacci retracement of the Covid swing Low (see the second weekly chart). Then watch whole numbers on the way up to the 5,000 level.

Bearish targets: any bearish 4hr chart trend line breakout would render a break of the 18-month support trend line and would bring 4,450 and 4,400 into focus. After that, whole-numbers on the way down to the weekly chart’s 61.8% Fibonacci retracement level, now near 3,100.

- Watch the 18-month support trend line for any new make or break:

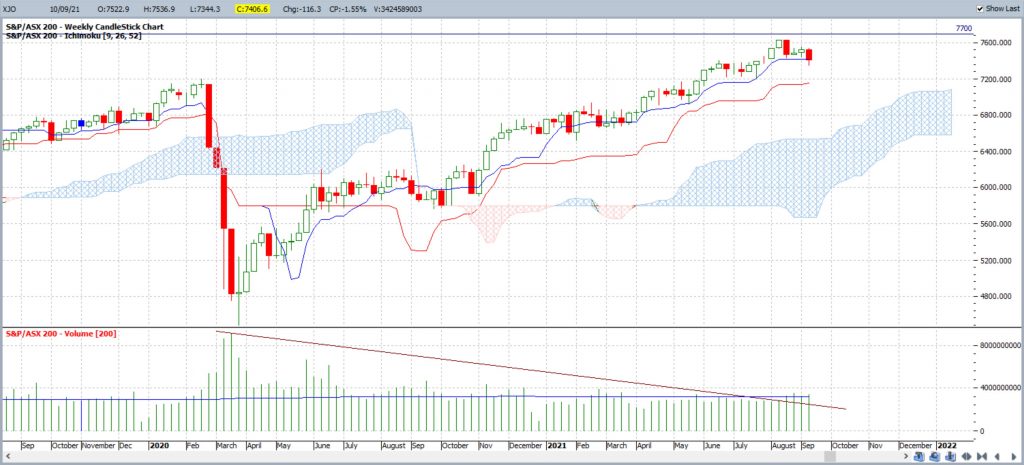

ASX-200: XJO: The XJO closed with a bearish weekly candle and has now broken below an 18-month support trend line. The break of this support trend line triggered on Thursday and one reason offered for this weakness was a poor lead from US markets but it was also the day when Chinese regulators took aim at their tech stocks and this dragged a number of Asian stock indices lower. Don’t forget, though, that around half the population of Australia is still in a Covid-inspired lock down and here in my state, the most populated of the country, many of us are entering week 13 of lock down.

Regardless of having ample reasons for bearish follow-through, XJO traders need to remain open minded over the coming weeks and watch for any potential sideways consolidation that might form a Bull Flag. The 4hr chart shows how last week’s pullback paused at the 61.8% Fibonacci of the recent swing High move, near 7,350, making this the support level to monitor in coming sessions.

As mentioned over recent weeks:

- It has taken a long time for the XJO to break and hold above the pre-GFC High region and, in this regard, it has lagged well behind most other global stock indices. However, any continued hold above this 7,200 region could well mark the beginning of a new trading range for the index and put it in catch-up mode with its peers.

- S&P upgraded the Australian outlook from ‘Negative’ to ‘Stable’ recently so watch for any impact this may have on market sentiment for the XJO.

Trading volume was a bit higher last week and has edged above the 200 MA so watch for any continued push higher.

XJO weekly: watch for any push higher with trading volume:

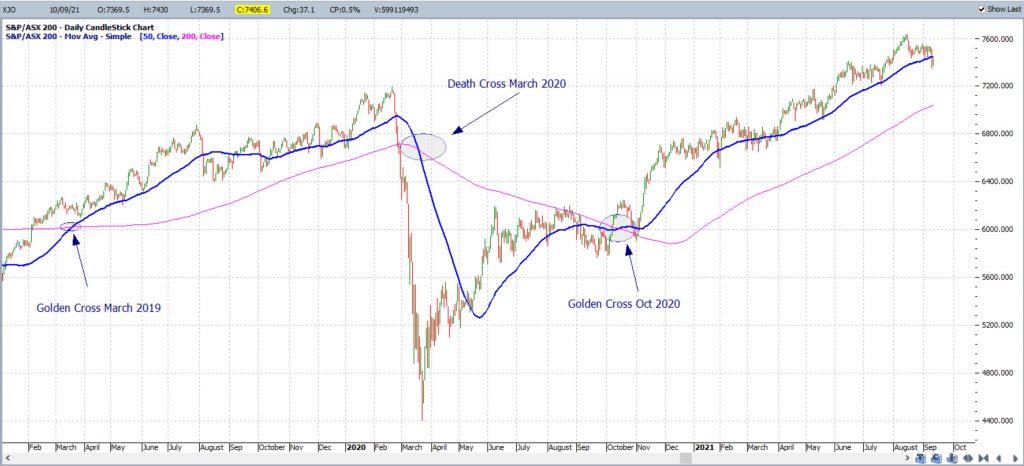

Keep in mind that the recent Golden Cross still remains valid for the time being although the index has moved back below the 50 SMA. The Golden Cross is a bullish signal where the 50 SMA crosses above the 200 SMA. Such crosses are often, but not always, followed by a decent bullish run so these crosses are worth noting. This current Golden Cross has proved to be great signal!

XJO daily: the recent Golden Cross remains valid for the time being:

The index closed just above the 7,350 level making this the level to watch for any new make or break.

Bullish targets: Any bullish hold above 7,350 would bring 7,400, 7,500 and, then, the recently broken 18-month support trend line into focus.

Bearish targets: Any bearish break below 7,350 would bring 7,300 and 7,200 into focus. After that watch the previous 2020 High of 7,197.20, the pre-2020 High of 6,893.70 and the pre-GFC High of 6,851.50. The weekly chart’s 61.8% Fibonacci is down near 5,600 so that would be the next support to monitor.

- Watch 7,350 for any new make or break:

Gold: Gold closed with a bearish, almost engulfing, weekly candle and back below the $1,800 level. The precious metal didn’t receive the same flows that Copper enjoyed nor any flight to safety flow.

As mentioned over recent months: The activity below $1,900 acts as further evidence in support of the longer-term Inverse H&S thesis that I have been discussing as an option here for many months.

The weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800 – $900. Keep watch of $1,900 now that price action is trading back above this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any break back above $1,900 would support the Cup pattern thesis.

- Any hold below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming sessions especially as the US$ index is still below the recently broken 10-year support trend line:

- any US$ hold below the multi-year support trend line could help send Gold higher.

- any US$ move back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

The daily chart reveals the importance of the $1,670 level so this continues to be a ‘line in the sand’ support level to monitor. Any new weekly close below the $1,670 level would bring $1,500 into greater focus. The weekly charts show that $1,500 is:

- near the 61.8% Fibonacci of the Aug 2018 – Aug 2020 swing High move.

- forms the lower boundary of the Inverse H&S pattern I have had on my charts for many months.

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: any bullish 4hr chart trend line breakout would bring $1,850 and $1,900 into focus.

Bearish targets: any bearish 4hr chart trend line breakout would bring $1,770 and $1,750 into focus. After that, watch for any push down to the $1,670 support level.

- Watch for any 4hr chart trend line breakout.

EUR/USD: The EUR/USD closed with a bearish-coloured Inside weekly candle, reflecting indecision, as price action failed to hold back above the recently broken 18-month support trend line.

The weekly chart’s bullish-reversal Descending Wedge remains in play for the time being but any new weekly break and hold below 1.18 would likely undermine this pattern. The weekly chart shows that ADX momentum is contracting so I am keeping a close eye on this metric.

As mentioned over recent weeks: I have included a second weekly chart again and this shows the potential for a longer-term bearish Double Top pattern but, if the 1.17 continues to hold, then this would be a rather bullish signal. All of this suggests that, at the very least, traders should keep an open mind!

There are revised 4hr chart Flag-style trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart Flag trend line breakout would bring the recently broken 18-month support trend line and 1.19 S/R back into focus. After that, watch whole-numbers on the way up to the 14-yr bear trend line.

Bearish targets: Any bearish 4hr chart Flag trend line breakout would bring 1.18 S/R back into focus. After that, watch for any push to the 4hr chart’s wedge 61.8% Fibonacci and 1.17 level and, then, whole numbers on the way down to the daily chart’s 61.8% Fibonacci, near 1.13.

- Watch for any new 4hr chart trend line breakout.

AUD/USD: The Aussie closed with a bearish-coloured Inside weekly candle reflecting indecision as this also failed to hold back above the recently broken 18-month support trend line.

There are revised 4hr chart Flag-style trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart Flag trend line breakout would bring 0.74 into focus. After that, watch the daily 200 EMA and recently broken 18-month support trend line followed by 0.75 and whole numbers on the way up to the 11-yr bear trend line and 0.80 S/R.

Bearish targets: Any bearish 4hr chart Flag trend line breakout would bring 0.73 into focus. After that, watch whole-number levels on the way down to 0.65 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move (see daily chart).

- Watch for any 4hr chart Flag trend line breakout; especially with this week’s Australian Employment data update.

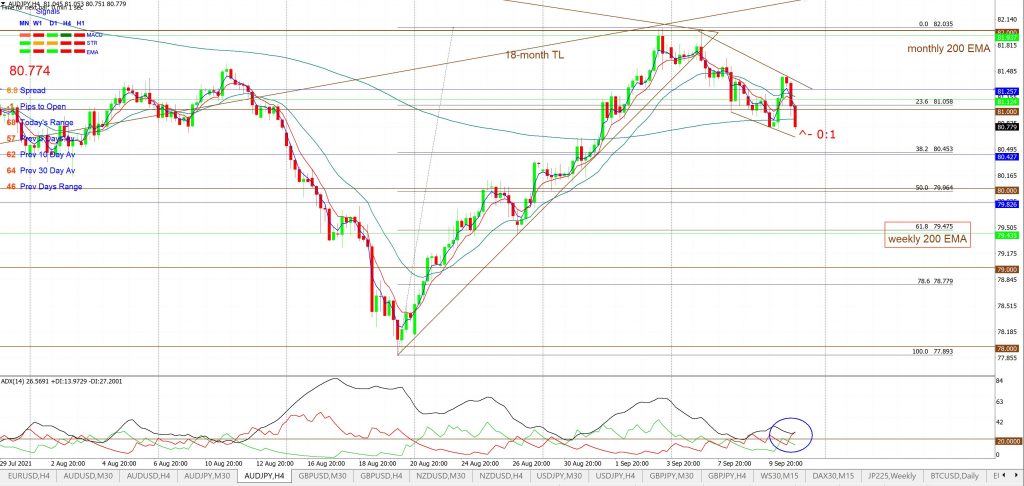

AUD/JPY: The AUD/JPY closed with a bearish-coloured Inside weekly candle reflecting indecision as price action struggled to break back above the recently broken 18-month support trend line, monthly 200 EMA and 82 S/R level.

As noted over recent weeks:

- The weekly chart reveals that the 85 level has been a significant reaction zone for the AUD/JPY and has been resistance for the last three years; this level was peppered many times throughout 2018 but could not be broken. The next major level above 85 is 90 so watch this target level if 85 is broken.

- AUD/JPY traders also need to keep an eye on the sentiment with stocks though, especially the S&P500 index, as the two are generally highly aligned; as the chart below reveals. Any pause or serious pullback with stocks might render similar for the AUD/JPY.

- The recent divergence on the chart below still has me wondering which of the two will yield? Will the S&P500 join the AUD/JPY in tracking lower or will the AUD/JPY recover and move higher to catch up with the S&P500?

AUD/JPY versus S&P500 (gold line): a high degree of positive correlation BUT note the recent divergence!

There are revised 4hr chart Flag-style trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart Flag trend line breakout would bring 82 S/R and the monthly 200 EMA into focus. After that, watch the recently broken 18-month TL and whole numbers on the way up to 85 and 90 S/R.

Bearish targets: Any bearish 4hr chart Flag trend line breakout would bring 80 S/R and the weekly 200 EMA into focus as the latter is near the 4hr chart’s 61.8% Fibonacci. After that, watch whole-numbers on the way down to 70 as this is near the 61.8% Fibonacci of the March 2020 – March 2021 swing High move (see daily chart).

- Watch for any new 4hr chart trend line breakout; especially with this week’s Australian Employment data update.

NZD/USD: The Kiwi closed with a bearish-coloured Inside weekly candle reflecting indecision as price action struggled to break free of the 0.71 and recently broken 18-month support trend line region. This was one of the few currency pairs that managed to hold back above the support trend line so this relative strength is worth noting.

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 0.72 into focus. After that, watch for any push up to 0.75.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 0.71 and the recently broken 18-month support trend line into focus. After that, watch the 4hr chart’s 61.8% Fibonacci region, near the weekly 200 EMA, and whole-number levels on the way down to 0.63 as this is near the 61.8% Fibonacci of the daily chart’s March 2020 – Feb 2021 swing High move.

- Watch for any new 4hr chart trend line breakout; especially with this week’s NZ GDP data:

GBP/USD: The Cable closed with a bearish-coloured, almost, Inside / Spinning Top weekly candle reflecting indecision as price action struggled to break away from the recently broken 18-month support trend line.

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish break back above the the 18-month support TL would bring 1.39 into focus. After that, watch 1.40 and whole number levels on the way up to the 15-yr bear trend line.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 1.38 and 1.37 into focus. After that, watch whole-number levels on the way down to 1.25 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move (see daily chart).

- Watch for any new 4hr chart trend line breakout:

USD/JPY: The USD/JPY closed with a bullish-coloured Spinning Top weekly candle reflecting indecision as price ended back below the 110 S/R level.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 111 into focus followed by whole-numbers on the way up to 115.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 109 S/R into focus followed by whole numbers down to 106 as the latter is near the weekly chart’s 61.8% Fibonacci.

- Watch for any new 4hr chart trend line breakout:

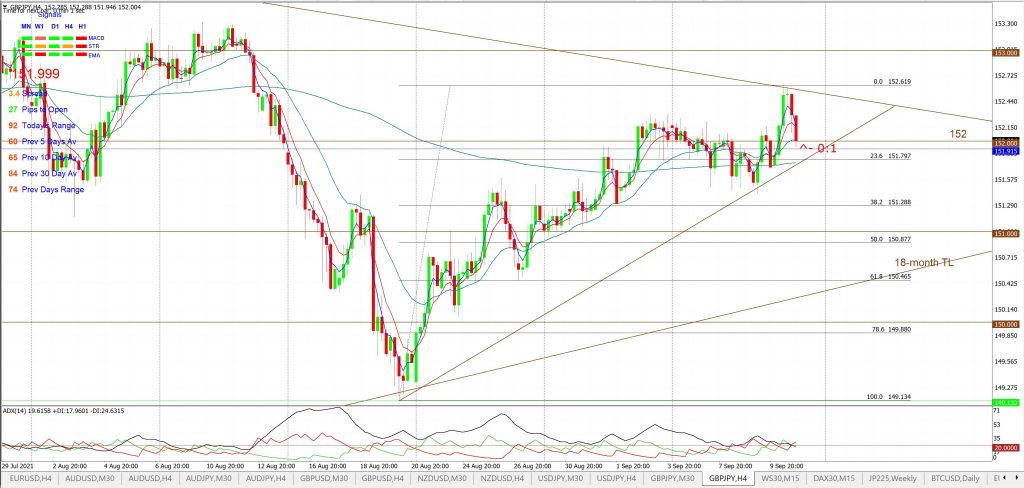

GBP/JPY: The GBP/JPY closed with a bearish coloured Doji weekly candle reflecting indecision as price action struggled under a multi-month bear trend line and near the 152 S/R level.

NB: The longer-term target for any bullish continuation above the previously broken 40-yr trend line, noted in my post of January 3rd, is the weekly chart’s 61.8% Fibonacci, near 170. Price action at the time of this breakout was near 141 and has reached up as far as 156, a move of around 1,500 pips, and so is another trend line breakout that has proven to be worthwhile monitoring.

There are revised trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 153 into focus. After that, watch whole-number levels on the way up to the weekly chart’s 61.8% Fibonacci, near 170.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 151 and the 18-month support trend line into focus. After that, watch whole-number levels on the way down to 136 as this is near the daily chart’s 61.8% Fibonacci of the March 2020 – March 2021 swing High move (see daily chart).

- Watch 152 and for any new 4hr chart trend line breakout: