Last week: Most trading instruments closed with small weekly candles, and there were many indecision candles again, reflecting a lack of confidence with the current risk-on market sentiment. As if the worsening global Covid-19 situation isn’t enough there is also increasing China trade tension among the range of geopolitical issues to navigate. The NASDAQ was a bit of an outlier last week closing with a bearish-reversal candle although the Russell-2000, often considered the Canary in the Coal Mine, closed with a bullish weekly candle so, yet again, it is clear as mud! In the Forex space it looks like the EUR/USD is trying to make a bullish breakout which only adds to confusion as Covid worsens across the globe. In fact, the EUR/USD was the only decent market move last week so keep an eye on this space in coming sessions. The best traders can do is to watch for momentum-based trend line breakouts and to manage risk and trade size appropriate for these unusual market conditions.

NB: I am away from next Wednesday 22nd July for 5 days so updates during this period will be brief.

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts and TC signals: It was a very quiet week for trend line breakout moves. Articles published during the week can be found here, here, here and here:

- EUR/USD: a bounce up from 1.13 for 140 pips.

- This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with another bearish-coloured weekly candle and remains range-bound HOWEVER, note the uptick with momentum so watch to see if the ADX can pop above 20:

DXY weekly:

-

- Indecision weekly candles: these appeared again last week and were printed on: the DJIA, S&P500, ASX-200, Gold, Crude Oil, Copper, TLT, AUD/USD, AUD/JPY, GBP/USD, NZD/USD and USD/JPY.

-

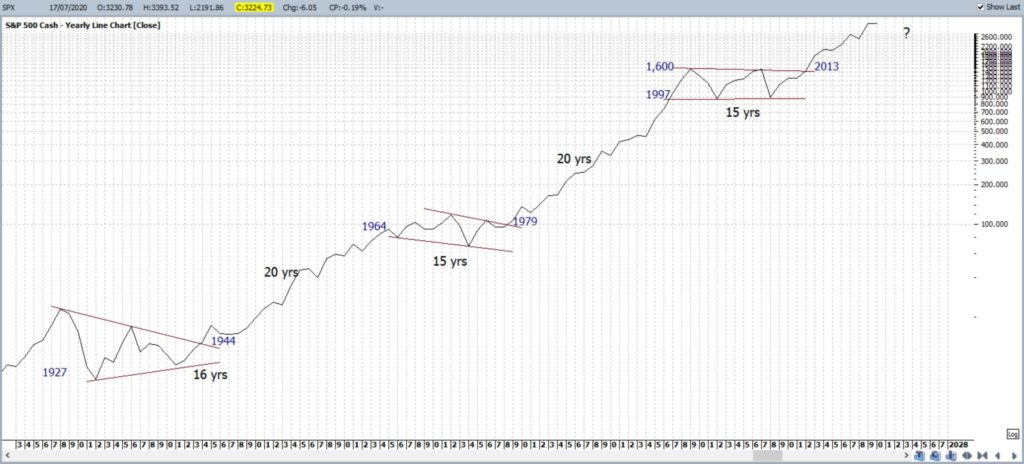

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

- Currency Strength Indicator: note how the currencies continue converging on the daily time frame. I ask again: Is a breakout move brewing?

Currency Strength Indicator (daily):

-

- Gold: I have been warning about the bigger picture chart pattern shaping up on the weekly chart of an Inverse H&S. Watch carefully now as the precious metal holds above the $1,800 ‘neck line’ breakout level of this pattern.

-

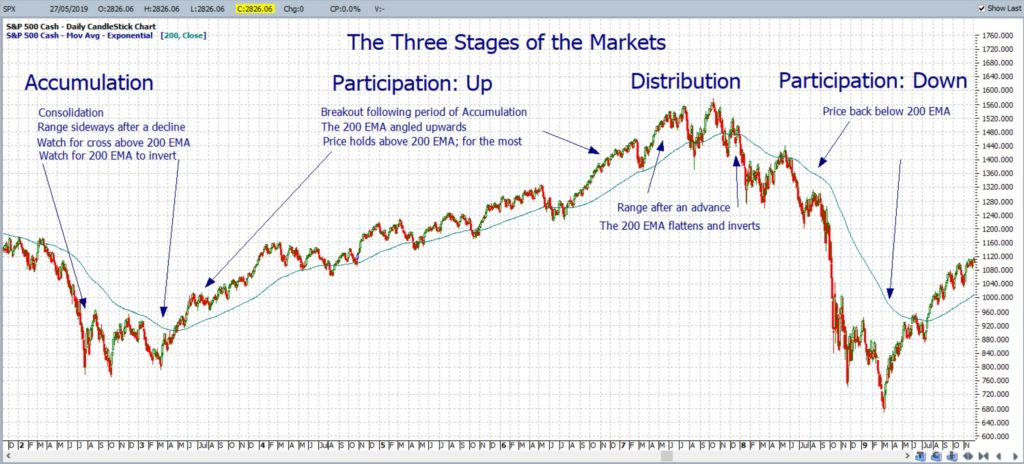

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; even if the S&P500 heads back to testing its all time High: The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper Weekly: Copper closed with a bearish-coloured Spinning Top weekly candle under the 3 S/R level BUT watch for any new triangle breakout:

Copper weekly:

-

- DJIA weekly: The DJIA closed with a bullish-coloured Spinning Top style weekly candle reflecting indecision as the index holds above the key 25,000 S/R region. Bullish momentum is edging higher though so keep an eye on the ADX for any new upswing:

DJIA weekly:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bearish-reversal Hanging Man weekly candle so watch for any pause from this lengthy rally. Netflix earnings impacted the NASDAQ last week so keep an eye on tech sector earnings results this week for any further impact. The 10,000 level, which was previous resistance, will likely now offer some psychological support:

NASDAQ weekly:

-

- DAX weekly: The DAX closed with a bullish weekly candle so watch for any push to the recent all-time High:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and has now closed with a bullish weekly candle:

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a small bullish-coloured Spinning Top style weekly candle reflecting indecision as the risk-on bias across stock markets continues. However, note the pullback that is still being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a small, bearish weekly candle having a long upper shadow reflecting that sellers dominated to see out the week. The Index is still below the 30 level so watch this region for any new momentum based make or break:

VIX weekly: watch the key 30 level for any new momentum based make or break:

Calendar: Courtesy of Forex Factory:

Earnings: Courtesy of Earnings Whispers: Watch for impact from Earnings as the season ramps up:

Market Analysis:

S&P500: The S&P500 closed with a bullish-colored Spinning Top style weekly candle having a long lower shadow reflecting that buyers stepped up during the week.

Price action closed above the resistance of the 3,200 level and trading Volume, whilst still relatively low, has made a subtle break above the bear trend line; as the following chart reveals. Any Volume move above the 200 Moving Average line would be viewed as supportive and bullish:

S&P500 ETF: SPY weekly: Volume is still low and below the moving average BUT note the break of the bear trend line:

The recent High, near 3,230, remains as a resistance to pass so watch this for any new breakout.

Bullish targets: any bullish 4hr chart triangle breakout above the recent High, circa 3,230, would bring whole-numbers on the way back to the previous all-time High, near 3,400, into focus.

Bearish targets: any bearish 4hr chart triangle breakdown would bring 3,100 and 3,000 into focus followed whole-number levels on the way down to 2,800.

- Watch 3,230 S/R and the 4hr chart triangle trend lines for any new breakout:

ASX-200: XJO: The ASX-200 closed with a bullish-coloured Inside-style and Spinning Top weekly candle with both reflecting indecision as price continues trading near the psychological 6,000 level.

Trading Volume remains low so keep watch for any new Volume trend line breakout.

XJO weekly: trading Volume was low again this week:

The 6,000 level remains the S/R level to watch for any new make or break although there are still 4hr chart trend lines to monitor as well.

Bullish targets: Any bullish 4hr chart triangle breakout would bring the recent High, near 6,190, into focus followed by whole number levels on the way back to the previous all time High, circa 7,200.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the 11-yr trend line support into focus followed by the 5,000 level as this is still near the 4hr chat’s 61.8% fib level.

- Watch 6,000 S/R and for any new 4hr chart triangle breakout:

Gold: Gold closed with another bullish-coloured Spinning Top style weekly candle and just above the key $1,800 level making this the level to keep watching for any new make or break in coming sessions.

Note how price action is trading in a 4hr channel near this key $1,800 level so watch these trend lines for any new breakout.

Weekly chart: As mentioned over recent weeks, the weekly chart has the look of a broad Inverse H&S pattern or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around $700 so it is a longer-term pattern worth monitoring. Keep watch of $1,800 now that price action is trading above this neckline region!

Bullish targets: any bullish 4hr chart channel breakout would bring the previous all time High region, near $1,900, into focus.

Bearish targets: any bearish 4hr chart channel breakout below $1,800 would bring $1,750 into focus followed by $1,700 and, then, $1670.

- Watch $1,800 and the channel trend lines for any new momentum based trend line breakout:

Oil: Oil closed with another bullish-coloured Doji weekly candle and under the $41.50 level reflecting ongoing indecision. This region marks an earlier Gap Fill level so is the level to watch for any new make or break.

Bullish targets: any continued bullish daily chart triangle breakout above $41.50 and daily 200 EMA would bring $42 into focus on the way up to the $50 S/R region.

Bearish targets: any bearish retreat from $41.50 would bring $40 and $35 followed by $30 and $20 and, then, the recent Low, near $6.50, into focus.

- Watch the $41.50 level and the daily 200 EMA for any continued daily chart triangle breakout:

EUR/USD: The EUR/USD closed with a bullish weekly candle and above 1.14 giving the daily chart a bullish breakout look to the Cup ‘n’ Handle pattern. The 1.15 features as the next key S/R level for this pattern so watch for any move to this key zone.

Price action is now in a 4hr chart triangle, just above this daily chart Flag, so watch for any new trend line breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring the recent High, near 1.15, into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 1.14 into focus followed by whole-numbers on the way down to the 20-yr support trend line.

- Watch for any new 4hr chart triangle breakout:

AUD/USD: Not much has changed here this week as the Aussie closed with another bullish-coloured Spinning Top weekly candle reflecting indecision as price navigates the major 9-11 year bear trend line. Remember that this trend line is the upper trend line of the longer-term bullish-reversal Descending Wedge so traders should keep watch of this region for any new new breakout.

As mentioned over recent weeks:

- The June monthly candle actually closed just under this wedge trend line so it will take another month before the next candle close could confirm a monthly wedge breakout. The monthly candle close below the multi-year trend line supports the full range of trading possibilities: a pullback, further consolidation and continuation so keep an open mind here.

- A pullback, even if only temporary, could still well evolve here so watch the multi-year trend line here for clues. Remember, trends do not travel in straight lines unabated and so a pullback at this major wedge trend line resistance zone would not be at all unexpected.

There are revised 4hr chart trend lines to watch for any momentum breakout. Note the Elliott Wave pullback being suggested by my software on the weekly chart though!

Bullish targets: Any bullish 4hr chart triangle breakout above 0.70 would bring whole-number levels on the way up 0.90 into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 0.69 into focus followed by the 9-11 year bear trend line and, then, 0.67 S/R.

- Watch 0.70 and for any new triangle trend line breakout;

AUD/JPY: The AUD/JPY closed with another Spinning Top weekly candle reflecting indecision, however this time bullish coloured, as price continues to struggles under the 75 S/R level making this the region to keep watch for any new make or break.

There are revised trend lines on the 4hr chart to watch for any breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring whole-number levels on the way up to the 7-year bear trend line and 78 S/R into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 74 and 73 S/R back into focus followed by whole-number levels on the way down to 65 and 60 S/R as well as the longer-term support trend line.

- Watch for any 4hr chart triangle breakout

NZD/USD: The Kiwi closed with a bearish-coloured Spinning Top weekly candle reflecting indecision as price struggles under the major resistance of the 7-year bear trend line keeping this as the upper region to watch for any new make or break.

Bullish targets: Any bullish breakout above the 7-year bear TL would bring 0.70 S/R into focus.

Bearish targets: Any bearish 4hr chart break of the support trend line would bring 0.65 into focus followed by the weekly chart’s support trend line.

- Watch the 7 yr bear trend line and for any 4hr chart momentum-based trend line breakout:

GBP/USD: The GBP/USD closed with a bearish-coloured Spinning Top weekly candle reflecting indecision as the Cable holds near the 1.26 S/R level.

Price action is in a revised 4hr chart triangle, that continues sitting within a larger weekly triangle, so watch trend lines for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.26 followed by the recent High, near 1.28, into focus.

Bearish targets: Any bearish 4hr chart triangle breakout bring the weekly support trend line into focus as this is near the 4hr chart’s 61.8% Fibonacci

- Watch for any 4hr chart triangle breakout:

USD/JPY: The USD/JPY closed with yet another Spinning Top weekly candle, this time bullish coloured, making this the fifth consecutive such weekly candle. These small indecision-style candles reflect that price action has essentially chopped sideways for the last five weeks.

There are revised triangle trend lines on the 4hr chart giving traders trend lines to watch for any new momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 108 and 108.5 into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the recent Low, near 106, into focus.

- Watch for any 4hr chart triangle breakout: