Markets maintained their positive risk appetite drift last session but it was small steps, rather than leaps, ahead of the looming Fed Summit. I am not expecting a whole lot of movement until after this event. An exception being across some of the meme stocks and this volatility might be more of a warning than anything else.

Data:

DXY weekly: still consolidating ahead of the Fed Summit:

Trend line breakouts:

S&P500 4hr: this TL b/o is now at 65 points BUT watch 4,500 for any new make or break:

EUR/USD 4hr: this TL b/o is now at 60 pips BUT watch the daily chart’s bear TL for any new make or break:

EUR/USD daily: watch the daily chart’s bear TL for any new make or break:

AUD/USD 4hr: this TL b/o is now at 100 pips BUT watch the 61.8% fib for any new make or break:

AUD/USD 30 min: note the decent range b/o opportunity here:

AUD/JPY 4hr: this TL b/o is now at 100 pips BUT watch the 80 level for any new make or break:

AUD/JPY 30 min: note the decent range b/o opportunity here:

NZD/USD 4hr: this TL b/o is at 60 pips BUT watch the 61.8% fib for any new make or break:

NZD/USD 30 min: note the decent range b/o opportunity here:

ASX-200 4hr: watch for any push higher after this subtle TL b/o:

Other markets:

Gold 4hr: watch for any new TL b/o:

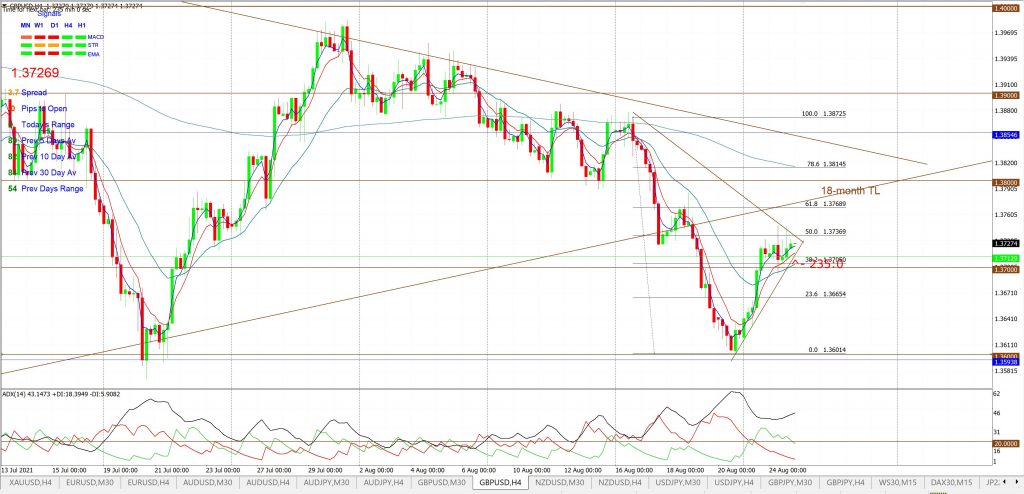

GBP/USD 4hr: watch revised TL for any new b/o:

USD/JPY 4hr: watch revised TL for any new b/o:

GBP/JPY 4hr: watch revised TL for any new b/o: