Last week: US Thanksgiving week will be one to remember this year. In spite of the surging US caseload of Covid-19 and the incumbent US President pushing back against his election defeat, the four US stock major indices of the S&P500, DJIA, NASDAQ and Russell-2000 are all printing large bullish monthly candles, with one day left of trade, and closed the week at new all-time Highs. These aren’t the only large bullish monthly candles currently being printed however. Risk-sensitive assets such as Copper, the Emerging Markets EEM ETF, the ASX-200, the AUD/USD and NZD/USD are also shaping up with similar large candles suggesting confidence in the transition to the new Biden / Harris administration and anticipated relief following recent and positive Covid vaccine news. This improved sentiment resulted in flows out of safety-haven Gold and it now looks like the price ranging technical pattern I’ve been noting here for some time might be dominating.

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts summary: There were a few trend line breakouts in the shortened Thanksgiving week. Articles published during the week can be found here, here, and here:

- Gold: a TL b/o for $85.

- USD/JPY: a TL b/o for 80 pips.

- GBP/JPY: a TL b/o for 170 pips.

- AUD/JPY: a TL b/o for 80 pips.

- S&P500: a TL b/o for 50 points.

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bearish weekly candle and down near the 91.75 support level making this the region to watch for any new make or break. After that, watch the previous Low near 88; especially with this week’s US NFP jobs data update.

DXY weekly: a bearish weekly candle:

-

- Schedule for weekend Market Update posts: The Weekly Market update has, to date, been posted on a Sunday, Australian time. I am looking to delay the release of this update to a Monday, Australian time, which is still a Sunday in many other parts of the world. My analysis takes a full day to complete and I am attempting to shift this load away from my weekend time.

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

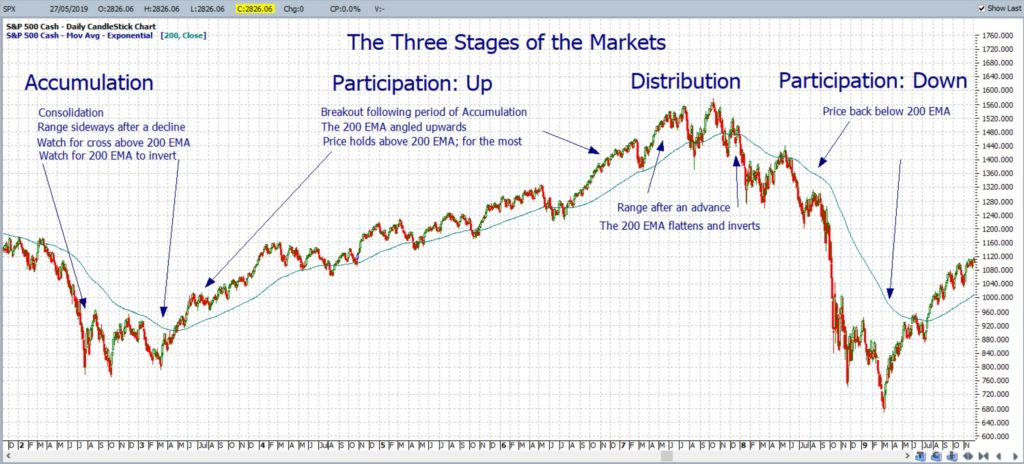

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 trades at a new all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and is currently shaping up with a large and bullish monthly candle as price action also continues holding above the recently broken 10-year bear trend line:

Copper monthly: watch for any push to the monthly chart’s 61.8% Fib level, circa 3.6:

-

- Emerging Markets: The Emerging market ETF, EEM, is currently shaping up with a large, bullish monthly candle so watch for any push to the previous High, near 52.

EEM monthly: now above the 50 level:

-

- DJIA: The DJIA is currently shaping up with a large, bullish monthly candle, at an all-time High and just below 30,000. Watch for any ascending triangle-style breakout above the psychological 30,000 level.

DJIA monthly: very close to the psychological 30,000:

-

- NASDAQ composite: The NASDAQ Composite Index is currently shaping up with a large, bullish monthly candle, at an all-time High and above the $12,000 S/R level.

NASDAQ monthly: trying for a monthly close above 12,000:

-

- DAX weekly: The DAX is currently shaping up with a large, bullish monthly candle so watch for any ascending triangle-style breakout.

DAX monthly: a large bullish candle for the month with one day left to trade!

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index is currently shaping up with a huge bullish monthly candle. Recall that one target for this bullish move is the 161.8% Fibonacci extension, near 2,200:

RUT monthly: a huge bullish monthly candle shaping up here!

-

- Bonds / TLT: The Bond ETF, TLT, closed with a small, bearish weekly candle. The Elliott Wave indicator is still suggesting an uptrend from here:

TLT weekly:

-

- Fedex: Fedex closed a bullish weekly candle:

Fedex weekly: watch for any potential Bull Flag:

-

- VIX: the Fear index closed with a bearish weekly candle and still below the key 30 level.

VIX weekly: watch the 30 level for any new make or break:

Calendar: Courtesy of Forex Factory: It is USA NFP this week:

Earnings: Courtesy of Earnings Whispers:

Market Analysis:

S&P500: The S&P500 closed with a small, bullish weekly candle, and is currently printing a large, bullish monthly candle, as it closed at a new all time High of 3,638.35

Trading volume was lower last week due to USA Thanksgiving but keep watch of the volume trend line for any new breakout.

S&P500 ETF: SPY weekly: Volume lower last week with US Thanksgiving:

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: any bullish 4hr chart Flag triangle breakout would bring 3,700 into focus.

Bearish targets: any bearish 4hr chart trend line breakout would bring 3,600 and whole-number levels on the way down to 3,200 into focus. The 3,400 level is still near the 4hr chart’s 61.8% Fibonacci so that would be a key level to monitor if weakness sets in at all.

- Watch for any 4hr chart trend line breakout:

ASX-200: XJO: The ASX-200 closed with a bullish weekly candle but the main feature of note is the monthly candle. The Index is currently printing its most bullish monthly candle since recovering off the 2009 GFC Lows. That recent Golden Cross was right on the money!

Price action slowed last week as the pre-2020 High looms just above. The index closed just above 6,600 so this will be the region to watch next week for any new make or break.

Trading volume is holding up well but watch for any spike-up above the multi-month volume trend line.

XJO weekly: trading volume holding steady for now:

Keep in mind that the recent Golden Cross remains valid. This is a bullish signal where the 50 SMA crosses above the 200 SMA. Such crosses are often, but not always, followed by a decent bullish run so these crosses are worth noting:

XJO daily: the recent Golden Cross remains valid:

There are revised trend lines on the 4hr chart to monitor for any new momentum breakout and note the look of a Bull Flag here!

Bullish targets: Any bullish 4hr chart Bull Flag breakout would bring whole-number levels on the way up to the pre-2020 High of 6,893.70 into focus.

Bearish targets: Any bearish 4hr chart Flag breakdown would bring whole-numbers on the way down to 6,000 into focus. Note how 6,200 is near the daily chart’s 61.8% Fibonacci so that would be in focus as well.

- Watch for any 4hr chart Bull Flag breakout:

Gold: Gold closed with a bearish weekly candle and well below the $1,900 S/R region. It is starting to look like the Inverse H&S pattern might be playing out here.

As mentioned over recent weeks: the weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is back trading below this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any new move back above $1,900 would support the Cup pattern thesis.

- Any hold below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming days / weeks especially as the US$ index is still below the recently broken 10-year support trend line:

- any US$ hold below the multi-year support trend line could help send Gold higher.

- any US$ move back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

There are revised trend lines on the 4hr chart to monitor for any new breakout BUT note the look of a bullish-reversal Descending Wedge here! Keep an open mind for some mean reversion to the upside after last week’s bearish drop.

Note how the Evening Star pattern on the monthly chart was a good predictor of subsequent price action!

Bullish targets: any bullish 4hr chart wedge trend line breakout would bring $1,850 and $1,900 back into focus as the latter is near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: any bearish 4hr chart trend line breakout would bring $1,700 into focus as this is near the daily chart’s 61.8% Fibonacci level.

- Watch the 4hr chart wedge triangle trend lines for any new breakout:

EUR/USD: The EUR/USD closed with large bullish weekly candle, and is currently printing a large, bullish monthly candle, as it finished the week above the 1.19 S/R level and also made a bullish breakout from the weekly chart’s Bull Flag.

Watch for any bullish continuation up to 1.20 S/R.

Bullish targets: Any bullish 4hr chart trend continuation from the weekly chart’s Bull Flag breakout would bring whole-numbers on the way up to a previous weekly chart High, circa 1.26, into focus.

Bearish targets: Any bearish 4hr chart break of the support trend line and back below 1.19 would bring 1.18 and 1.17 S/R into focus.

- Watch for any continued weekly chart Bull Flag breakout;

AUD/USD: The Aussie closed with a bullish weekly candle, and is currently printing a large, bullish monthly candle, following the recent weekly-chart Bull Flag breakout.

There are revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout as price now sits just under 0.74 S/R. There is the RBA rate update this week so watch to see how this impacts the AUD/USD.

Keep in mind that price action continues to hold above the recently broken upper trend line of the multi-year bullish-reversal Descending Wedge.

Bullish targets: Any bullish 4hr chart break above 0.74 would bring whole-number levels on the way up to the weekly chart’s Descending Wedge breakout target of 0.90 into focus.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 0.73, 0.72 and 0.71 into focus.

- Watch 0.74 and for any new 4hr chart trend line breakout; especially with this week’s RBA rate update;

AUD/JPY: The AUD/JPY closed with a bullish weekly candle, and is currently printing and almost bullish-engulfing monthly candle, as it edges up closer to a 7-yr bear trend line making this the region to watch for any new make or break.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart trend line breakout above 77 would bring the 7-yr bear trend line into focus.

Bearish targets: Any bearish 4hr chart trend breakout would bring 76, 75 and 74 S/R into focus.

- Watch 77 S/R and for any new 4hr chart trend line breakout; especially with this week’s RBA rate update;

NZD/USD: The Kiwi closed with a large bullish weekly candle, and is currently printing a large bullish monthly candle, following the recent weekly-chart Bull Flag breakout.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart trend line continuation above 0.70 would bring whole-number levels on the way up to 0.75 into focus as this is near the monthly chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr chart break of the support trend line and retreat below 0.70 would bring 0.69 into focus.

- Watch 0.70 for any new make or break;

GBP/USD: The Cable closed with a bullish weekly candle and just above the key 1.33 S/R level making this the level to watch for any new make or break.

Bullish targets: Any bullish 4hr chart hold above 1.33 would bring 1.34 into focus on the way up to the recent weekly-chart High, near 1.35.

Bearish targets: Any bearish 4hr chart break back below 1.33 would bring the 7-month support trend line into focus.

- Watch 1.33 for any new make or break:

USD/JPY: The USD/JPY closed with a small bullish weekly candle and just above 104 S/R keeping this as the level to watch in coming sessions for any new make or break.

There are also revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 105 into focus as this is still near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the recent Low, near 103.25, into focus followed by whole-number levels on the way down to 100 S/R.

- Watch 104 S/R and for any 4hr chart trend line breakout:

GBP/JPY: The GBP/JPY closed with a bullish weekly candle but has once again rejected the 40-yr bear trend line. This will be the level to watch for any new make or break in coming sessions.

There are revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 139 into focus followed by 140 as the latter sits near the 40-yr bear trend line.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 138 followed by the daily 200 EMA region into focus as this is near the weekly chart’s support trend line.

- Watch for any 4hr chart triangle breakout;