There were some warning moves noted last week and this theme continued last session with safe-haven flows into the US$ and Yen. No such moves as yet into Gold and the AUD/USD and AUD/JPY are holding up fairly well for now but traders should take note of this shift and exercise caution.

Data: Watch today with AUD and GBP Retail Sales data, the EU Summit and a Fed Chair Powell speech.

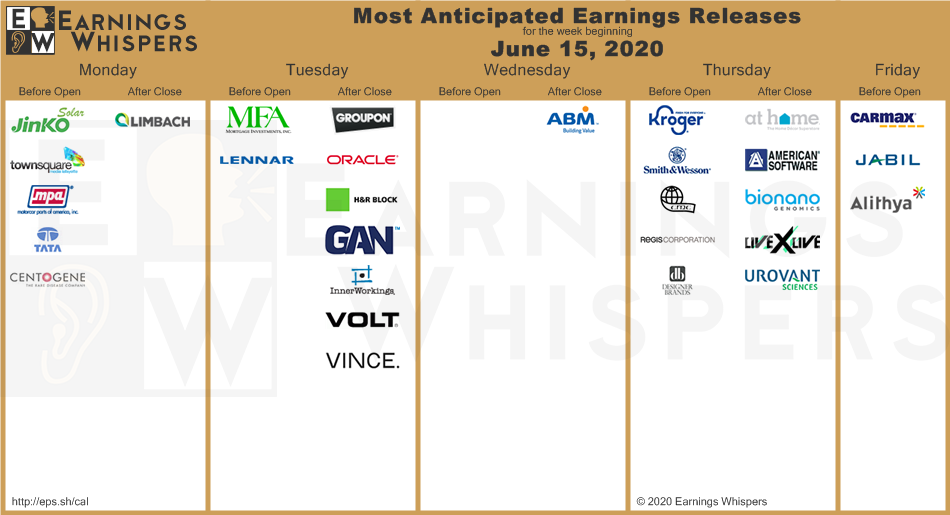

Earnings:

DXY daily: this had started to look like it could be a Bear Flag but weak US Employment data and rising US Covid-19 cases has resulted in flight to safety flows into the US$.

Trend line breakouts:

GBP/JPY 4hr: this got the double whammy of Yen strength and GBP weakness for a 150 pip TL b/o:

GBP/USD 4hr: this has broken support but watch the 61.8% fib for any new make or break:

Other markets:

S&P500 4hr: consolidating near 3,100 so watch for any new momentum-based TL b/o:

ASX-200 4hr: consolidating near 6,000 so watch for any new momentum-based TL b/o:

Gold 4hr: consolidating under $1,750 so watch for any new momentum-based TL b/o:

EUR/USD 4hr: consolidating near 1.12 so watch for any new momentum-based TL b/o:

AUD/USD 4hr: consolidating near the 9-11 year TL so watch for any new momentum-based b/o:

AUD/JPY 4hr: consolidating above 73 so watch for any new momentum-based b/o:

NZD/USD 4hr: consolidating under a bear TL so watch for any new momentum-based b/o:

USD/JPY 4hr: consolidating in a revised triangle so watch for any new momentum-based TL b/o: