There has been some US$ weakness to start the week. I’m reading this was due to poor US data BUT I would posit it could also be due to the daily Ichimoku Cloud acting as decent resistance just above current price action. I Tweeted yesterday to watch for any pause on the USD/JPY, given the 61.8% Fibonacci was reached, and the pair did turn, right on cue! Never underestimate the power of Fibonacci! It is RBA rate update day today so watch for any impact on AUD pairs.

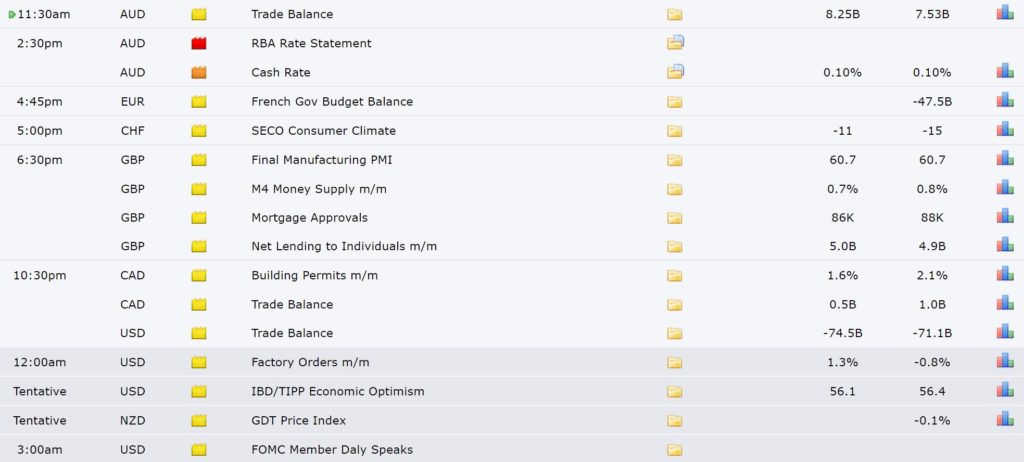

Data:

Earnings:

DXY daily: watch for any new TL b/o:

Trend line breakouts:

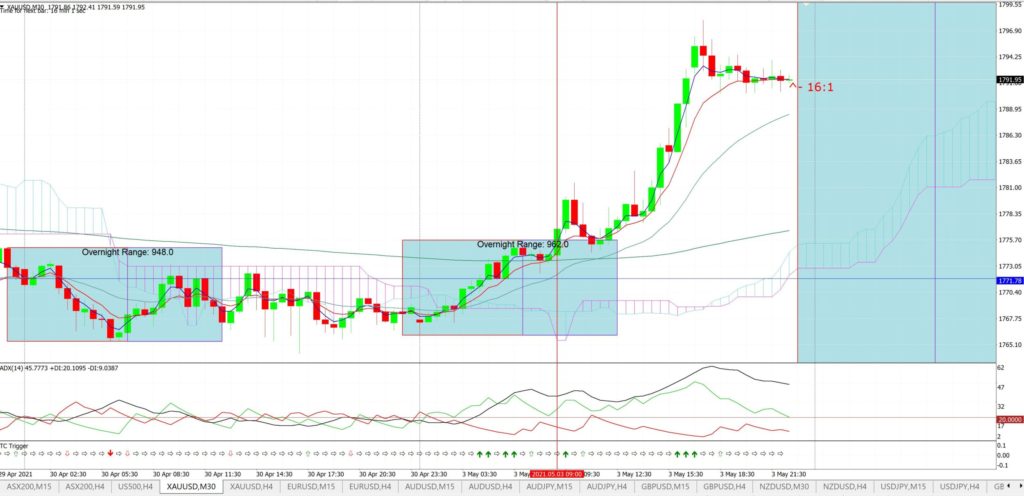

Gold: has enjoyed this US$ weakness:

Gold 4hr: a TL b/o for $12:

Gold 30 min: note how this move could have been caught nicely as an Asian b/o trade:

USD/JPY 4hr: this b/o move gave 140 pips before reversing, right on cue, at the 61.8% Fibonacci:

Other markets:

S&P500 4hr: watch for any new TL b/o:

ASX-200 4hr: watch for any new TL b/o; especially with today’s RBA update:

EUR/USD 4hr: watch for any new TL b/o:

AUD/USD 4hr: watch for any new TL b/o; especially with today’s RBA update:

AUD/JPY 4hr: watch for any new TL b/o; especially with today’s RBA update:

GBP/USD: the Cable seemed to enjoy the Bank holiday!

GBP/USD 4hr: watch 1.39 for any new b/o:

GBP/USD 30 min: note how this move could also have been caught nicely as an Asian b/o trade:

NZD/USD 4hr: watch 0.72 for any new b/o:

GBP/JPY 4hr: watch 152 and for any new TL b/o;