Rising yields have kept pressure on the NASDAQ but the S&P500 and DJIA held steady last session. The EUR/USD and commodity currencies are markedly lower though but Gold is holding steady for the time being. It does feel like there is a shift underway and remember that distribution phases are generally marked by volatility.

Data:

DXY weekly: higher again so watch for any new Cloud b/o:

The 94.6 level looks important here as a possible neck line for a Double Bottom / W Bottom:

TNX weekly: yields trying for a new weekly b/o:

Trend line breakouts:

EUR/USD: recall the importance of the 1.17 on the weekly chart as being the neck line of a potential weekly bearish Double Top.

EUR/USD 4hr: the wedge failed to the tune of about 70 pips:

EUR/USD 30 min: note the decent Asian range b/o opportunity here though:

AUD/USD 4hr: a TL for about 50 pips:

AUD/JPY 4hr: a small TL b/o:

NZD/USD 4hr: this TL is now at 130 pips:

GBP/USD 4hr: this TL is now at 130 pips:

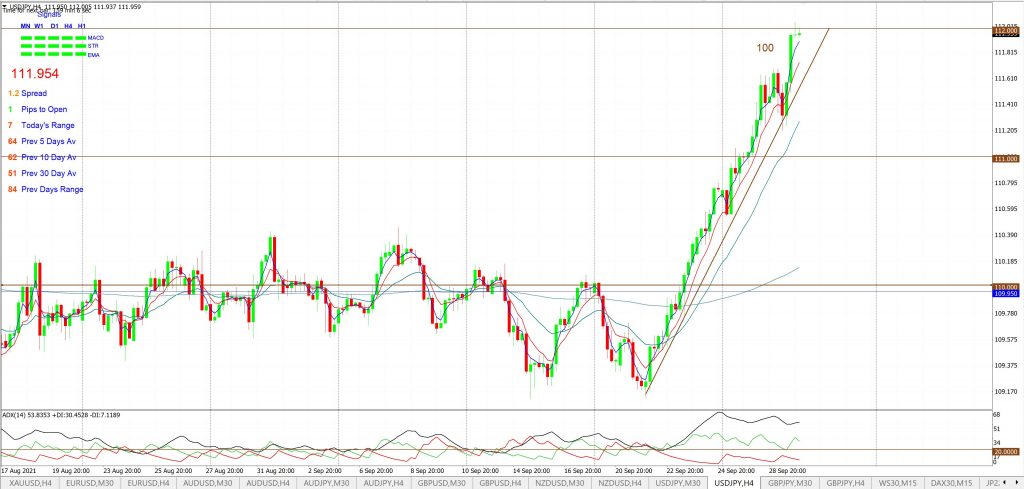

USD/JPY 4hr: this TL is now at 100 pips:

Other markets:

S&P500 4hr: watch for any new TL b/o:

ASX-200 4hr: watch the 7,200 region and for any new TL b/o:

Gold 4hr: watch for any new TL b/o:

GBP/JPY 4hr: messy but note the hold near the 4hr chart’s 61.8% Fibonacci: