It’s been raining pips and points from trend line breakouts based off the chart patterns profiled on the weekend. I had also warned on the weekend that the US$ was butting up against major resistance and to watch for weakness and this has played out as anticipated. The latest risk-on sentiment is hard to fathom as the Covid-19 situation worsens across many countries outside of Asia but they do say markets are ‘forward looking’. It’s just they have such a long way to look! This is certainly a most poignant example of ‘trade what you see and not what you think‘.

Trend line breakouts: I posted an article for members yesterday about how to manage trend line breakouts so please make sure that you check this out.

Data: Coronavirus remains the main theme driving markets but watch also for US Income, Spending and Consumer Sentiment data.

Earnings: a quiet end to the week.

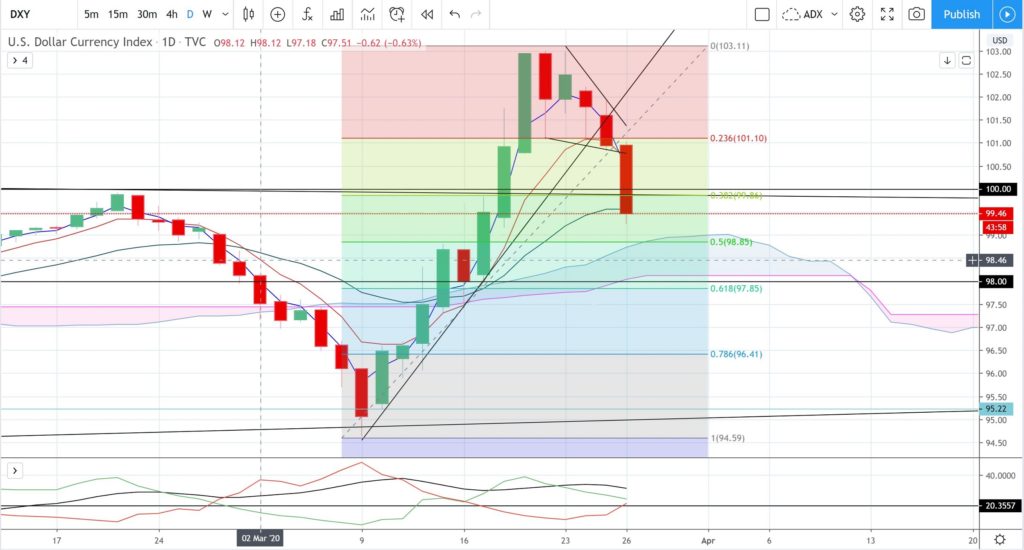

DXY daily: the pullback has continued so watch for any push to the 61.8% fib, near 98 S/R:

Trend line breakouts:

USD/JPY 4hr: a new trend line breakout for 160 pips:

ASX-200 4hr: this trend line breakout is now up 450 points. Watch how price action reacts at the recently broken 11-yr support trend line:

S&P500 4hr: this trend line breakout is now up 230 points:

Gold 4hr: this trend line breakout is now up $140:

EUR/USD 4hr: this trend line breakout is now up 220 pips:

NZD/USD 4hr: this trend line breakout is now up 200 pips:

GBP/USD 4hr: this trend line breakout is now up 500 pips:

GBP/JPY 4hr: this trend line breakout is now up 350 pips:

Other markets:

Oil 4hr: still holding above $20 for now BUT still looking for any relief rally to fill the recent gap. There is confluence here as this is also near the 4hr 200 EMA & 61.8% fib. Any sustained bounce, with momentum, would bring $41.50 into focus. Watch for any trend line breakout:

AUD/USD 4hr: watch 0.61 S/R and for any trend line breakout:

AUD/JPY 4hr: watch 67 S/R and for any trend line breakout: