Risk-off continued last session and flows have accelerated into the US$; I’m reading the liquidity of the US$ is the reason here. The Aussie XJO is getting down close to a major support so watch for any technical pause or possible bounce here; especially after today’s 4pm RBA rate announcement.

Data: Watch for AUD Employment data, the SNB rate update, US Philly Fed Manufacturing Index and a US President Trump speech. NB: There is an RBA meeting about rates as well with an announcement scheduled for 4 pm local time.

Earnings:

DXY weekly: broke above 100 so watch for any push to the recent High, circa 103.80:

Trend line breakouts:

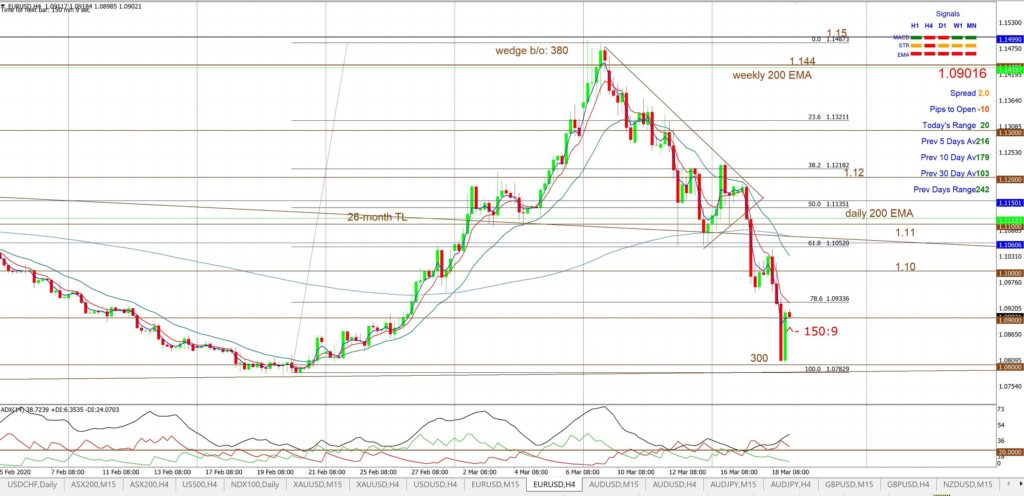

EUR/USD 4hr: this TL b/o has now given up to 300 pips so watch 1.09 for any new make or break. This longer-term wedge looks to have failed; yet again.

AUD/JPY 4hr: this TL b/o has now given up to 400 pips so watch 62.50 for any new make or break; especially with today’s 4pm RBA rate meeting:

Oil 4hr: this TL b/o has now given up to $9.60 so watch $20 for any new make or break:

ASX-200

ASX-200 4hr: this TL b/o has now given up to 30 points so watch for any push to 4,700 S/R:

ASX-200 weekly: watch the 4,700 level:

Other Markets:

Gold 4hr: watch for any trend line breakout:

S&P500

S&P500 4hr: watch for any TL b/o:

S&P500 weekly: watch for any push to the weekly 61.8% fib:

TLT daily: note the drop to the 144 S/R level:

AUD/USD 4hr: watch 0.57 for any new make or break; especially with today’s RBA rate meeting:

NZD/USD 4hr: watch 0.57 for any new make or break:

GBP/USD 4hr: watch 1.15 for any new make or break:

USD/JPY 4hr: a new b/o so watch for any push higher:

GBP/JPY 4hr: watch 126 for any new make or break: