Last week: Sentiment shifted by the end of the week to one of optimism and this was underpinned by the impressive vaccine roll out in the USA, Friday’s stellar North American jobs report and expectations vested in the next batch of US earnings. The S&P500, DJIA and NASDAQ all closed higher for the week with the first two, again, printing new all-time Highs, however, the Russell-2000 index diverged to close lower. The US$ Index also closed lower and this helped to trigger bullish wedge breakouts on Gold and the EUR/USD; moves that are both still in progress.

Technical Analysis: It is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Covid-19, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts: Just a few breakouts this week. Updates posted throughout last week can be found through the links here, here, here and here:

- Gold: a TL b/o for $30.

- EUR/USD: a TL b/o for 140 pips.

- USD/JPY: a TL b/o for 140 pips.

- GBP/JPY: a TL b/o for 320 pips.

- AUD/JPY: a TL b/o for 80 pips.

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bearish, almost ‘engulfing’, weekly candle. The index has been in an uptrend for around 3 months and had recently made a bullish breakout from a 12-month bullish-reversal descending wedge. However, the large bearish weekly candle might be a signal that this run has completed.

DXY weekly: note how momentum continues to decline:

-

- Central Bank Update: There is one Central Bank update this week: RBNZ (NZD).

-

- 10-yr T-Note Interest rate: The chart of the 10-yr Treasury Interest rate shows the recent bullish breakout from the triangle congestion pattern remains paused near the weekly 200 EMA region. Watch this region for any new make or break and for any consequential impact on stock sentiment:

- 10-yr T-Note Interest rate: watch for any pullback:

-

- % Stocks above their 200 Day Moving Average Index: The Percentage of stocks above their 200 Day Moving Average remains above the 85% region. The first chart below gives a perspective of this current level and shows the previous peaks near 92.50% and how there often tends to be some mean-reversion once such lofty levels are reached. The second, expanded, chart shows the continued struggle under the 92.50% level.

% of US Stocks above the 200 Day Moving Average: watch for any further reaction at the 92.50% region:

% of US Stocks above the 200 Day Moving Average (expanded): holding below 92.50%:

-

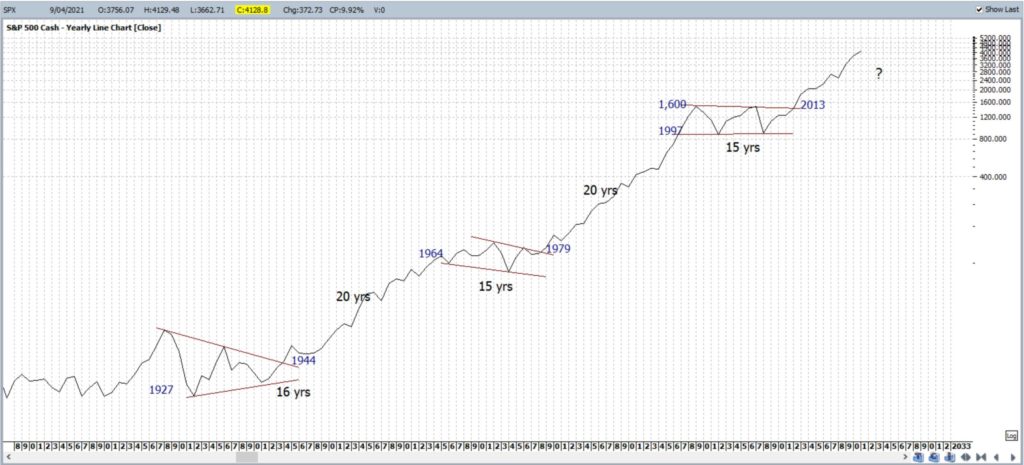

- S&P500: Keep the bigger picture in perspective with the recent moves as this chart suggests there is a lot more room to move with the overall bullish run. However, this does not discount the odd pullback along the way as trends do not travel in straight lines forever; they tend to zig and zag their way along either bullish or bearish paths. Note how the recent Covid dip does not even figure on this chart!

S&P500 yearly: keep this latest move in perspective:

-

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 trades up at an all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed with a bullish weekly candle and is still shaping up in a potential Bull Flag so watch for any new breakout: up or down.

Copper weekly: watch for any Bull Flag:

-

- Emerging Markets: The Emerging market ETF, EEM, closed with a bearish weekly candle and, whilst still below the 12-month support trend line, note the continued look of a Bull Flag so watch for any new breakout.

EEM weekly: watch for any new Bull Flag here?

-

- DJIA: The DJIA closed with a large, bullish weekly candle and at a new all-time High just under 34,000.

DJIA weekly: now watch 34,000 for any new make or break.

-

- NASDAQ composite: The NASDAQ Composite Index gapped up last week and closed with a bullish weekly candle following last week’s bullish engulfing weekly candle. The Bull Flag breakout is still underway so watch for any push to the previous all-time High.

NASDAQ weekly: watch for any continued Bull Flag:

-

- DAX weekly: The DAX gapped up this week but closed with a bearish coloured Spinning Top weekly candle. Traders need to watch for the formation of any new 3-candle bearish-reversal Abandoned Baby–style pattern.

DAX weekly: watch for any bearish-reversal Abandoned Baby pattern:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index closed with a bearish weekly candle. The Index continues to hold above the 61.8% Fibonacci extension of the Covid-induced Swing Low so watch for any push to the 100% level, circa 2,500.

RUT weekly: keep watch for any hold above the 61.8% Fibonacci Extension:.

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish weekly candle. My Elliott Wave indicator is still suggesting a potential uptrend.

TLT weekly: holding above the 135 level:

-

- USD/CAD and USD/CNY: keep an eye on these two weekly chart Descending Wedge patterns for any bullish breakout and / or follow-through.

USD/CAD weekly: watch for any new breakout:

USD/CNY weekly: watch to see if this the TL b/o keeps going:

-

- VIX: the Fear index closed with a bearish weekly candle and is holding below the 20 S/R level so keep watch to see if this marks a return to a new and lower trading range for the index.

VIX weekly: watch the 20 S/R level for any new make or break:

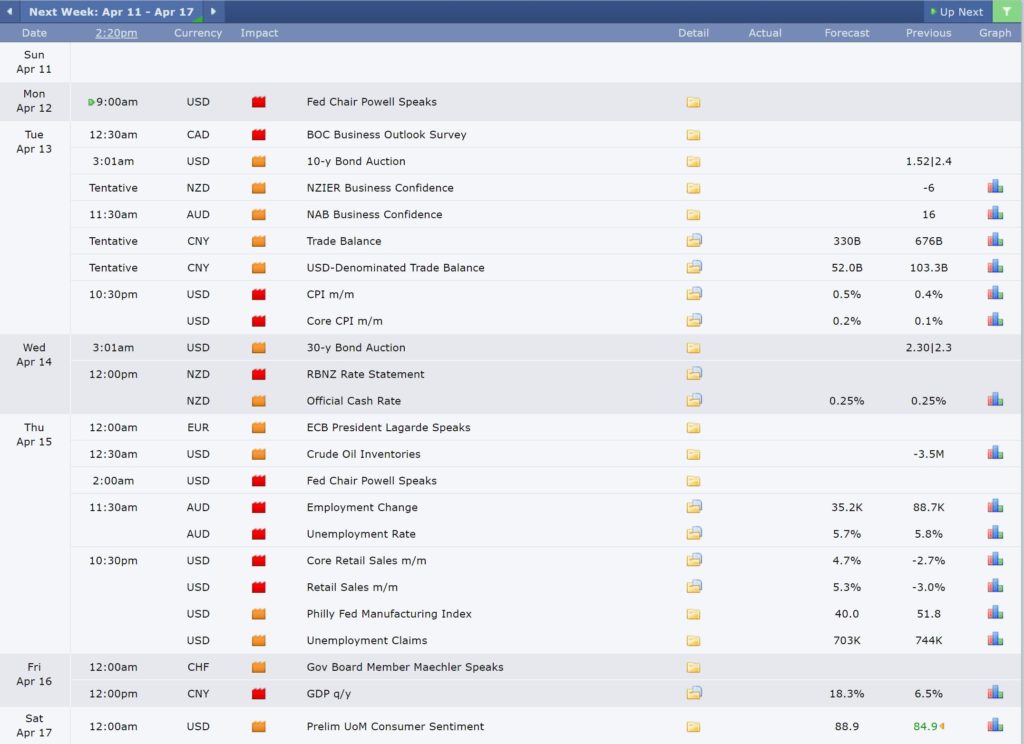

Calendar: Courtesy of Forex Factory: quite a few high impact items this week:

Earnings: Courtesy of Earnings Whispers: Earnings gets going again this week with the Banks:

Market Analysis:

S&P500: The S&P500 closed with a large, bullish weekly candle, at a new all-time High and just under the 4,150 level. This is a significant resistance zone for the index given that, as mentioned over recent weeks, it is the 61.8% Fibonacci extension of the Covid-induced Swing Low so watch this region for any new make or break.

Whilst momentum is on the rise on the weekly chart, this is somewhat divergent from the action seen with volume. Trading volume was lower again last week and remains below the 200 MA and bear trend line so watch for any new breakout.

S&P500 ETF: SPY weekly: watch for any new breakout.

:

The 4,150 level is the resistance to watch for any new make or break and there are revised 4hr chart trend lines to assess with any new momentum breakout as well.

NB: The second weekly chart shows how the 61.8% Fibonacci extension of the Covid-induced Swing Low is up near 4,150. This would be one target for any bullish continuation move.

Bullish targets: any bullish 4hr chart trend line breakout above 4,150 would bring 4,200 into focus.

Bearish targets: any bearish 4hr chart break of the recent support trend line would bring 4,100 and 4,000 back into focus. After that, watch 3,950, 3,900 and the 12-month support trend line followed by whole-numbers on the way down to the weekly chart’s 61.8% Fibonacci retracement level, near 2,800.

- Watch 4,150 and 4hr chart trend lines for any new breakout:

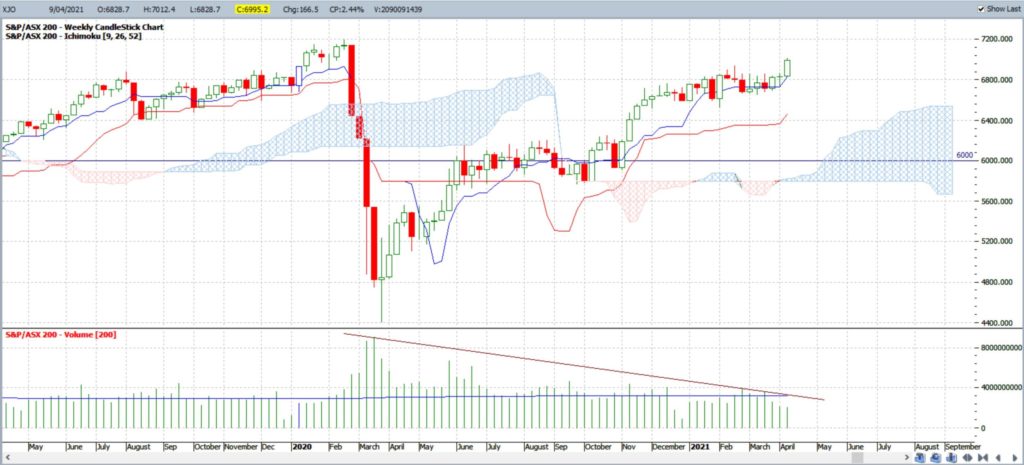

ASX-200: XJO: The ASX-200 closed with a large, bullish weekly candle, above the pre-GFC High of 6,851.50 and pre-2020 High of 6,893.7 and just below the 7,000 whole-number level making this the resistance to monitor for any new make or break.

Apart from the 7,000 level, the pre- 2020 High of 7,197.20 also remains ahead of current price action and might offer some resistance for the index.

As with the S&P500, there is a bit of divergence between momentum and volume. Momentum is on the rise on the weekly chart but trading volume remains low so watch for any new break back above the 200 MA and the bear trend line.

XJO weekly: keep watch for any new b/o above the 200 MA and bear TL:

Keep in mind that the recent Golden Cross still remains valid. The Golden Cross is a bullish signal where the 50 SMA crosses above the 200 SMA. Such crosses are often, but not always, followed by a decent bullish run so these crosses are worth noting:

XJO daily: the recent Golden Cross remains valid for the time being:

There are revised 4hr chart trend lines to monitor for any new breakout.

Big news: Note how bullish ADX momentum has broken above the 20 threshold on the daily chart and weekly charts.

Bullish targets: Any bullish 4hr chart breakout above 7,000 would bring the 2020 High of 7,197.20 into focus.

Bearish targets: Any bearish hold below 7,000 and break of the recent support trend line would bring 6,950, the pre-2020 High of 6,893.70 and the pre-GFC High of 6,851.50 back into focus followed by 6,800 and 6,700 into focus.

- Watch 7,000 and for any new 4hr chart trend line breakout:

Gold: Gold closed with a bullish-coloured Spinning Top-style weekly candle and just below $1,750 making this the level to watch for any new make or break.

There was a bullish breakout from last week’s larger Descending Wedge, that gave around $30, but there are smaller 4hr chart triangle trend lines to monitor for any continuation move. Despite this bullish shift last week, there doesn’t look to be too much for Gold bugs to get excited about just yet as bullish +DMI momentum remains below the 20 threshold on the 4hr, daily and weekly time frames.

As mentioned over recent months: This price action and hold below $1,900 acts as further evidence in support of the longer-term Inverse H&S thesis that I have been discussing as an option here for many months.

The weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is trading below this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any hold above $1,900 would support the Cup pattern thesis.

- Any move back below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming sessions especially as the US$ index is still below the recently broken 10-year support trend line:

- any US$ hold below the multi-year support trend line could help send Gold higher.

- any US$ move back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

As per recent weeks: the daily chart reveals the importance of the $1,670 level so this continues to be a ‘line in the sand’ support level to monitor. Any new weekly close below the $1,670 level would bring $1,500 into greater focus. The two weekly charts show that $1,500 is:

- near the 61.8% Fibonacci of the Aug 2018 – Aug 2020 swing High move.

- forms the lower boundary of the Inverse H&S pattern I have had on my charts for many months.

Bullish targets: any bullish 4hr chart triangle breakout would quickly bring $1,750 and $1,770 back into focus followed by $1,800, the daily 200 EMA, $1,850 and $1,900.

Bearish targets: any bearish 4hr chart triangle breakout would bring $1,700 and the bottom wedge trend line into focus followed by the $1,670 support level.

- Watch for any 4hr chart triangle breakout:

EUR/USD: The EUR/USD closed with a large, bullish weekly candle and made a bullish breakout from last week’s 4hr chart descending wedge. This breakout has given 140 pips but is still going and so there are revised 4hr chart trend lines to help track any bullish continuation move.

As well as this bullish wedge breakout, the last three candles on the weekly chart have shaped up in a bullish-reversal Morning Star pattern which helps to support the recent bullish bias.

NB: Note that the longer-term target for any continued bullish movement following the previous break of the 13-yr trend line is the monthly chart’s 61.8% Fibonacci, near 1.40. This trend line breakout was flagged back in a post on August 2nd 2020. Price at the breakout was around 1.17 and has reached up as far as 1.23, a move of around 600 pips, so this has been a breakout worth monitoring.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.20 and 1.21 into focus followed by the monthly 200 EMA and 1.22 level. After that, watch whole-numbers on the way up to a previous weekly chart High, circa 1.26 and, for any continued push up to 1.40.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 1.18 and 1.17 back into focus.

- Watch 1.19 and for any new 4hr chart triangle breakout;

AUD/USD: The Aussie closed with a bullish-coloured Spinning Top weekly candle, reflecting indecision, and remains below the recently broken 12-month support trend line.

Not a lot changed here last week and so there is still the look of a larger wedge on the 4hr chart; which forms the potential Bull Flag on the weekly time frame.

NB: The longer-term target for any bullish continuation from the weekly/monthly chart’s Descending Wedge breakout is the weekly 61.8% Fibonacci, near 0.90. This monthly wedge trend line breakout was also flagged back in the post on August 2nd 2020. Price at the breakout was around 0.71 and has reached up as far as 0.80, a move of around 900 pips, so has been another breakout worth monitoring.

Bullish targets: Any bullish 4hr chart hold above 0.76 would bring the 4hr chart’s upper wedge trend line into focus. After that, whole-numbers on the way back to the 12-month TL and, then, whole-number levels on the way up to the weekly chart’s Descending Wedge breakout target of 0.90.

Bearish targets: Any bearish break below 0.76 would bring the bottom 4hr chart wedge trend line into focus. After that, watch 0.75 and whole-number levels on the way down to 0.65 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch 0.76 for any new make or break:

AUD/JPY: The AUD/JPY closed with a bearish-coloured Spinning Top weekly candle and below the 84 level making this the region to watch for any new make or break.

As noted over recent weeks:

- The weekly chart reveals that the 85 level has been a significant reaction zone for the AUD/JPY and has been resistance for the last three years; this level was peppered many times throughout 2018 but could not be broken. The next major level above 85 is 90 so watch this target level if 85 is broken.

- AUD/JPY traders also need to keep an eye on the sentiment with stocks though, especially the S&P500 index, as the two are generally highly aligned; as the chart below reveals. Any pause or serious pullback with stocks might render similar for the AUD/JPY:

AUD/JPY versus S&P500 (gold line): a high degree of positive correlation:

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 84 and 85 S/R back into focus followed by whole numbers on the way to 90 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 83 into focus followed by the 12-month support trend line. After that, watch whole-numbers on the way down to 76 as this is still near the recently broken 7-yr bear trend line, and then 72 as this is near the 61.8% Fibonacci of the March 2020 – March 2021 swing High move.

- Watch for any new 4hr chart triangle breakout:

NZD/USD: The Kiwi closed with a bullish-coloured Spinning Top weekly candle, reflecting indecision, but again managed to hold the week just above 0.70 keeping this as the level to watch for any new make or break.

Like with the Aussie, there is still the look of a larger descending wedge / channel on the 4hr chart which forms the potential Bull Flag on the weekly time frame.

Bullish targets: Any bullish 4hr chart hold above 0.70 would bring the upper wedge / channel trend line into focus. After that, watch whole-numbers on the way up to the recently broken 12-month support trend line.

Bearish targets: Any bearish 4hr chart break below 0.70 would bring the monthly 200 EMA, 0.69 and bottom wedge / channel trend line into focus. After that, watch whole-number levels on the way down to 0.63 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch 0.70 and for any 4hr chart wedge / channel breakout:

GBP/USD: The Cable closed with a bearish, almost ‘engulfing’, weekly candle and just above 1.37 making this the level to watch for any new make or break.

Like with the Aussie and Kiwi, there is still the look of a larger descending wedge on the 4hr chart which forms the potential Bull Flag on the weekly time frame. There is a smaller 4hr wedge to monitor for any new breakout though.

NB: The longer-term target for any bullish continuation above the previously broken 14-yr trend line, noted here in my article on December 20th, is the monthly chart’s 61.8% Fibonacci, near 1.75. Price action at the initial breakout was around 1.35 and has reached to 1.42, a move of 700 pips, so this trend line breakout was a great clue about things to come and the target for this move has not even been reached yet!

Bullish targets: Any bullish 4hr chart wedge trend line breakout would bring 1.38 and the upper trend line of the larger wedge into focus. After that, watch for any push to the recently broken 12-month support trend line and, then, whole-number levels on the way up to 1.50 as this is a previous S/R region on the weekly chart. Any bullish continuation after that would bring whole-number levels on the way up to 1.75 into focus.

Bearish targets: Any bearish 4hr chart break back below 1.37 would bring 1.36 and, then, the lower wedge trend line into focus. After that, watch whole-number levels on the way down to 1.25 as this is near the 61.8% Fibonacci of the March 2020 – Feb 2021 swing High move.

- Watch 1.37 and the 4hr chart wedge trend lines for any new breakout:

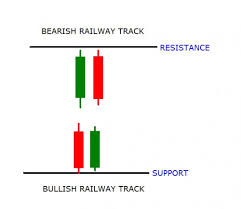

USD/JPY: The USD/JPY closed with a bearish engulfing weekly candle and just under 110 making this the one to watch for any new make or break. The last two weekly candles have shaped up in a bearish-reversal Railway Track pattern so watch for any pause with this bullish rally that has run for around 10 weeks. Remember, trends do not travel in straight lines forever.

NB: The bullish weekly descending wedge breakout was first noted in my article of January 31st. Price action at the initial breakout was around 104.5 and has reached to near 111, a move of around 650 pips, so this trend line breakout was a great clue about things to come!

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 111 and whole-numbers on the way up to 115 into focus.

Bearish targets: Any bearish 4hr triangle breakout would bring 110, 109, and 108 back into focus. After that, watch whole-number levels on the way down to 105 as this is near the 61.8% Fibonacci of the Jan-March 2021 swing High move.

- Watch 110 and for any new 4hr chart triangle trend line breakout.

GBP/JPY: The GBP/JPY closed with a bearish, almost ‘engulfing’, weekly candle and back near the 16- week support trend line making this the region to watch for any new make or break.

NB: The longer-term target for any bullish continuation above the previously broken 40-yr trend line, noted in my post of January 3rd, is the weekly chart’s 61.8% Fibonacci, near 170. Price action at the time of this breakout was near 141 and has reached up to 153, a move of around 1,200 pips, and so is another trend line breakout that has proven to be worthwhile monitoring.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 151 and the he 16-week support trend line followed by whole-number levels on the way up to the weekly chart’s 61.8% Fibonacci, near 170, into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 150 back into focus. After that, watch whole-number levels on the way down to 135 as this is near the 61.8% Fibonacci of the March 2020 – March 2021 swing High move.

- Watch for any new 4hr chart triangle breakout: