Daily ranges are low again ahead of today’s ECB but spike-action following FOMC isn’t being too kind for TC set-ups. I’m hoping that a bit more side-ways action might develop in the lead up to ECB to correct this. Keep an eye on the cross-pairs though as the wait for ECB might set up some opportunities on some of these; the GBP/AUD being one that is profiled in today’s analysis and the EUR/AUD might be one for after ECB.

Data today: watch for GBP Retail Sales, the ECB rate update and US Retail Sales.

USDX: didn’t get much of a boost from the FOMC rate hike. Watch to see how it behaves after ECB:

USDX daily:

USDX 4hr:

Trend line breakouts: there have only been two trend line breakouts so far this week: a small one on the USD/JPY and one last session on the EUR/AUD following the FOMC rate hike.

EUR/AUD: a trend line breakout for 100 pips but the spike action, following FOMC, meant this did not give a TC signal. Any ECB rate hike would underpin this bullish divergence and so I’ll be looking for any TC opportunities that might develop here. This pair has been in greater focus for me given the current projected Central Bank divergence; a rate hike might help develop this trade:

EUR/AUD 4hr:

EUR/AUD 15 min:

Forex:

EUR/USD 4hr:

EUR/JPY 4hr:

AUD/USD 4hr:

AUD/JPY 4hr:

GBP/USD 4hr:

NZD/USD 4hr:

USD/JPY 4hr:

GBP/JPY 4hr:

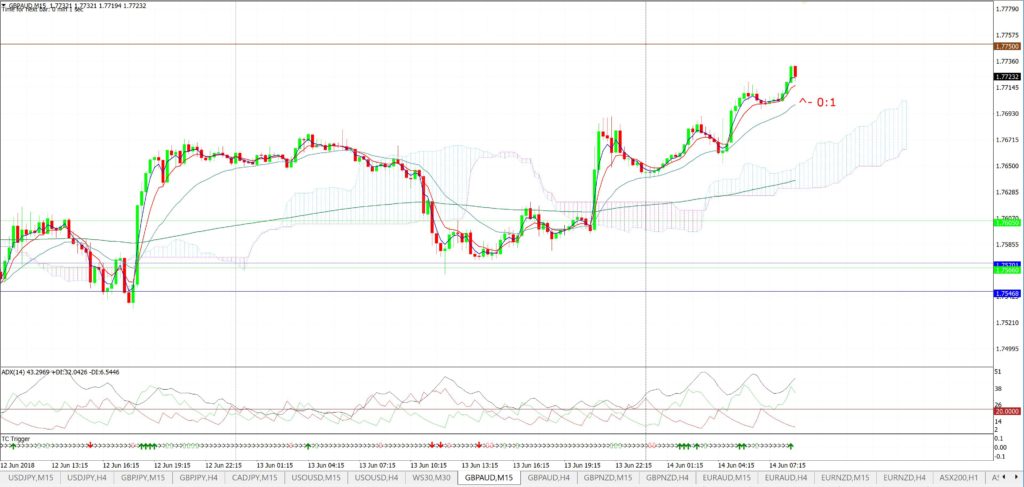

GBP/AUD: watch to see how this pair fares after today’s GBP Retail Sales data. This might be one that gives some opportunity in the wait for ECB or in spite of ECB:

GBP/AUD 4hr: there could be a bullish-reversal Inverse H&S brewing here and coming out of recent basing-style behaviour. Maybe watch the 1.775 for any new make or break:.

GBP/AUD 15 min:

EUR/NZD 4hr:

GBP/NZD 4hr:

Gold 4hr: watch to see how the US$ fares as any bearish trend there could help Gold to breakout from its long-held triangle and away from the $1,300 level:

Oil 4hr: