Last week: There was little on offer for trend line breakout trades from my radar last week as many instruments consolidate near key S/R levels. There seems to be a lot of market indecision in an environment where economies are opening back up but Covid-19 cases continue rising at an alarming rate in many countries, the USA being just one. There were Flight to Safety moves into the Yen, Gold and US$ but, despite pandemic concern, the S&P500 and Crude Oil both closed with bullish weekly candles and the AUD/USD is holding up near a major 9-11 year potential breakout trend line. This apparent divergence with risk appetite should be noted with some caution. The sideways price action suggests to me that the next market move might be brewing but two key questions remain: when and in which direction. Time, and hopefully trend line breakouts, will no doubt tell.

Technical Analysis: As noted over recent weeks, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts and TC signals: It sure was slim pickings from my perspective last week! Articles published during the week can be found here, here and here:

- GBP/JPY: a TL b/o for 200 pips.

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bullish weekly candle following last week’s bullish-reversal candle.

DXY weekly:

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

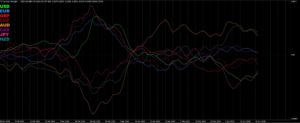

- Currency Strength Indicator: note how the currencies are converging on the daily time frame.

Currency Strength Indicator (daily):

-

- Gold: I have been warning about the bigger picture chart pattern shaping up on the weekly chart of an Inverse H&S. The choppiness I had anticipated continues playing out BUT watch for any eventual push to the $1,800 ‘neck line’ breakout level of this pattern.

-

- Central Banks: There is one Central Bank rate update this week: RBNZ (NZD).

-

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; even if the S&P500 heads back to testing its all time High: The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500 monthly: keep watch for any Distribution type of activity:

-

- DJIA weekly: The DJIA closed with a bullish weekly candle and just above 25,000 S/R so watch this region for any new make or break:

DJIA weekly:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bullish weekly candle and at a new all-time High. Watch the key 10,000 level for any new make or break:

NASDAQ weekly:

- NDX weekly: The NDX Index is made up of the top 100 or so NASDAQ non-financial stocks and it closed with a bullish weekly candle and above the key 10,000 level so keep watch of this for any new make or break:

NDX weekly:

-

- DAX weekly: The DAX closed with a bullish weekly candle but watch for any pullback to the whole-number 10,000 level:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks. The index closed with a small bullish-coloured Spinning Top style weekly candle reflecting indecision:

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bearish weekly candle. Note the pullback that is still being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a bearish weekly candle but note the hold above the key 30 S/R level so watch this region for any new momentum based make or break:

VIX weekly: note how the key 30 level was tested and held last week:

Calendar: Courtesy of Forex Factory:

Earnings: Courtesy of Earnings Whispers: another relatively light week:

Market Analysis:

S&P500: The S&P500 closed with a bullish weekly candle despite the worsening Covid-19 situation in the USA. Price action continues to consolidate above 3,000 S/R with low momentum evident on the 4hr, daily and weekly chart time frames. Note, also, how average weekly Volume was lower last week, as revealed on the S&P500 ETF chart: SPY, and how there is a revised Volume trend line to monitor for any new uptick:

S&P500 ETF: SPY weekly: watch the Volume trend line for any new breakout:

There is still a bit of a Bull Flag style formation on the 4hr chart so watch these trend lines for any new momentum breakout.

Bullish targets: any bullish 4hr chart Bull Flag breakout would bring whole-numbers on the way back to the previous High, near 3,400, into focus.

Bearish targets: any bearish 4hr chart Flag breakdown below 3,000 would bring whole-number levels on the way down to the recently broken 11-yr support TL and, after that, the recent Low, near 2,200.

- Watch for any 4hr chart Bull Flag breakout:

ASX-200: XJO: The ASX-200 closed with a small bullish weekly candle and still right up under the whole-number 6,000 S/R level and 61.8% Fibonacci. The candle had a bit of an Inside look to it reflecting indecision as the index navigates this psychological region.

Trading Volume still remains strong, as the weekly chart below reveals, and was higher last week than the previous two weeks:

XJO weekly: trading Volume remains strong:

The 6,000 and weekly 61.8% Fibonacci level remain as the upper resistance levels for the index. Price action is back down at the 3-month support trend line and there are revised 4hr chart trend lines to monitor for any new breakout. Like with the S&P500 though, momentum remains low and declining on the 4hr, daily and weekly time frame suggesting some caution is needed.

Bullish targets: Any bullish 4hr chart triangle trend line breakout would bring 6,000 followed by whole number levels on the way back to the previous all time High, circa 7,200, into focus.

Bearish targets: Any bearish break of the 4hr chart’s support trend line would bring the 11-yr trend line support into focus followed by the 5,000 level as this is near the 4hr chat’s 61.8% fib level.

- Watch for any new 4hr chart triangle momentum breakout:

Gold: Gold closed with a small bullish weekly candle and back up under $1,750 S/R making this the level to watch for any new make or break in coming sessions.

Price action made a bullish breakout from last week’s 4hr chart triangle so watch for any continued push up to $1,750 S/R.

Weekly chart: As mentioned over recent weeks, the weekly chart has the look of a broad Inverse H&S pattern or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around $700 so it is a longer-term pattern worth monitoring. The upper breakout region for this pattern is $1,800 which is still a way off yet.

Bullish targets: any continued bullish 4hr chart breakout would bring $1,750 S/R into focus followed by $1,800.

Bearish targets: any bearish retreat from $1,750 would bring $1,700 and, then, $1670 into focus.

- Watch for any continued 4hr chart triangle breakout and $1,750 for any new make or break:

Oil: Oil closed with a bullish weekly candle and back up under the $40 level making this the one to watch for any new make or break.

Bullish targets: any continued bullish daily chart triangle breakout above $40 would bring the $41 / $43 region into focus as this represents a Gap Fill region and is near the 61.8% fib of the recent swing Low move.

Bearish targets: any bearish retreat from $40 would bring $35 followed by $30 and $20 and, then, the recent Low, near $6.50, into focus.

- Watch the $40 level and for any continued daily chart triangle breakout:

EUR/USD: The EUR/USD closed with a bearish weekly candle and below the 1.12 S/R level keeping this as the region to watch of for any new make or break.

Price action is in a sort of Bull Flag or channel on the 4hr chart with declining momentum being evident so watch these trend lines for any new momentum breakout.

Bullish targets: Any bullish 4hr chart Flag / channel breakout would bring the 1.130 and the weekly 200 EMA into focus followed by whole-number levels on the way up to a recent High, near 1.15.

Bearish targets: Any bearish 4hr chart Flag / channel breakout would bring 1.11 into focus as this is near the 4hr chart’s 61.8% fib, followed by the 20-yr support trend line.

- Watch the 4hr chart Flag / channel trend lines for any new breakout:

AUD/USD: The Aussie closed with a bullish-coloured Doji weekly candle reflecting indecision as it navigates this major 9-11 year multi-year bear trend line. Remember that this trend line is the upper trend line of the longer-term bullish-reversal Descending Wedge so traders should watch this region for any new make or break.

A pullback, even if only temporary, could still well evolve here so watch the support trend line here for clues. Remember, trends do not travel in straight lines unabated and so a pullback at this major wedge trend line resistance zone would not be at all unexpected.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 0.70 into focus followed by whole-number levels on the way up 0.90.

Bearish targets: Any bearish 4hr chart trend line breakout would bring the 0.67 into focus followed by 0.625 S/R as the latter aligns near the 50% Fibonacci level.

- Watch for any 4hr chart trend line breakout;

AUD/JPY: The AUD/JPY closed with a bearish-coloured Long Legged Doji, or Spinning Top with long shadows, weekly candle with both reflecting indecision.

Price action is holding near a 3 month support trend line and 73 S/R making this the region to watch for any new make or break.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 75 into focus followed by whole-number levels on the way up to 78 S/R.

Bearish targets: Any bearish 4hr chart break of the support trend line and 73 level would bring 70 S/R back into focus followed by whole-number levels on the way down to 65 and 60 S/R as well as the longer-term support trend line.

- Watch 73 S/R and for any momentum-based trend line breakout;

NZD/USD: The Kiwi closed with a bearish weekly and back down near 0.64 S/R so watch this for any new momentum breakout; either up or down.

There are revised 4hr trend lines to monitor for any new breakout as well and note the lack of momentum on this time frame.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 0.65 followed by the 6-year bear TL into focus.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 0.625 S/R into focus.

- Watch for any new 4hr chart momentum-based trend line breakout:

GBP/USD: The GBP/USD closed with a bearish weekly candle and back below the 1.265 S/R level.

Price action broke down from triangle pattern last week so watch for any bearish push to 1.21 S/R.

Bullish targets: Any bullish 4hr chart bounce up from 1.23 would bring 1.265 and the recent High, near 1.28 S/R, into focus.

Bearish targets: Any continued bearish 4hr chart breakdown would bring 1.21 S/R into focus.

- Watch for any continued 4hr chart triangle trend line breakout:

USD/JPY: The USD/JPY closed with a bearish weekly candle and back below 107 S/R making this the region to watch for any new make or break.

There are revised triangle trend lines on the 4hr chart giving traders trend lines to watch for any new momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout above 107 would bring 108.5 into focus as this is still near the 4hr chart’s 61.8% Fibonacci level.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 105 into focus.

- Watch for any 4hr chart triangle breakout: