News is driving the latest moves across markets. Specifically, news that President Trump has called for a closure of US stimulus talks until after the Presidential Election. This triggered flows out of stocks and into the US$, Yen and Bonds but not into Gold. Momentum remains low on most charts but there are revised trend lines to monitor for any new breakout.

Data: watch today for any impact from FOMC Meeting Minutes.

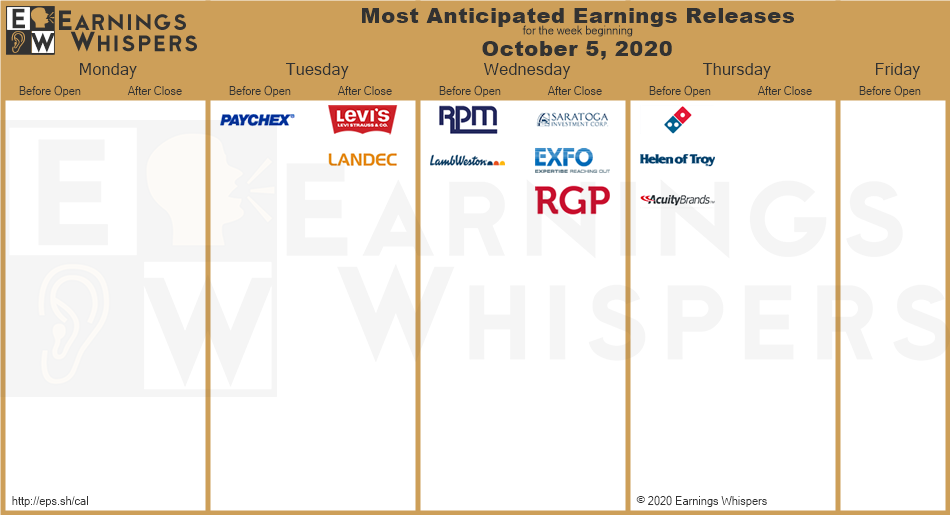

Earnings:

DXY daily: the US$ is higher on flight to safety flows following the halting of US stimulus talks. Watch trend lines for any new momentum b/o:

Markets:

S&P500 4hr: watch revised trend lines for any new momentum b/o:

ASX-200 4hr: watch 6,000 for any new momentum b/o:

Gold 4hr: watch $1,900 and trend lines for any new momentum b/o:

EUR/USD 4hr: watch revised trend lines for any new momentum b/o:

AUD/USD 4hr: watch revised trend lines for any new momentum b/o:

AUD/JPY 4hr: watch revised trend lines for any new momentum b/o:

NZD/USD 4hr: watch revised trend lines for any new momentum b/o:

GBP/USD 4hr: watch revised trend lines for any new momentum b/o:

USD/JPY 4hr: watch trend lines for any new momentum b/o:

GBP/JPY 4hr: watch revised trend lines for any new momentum b/o:

USD/CAD 4hr: this had shifted to a descending wedge. Watch 1.33 for any new make or break: