The US$ is a bit stronger but it pays to remember that the index is still consolidating in a range-bound pattern on low momentum. Gold and the commodity currencies are a bit weaker, due to this US$ strength, BUT momentum is low across many of their 4hr charts as well. This messiness might remain the case until after the ECB update.

Data: the BoC update is the main item today:

DXY weekly: range-bound on low momentum:

Markets:

S&P500 4hr: watch for any new TL b/o:

ASX-200 4hr: watch for any new TL b/o:

Gold:

Gold 4hr: back below $1,800:

Gold 30 min: this weakness was best chased in the European session. Look at the great range b/o opportunity here for those who trade short term in the session:

EUR/USD 4hr: weaker BUT note the low momentum so watch the Flag TL for any new b/o:

AUD/USD 4hr: weaker too after the RBA update BUT note the low/flat momentum so watch the revised TL for any new b/o:

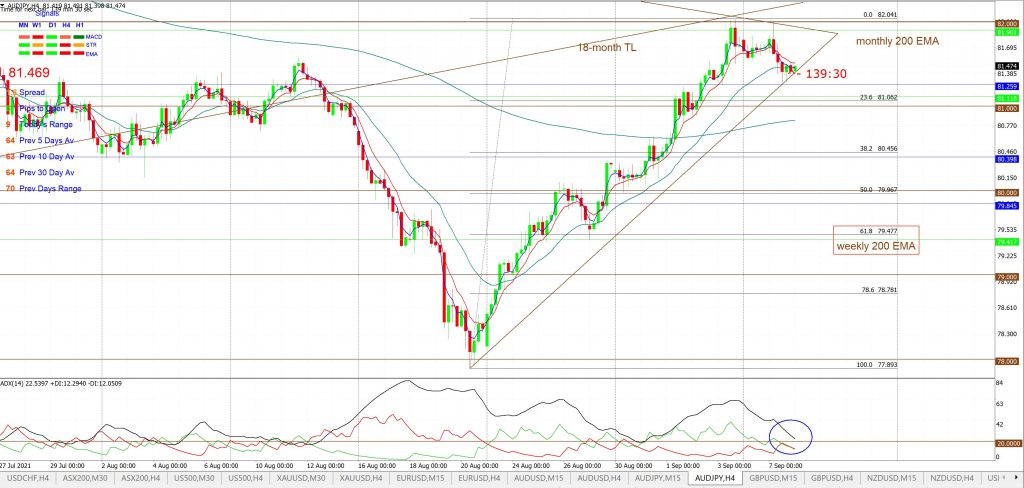

AUD/JPY 4hr: weaker too BUT note the low/flat momentum so watch the revised TL for any new b/o:

NZD/USD 4hr: weaker too BUT note the low/flat momentum so watch the revised TL for any new b/o:

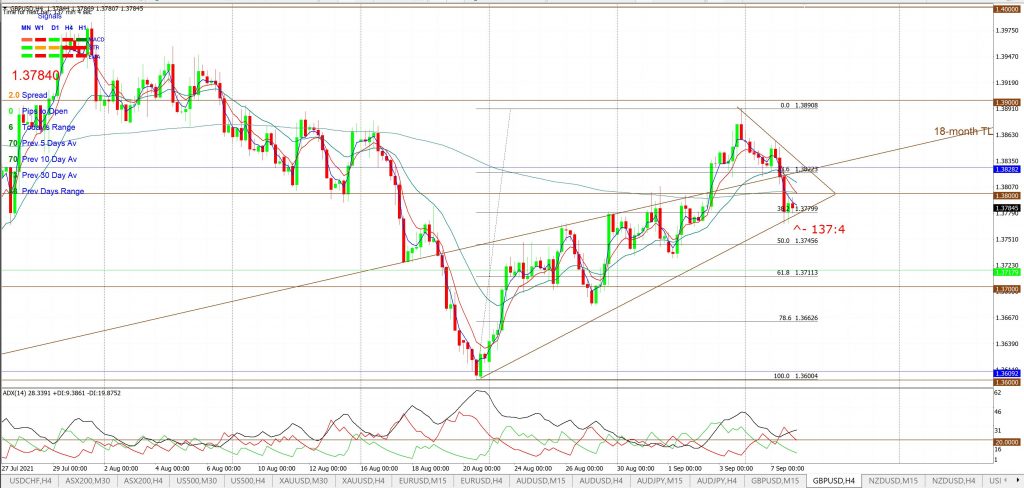

GBP/USD 4hr: weaker too BUT note the low/flat momentum so watch the revised TL for any new b/o:

USD/JPY 4hr: watch for any new TL b/o:

GBP/JPY 4hr: weaker too BUT note the low/flat momentum so watch the revised TL for any new b/o: