There is a saying that markets are ‘forward looking’ and that has certainly been the case in the last session. Weak US GDP and US food shortage concern was shrugged off in favour of hope of a Covid-19 treatment and a re-opening economy. The S&P500 is now in the vicinity of the key 61.8% fib make or break level so watch to see how the index fares from here.

NB: this weekend’s update will be brief as I have ATAA trading meeting and family commitments over the weekend.

Data: Watch today with CNY Manufacturing and Non-Manufacturing PMI, NZD Business Confidence, lots of EUR second tier data, the ECB rate update and US weekly Unemployment Claims data.

Earnings: more big names report On Thursday:

DXY daily: the US$ was lower on the day after FOMC so watch for any push down to 98 S/R:

Trend line breakouts:

AUD/USD 4hr: I had warned back in early April about the bullish longer-term pattern setting up on the AUD/USD! This latest bullish TL b/o is now up 150 pips but watch 0.66 for any new make or break:

Recall how the Aussie rallied after the GFC so I’m wondering if we might be in for more of the same here!

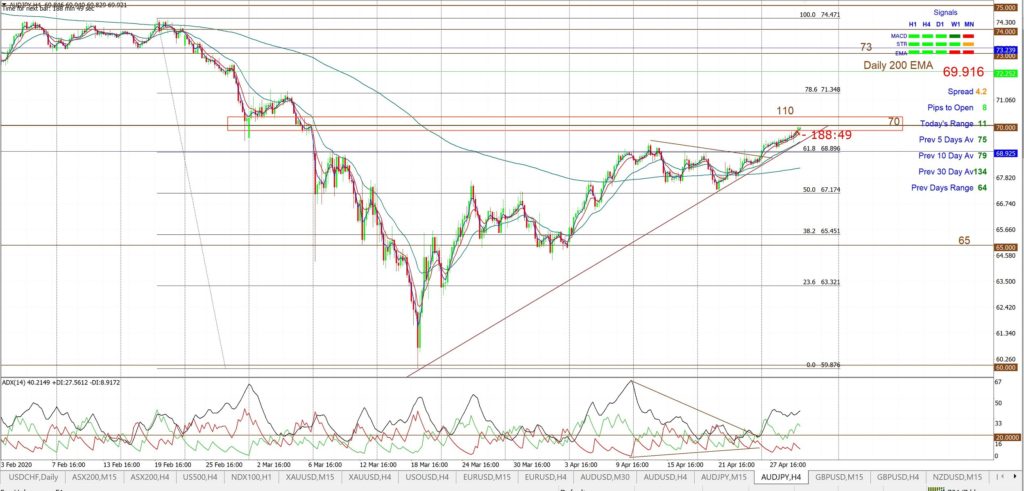

AUD/JPY 4hr: this TL b/o is now up 110 pips so watch 70 for any new make or break:

GBP/USD 4hr: this TL b/o is still at 100 pips so watch 1.25 for any new make or break:

NZD/USD 4hr: this new TL b/o has been very choppy but is up 100 pips so watch for any push to 0.625:

Other Markets:

S&P500 4hr: watch the psychological 3,000 for any new make or break. This level has been in focus for many weeks as per this article.

ASX-200 4hr: watch 5,450 for any new make or break BUT the 6,000 is also a key psychological level to monitor:

Gold 4hr: watch $1,700 and for any potential Bull Flag b/o:

EUR/USD 4hr: there looks to be some effort of recovery here BUT this will be best left until after the ECB rate update: