Last week: There was a multitude of trend line breakouts last week and many of these resulted from the weaker US$; something I had warned about two weeks back in my FX Index update. There was a risk-on mood to start the week on the back of positive Covid-19 vaccine news but developing US-China tension meant that the three major US stock indices closed lower for the week. This tension also sent Gold and Bonds higher but there was no Flight to Safety move into the US$; in fact, the US$ index is now down trying to hold above a 10-year support trend line. Rather strangely, the VIX also closed lower reflecting a lack of measured Fear at the moment. The weaker US$ has underpinned a number of currency pairs such that they are up testing multi-year bear trend lines. The EUR/USD, AUD/USD, NZD/USD as well as AUD/JPY fall into this category along with Gold / XAU/USD and the GBP/USD isn’t too far behind! The monthly candles close at the end of next week so they will be in keen focus with next week’s analysis. Any failure of the US$ to hold above this multi-year support trend line could herald some significant breakout moves across a range of instruments. Traders have a huge batch of high impact US Earnings and FOMC to factor in this week as well as ongoing Covid-19 and geo-political issues.

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts and TC signals:

It was a busy week for trend line breakout moves from patterns profiled in last week’s analysis. Technical analysis is working very well at the moment! Articles published during the week can be found here, here, and here:

- Gold: a channel b/o for up to $95:

- EUR/USD: a TL b/ above 1.15 for 150 pips but the move is up around 300 pips from the previous multi-week Flag pattern:

- AUD/USD: a multi-week Flag TL b/o for 130 pips.

- AUD/JPY: a multi-week Flag TL b/o for 180 pips.

- NZD/USD: a multi-year TL b/o for 80 pips.

- GBP/USD: a TL b/o for 200 pips.

- USD/JPY: a TL b/o for 100 pips on Friday:

- This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a large, bearish weekly candle and has broken below the 95 level to reach down to a 10-year support trend line. This will be the level to watch for any new make or break AND note how the ADX momentum indicator has edged higher and is now above the key 20 level. Any failure to hold above this support trend line would bring the 85 region into focus as this is near the 61.8% Fibonacci of the 10 year swing High. Price action has held above this support trend line numerous times before though so caution is needed at this major level:

DXY weekly:

DXY weekly + Fibonacci targets:

-

- End of Month: next Friday is the last day of the month so watch to see how the monthly candles close.

-

- Square Root √ shaped recovery: Some talk of V versus U shaped market recovery but Ryan Detrick has put forward the concept of a Square Root √ shaped recovery in this 4.5 minute interview. This is well worth a listen!

-

- FOMC: the FOMC rate update is next Wednesday.

-

- EUR/USD: The EUR/USD is testing a major monthly-based bear trend line so watch to see how the candle closes on Friday with the end of month:

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

- Currency Strength Indicator: note the weakness on the USD.

Currency Strength Indicator (daily):

-

- Gold: I have been warning about the bigger picture chart pattern shaping up on the weekly chart of an Inverse H&S. Watch carefully now as the precious metal trades up near $1,900, well above my first thought $1,800 ‘neck line’. Could $1,900 be a better neck line though?

-

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; even if the S&P500 heads back to testing its all time High: The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- DJIA weekly: The DJIA closed with a bearish-coloured Spinning Top style weekly candle reflecting indecision as the index holds above the key 25,000 S/R region. Watch for any new weekly triangle breakout:

DJIA weekly:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bearish weekly candle following last week’s bearish-reversal Hanging Man weekly candle. The 10,000 level, which was previous resistance, may now offer some psychological support but, if this breaks, keep an eye on the 8,400 region. Also watch for any potential Bull Flag price action given the new break of the 4-month support trend line:

NASDAQ weekly:

NASDAQ daily:

-

- DAX weekly: The DAX closed with a bullish-coloured Doji weekly candle BUT watch for any push to the recent all-time High:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and closed with a bearish-coloured Doji weekly candle reflecting indecision.

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish weekly candle as US-China tension escalated. However, note the pullback that is still being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a bearish-coloured Spinning Top weekly candle reflecting indecision. The Index is still below the 30 level so watch this region for any new momentum based make or break:

VIX weekly: watch the key 30 level for any new momentum based make or break:

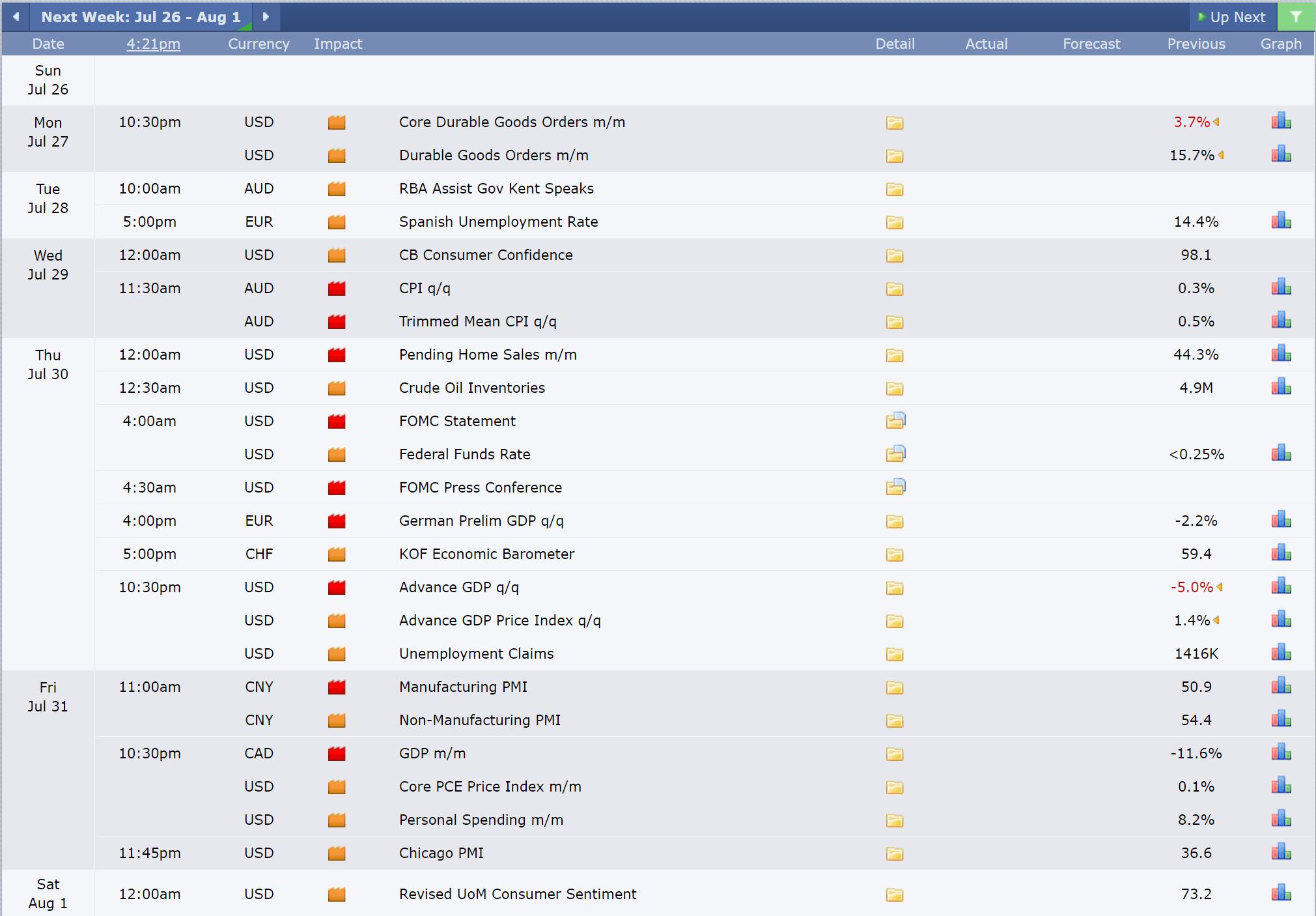

Calendar: Courtesy of Forex Factory: Keep abreast of Covid and China news but watch, also, for any impact from FOMC:

Earnings: Courtesy of Earnings Whispers: Watch for impact from Earnings as lots of big name companies report this week:

Market Analysis:

S&P500: The S&P500 closed with a bearish-colored Spinning Top / Doji weekly candle reflecting indecision as the market weigh the latest upbeat Covid vaccine news moderated against the developing US-China situation.

Trading volume still remains low and below the 200-Moving Average line and note the revised bear trend line so watch for any breakout here.

S&P500 ETF: SPY weekly: Volume is still low and below the moving average AND note the revised bear trend line:

Price action is back near near 3,230 so keep watch of this level for any new make or break.

Bullish targets: any bullish 4hr chart hold above 3,200 would bring whole-numbers on the way back to the previous all-time High, near 3,400, into focus.

Bearish targets: any bearish 4hr chart break below 3,200 would bring 3,100 and 3,000 into focus followed whole-number levels on the way down to 2,800.

- Watch 3,200 S/R for any new make or break:

ASX-200: XJO: The ASX-200 closed with a bearish-coloured Doji weekly candle reflecting ongoing indecision as price continues trading near the psychological 6,000 level and under the weekly 61.8% Fibonacci level.

Trading Volume remains low so keep watch for any new Volume trend line breakout.

XJO weekly: trading Volume was low again this week and remains below the 200 Moving Average:

The 6,000 level remains the S/R level to watch for any new make or break although there are still 4hr chart trend lines to monitor as well.

Bullish targets: Any bullish 4hr chart triangle breakout would bring the recent High, near 6,190, into focus followed by whole number levels on the way back to the previous all time High, circa 7,200.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the 11-yr trend line support into focus followed by the 5,000 level as this is still near the 4hr chat’s 61.8% fib level.

- Watch 6,000 S/R and for any new 4hr chart ascending triangle breakout:

Gold: Gold closed with a large, bullish weekly candle, worth around $100, and just above the key $1,900 level making this the new level to watch for any new make or break. This is the first weekly close above this whole-number level and so this is a most significant week for the precious metal. Traders need to watch this level carefully especially as the US$ index trades down near a 10-year support trend line:

- any break of US$ support could help send Gold much higher.

- any hold of US$ support could keep Gold range-bound. However, this would only help to further develop the Inverse H&S pattern.

Weekly chart: As mentioned over recent weeks, the weekly chart has the look of a broad Inverse H&S pattern or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $700 or $800, depending on where you view the ‘neck-line’ so it is a longer-term pattern worth monitoring. Keep watch of $1,900 now that price action is trading above this potential neckline region!

Bullish targets: any bullish 4hr chart hold above $1,900 would bring $2,000, into focus.

Bearish targets: any bearish 4hr chart break back below $1,900 would bring the 4hr chart’s support trend line followed by $1,800 into focus.

- Watch $1,900 for any new make or break; especially with this week’s FOMC:

Oil: Very little has changed here yet again. Oil closed with bullish-coloured Spinning Top weekly candle and still under the $41.50 level reflecting ongoing indecision.

Bullish targets: any continued bullish daily chart triangle breakout above $41.50 and daily 200 EMA would bring $42 into focus on the way up to the $50 S/R region.

Bearish targets: any bearish retreat from $41.50 would bring $40 and $35 followed by $30 and $20 and, then, the recent Low, near $6.50, into focus.

- Watch the $41.50 level and the daily 200 EMA for any continued daily chart triangle breakout:

EUR/USD: I had warned two weeks ago to watch for any bullish bias on the EUR/USD and this suggestion has delivered in spades! The bullish breakout from the daily chart’s Cup ‘n’ Handle pattern has continued above the key 1.15 level and given almost 250 pips of the projected 700 pip move.

It is of no surprise then the EUR/USD closed with a large bullish weekly candle but what might surprise is that this pair is now up testing a 13-year bear trend line. Price action closed just below 1.166 so this is the level to watch for any new make or break.

Bullish targets: Any continued bullish daily chart Cup ‘n’ Handle breakout above 1.166 would bring the 13-year bear trend line into focus.

Bearish targets: Any retreat from 1.166 would bring 1.16 into focus followed by the 4hr chart’s support trend line and, then, whole-numbers on the way down to 1.12 S/R.

- Watch 1.166 for any new make or break: especially with this week’s FOMC:

AUD/USD: The Aussie closed with another bullish-coloured weekly candle, albeit with a bit of an upper shadow, but with just one week to go before the monthly candle closes, the key feature to note is that it is holding above the major 9-11 year bear trend line and this trend line is the upper trend line of the longer-term bullish-reversal Descending Wedge.

As mentioned over recent weeks:

- The June monthly candle actually closed just under this wedge trend line so it will take another month before the next candle close could confirm a monthly wedge breakout. The monthly candle close below the multi-year trend line supports the full range of trading possibilities: a pullback, further consolidation and continuation so keep an open mind here.

- A pullback, even if only temporary, could still well evolve here so watch the multi-year trend line here for clues. Remember, trends do not travel in straight lines unabated and so a pullback at this major wedge trend line resistance zone would not be at all unexpected.

There are revised 4hr chart trend lines to watch for any momentum breakout. Note the Elliott Wave pullback being suggested by my software on the daily and weekly charts though!

Bullish targets: Any bullish 4hr chart triangle breakout above 0.71 would bring whole-number levels on the way up 0.90 into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 0.70 into focus followed by 0.69 and the the 9-11 year bear trend line and, then, 0.67 S/R.

- Watch 0.71 and for any new triangle trend line breakout;

AUD/JPY: The AUD/JPY closed with another indecision-style candle, albeit bullish coloured. The candle could be described as a Spinning Top with a long upper shadow or a Shooting Star style candle BUT they key point to note is that price action held above the 75 level making this the region to keep watch for any new make or break.

The AUD/JPY is back trading near the multi-month support trend line so watch this, and the revised trend lines on the 4hr chart, for any breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring whole-number levels on the way up to the 7-year bear trend line and 78 S/R into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 74 and 73 S/R back into focus followed by whole-number levels on the way down to 65 and 60 S/R as well as the longer-term support trend line.

- Watch 75 S/R for any 4hr chart triangle breakout:

NZD/USD: The Kiwi closed with a bullish weekly candle as price action finally broke up through the major resistance of the 7-year bear trend line. It pulled back after testing this major resistance zone but traders should watch for any new push back towards, or above, this key level.

Bullish targets: Any bullish breakout above the 7-year bear TL would bring 0.70 S/R into focus.

Bearish targets: Any bearish 4hr chart break back below the recent support trend line would bring 0.65 into focus as this now aligns with the weekly chart’s support trend line.

- Watch the 7 yr bear trend line and for any 4hr chart momentum-based trend line breakout:

GBP/USD: The GBP/USD closed with a large, bullish weekly candle and has made a bullish 4hr/daily/weekly chart triangle breakout. The monthly candle has a week to close but note the look of the Double Bottom shaping on the monthly chart: the 12-year bear trend line would be as good as any level to confirm this bullish monthly chart pattern.

Price action closed just below 1.28 S/R so watch this level for any new breakout with any bullish continuation move.

Bullish targets: Any bullish 4hr chart breakout above 1.28 would bring whole-number levels on the way to the recent daily chart high, circa 1.35, into focus.

Bearish targets: Any bearish 4hr chart triangle breakout bring 1.26 S/R and the weekly support trend line into focus.

- Watch 1.28 S/R for any 4hr chart trend line breakout:

USD/JPY: The USD/JPY closed with a bearish weekly candle.

There are revised triangle trend lines on the 4hr chart giving traders trend lines to watch for any new momentum breakout.

Bullish targets: Any bullish 4hr chart wedge breakout above 107 would bring 108 and 108.5 into focus.

Bearish targets: Any bearish 4hr chart wedge breakout would bring the monthly 200 EMA followed by 106 into focus.

- Watch for any 4hr chart wedge breakout: