Stocks have re-bounded off recent Lows but the point to note with these moves is that they are of low momentum. Most chart patterns are little changed since my weekend update so keep watch of trend lines for any momentum breakouts. Also, keep a close eye on Oil as this looks like it’s shaping up in a bullish-reversal descending wedge!

Data: Coronavirus remains the main theme but also watch for impact from NZD Business Confidence, CNY Manufacturing and Non Manufacturing PMI, lots of second tier EUR data and US Consumer Confidence data.

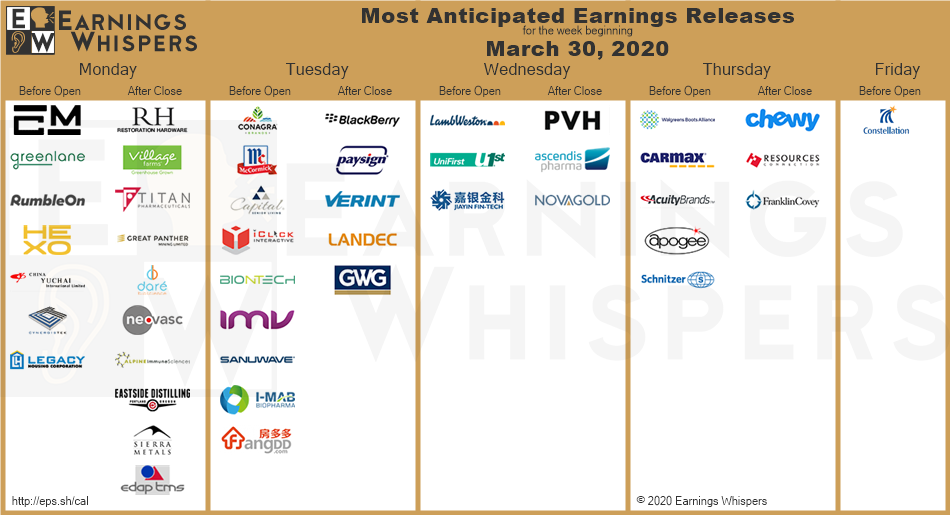

Earnings:

DXY 4hr: note the bounce off 98 S/R so watch for any push back to 100 and, then, 103.80:

Markets:

S&P500 4hr: a bounce up but note the lack of momentum. Still potential for a Bear Flag here but watch 2,650 for any new make or break:

ASX-200 4hr: ditto but any continued bounce would bring the 61.8% fib into focus as this is near a Gap fill region:

Oil 4hr: note the bullish-reversal Descending Wedge shaping up here. Target remains as $41.50 region::

Gold 4hr: chopping sideways with declining momentum:

EUR/USD 4hr: watch for any trend line breakout:

AUD/USD 4hr: watch for any trend line breakout:

AUD/JPY 4hr: watch 67 and for any trend line breakout:

NZD/USD 4hr: watch 0.605 and for any trend line breakout:

GBP/USD 4hr: watch 1.25 and for any trend line breakout:

USD/JPY 4hr: watch 108 and for any trend line breakout:

GBP/JPY 4hr: watch 135 and for any trend line breakout: