Any hope that the ECB update might trigger some new movement and clarity has been put to rest. Most instruments are lacking direction on low momentum and the Currency Strength Indicator screen shot of the 4hr chart reflects this rather clearly. There is US CPI and Retail Sales data next week so maybe these items will help define a new directional move. School is back in session for much of the norther hemisphere after the summer so new Covid cases with students will be a keenly watched metric as well.

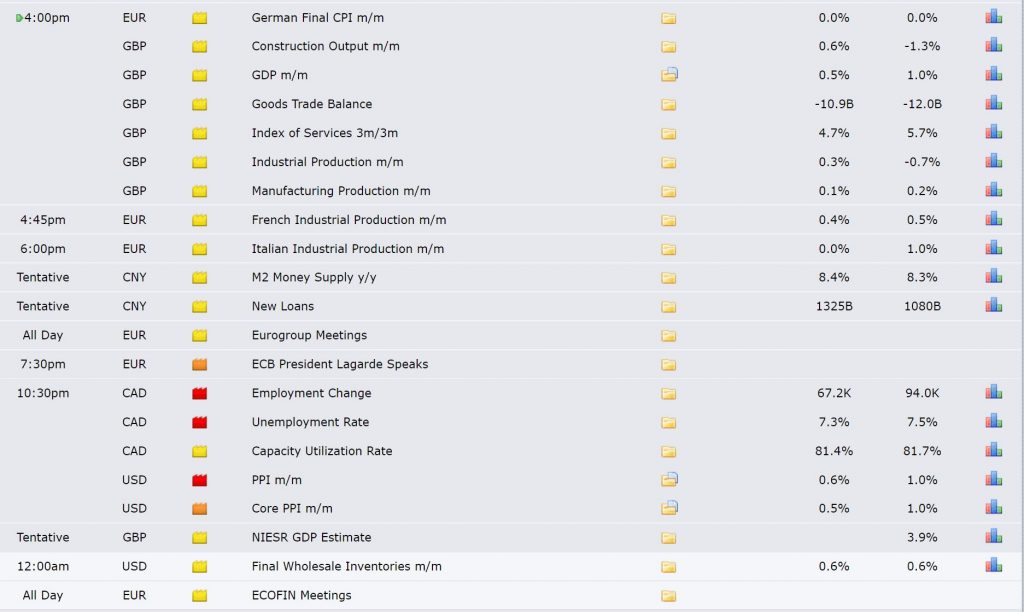

Data:

DXY weekly: still consolidating on low momentum:

CSI 4hr: still converging:

Markets:

S&P500 4hr: messy with a spike here but keep watch for any new TL b/o:

ASX-200 4hr: a new TL b/o here and note where price paused! At the 4hr chart’s 61.8% Fib so watch this for any new make or break:

Gold 4hr: revised trend lines again here so watch for any new b/o:

EUR/USD 4hr: watch TL and 1.18 for any new b/o:

AUD/USD 4hr: watch TL and weekly and 4hr 200 EMAs for any new b/o:

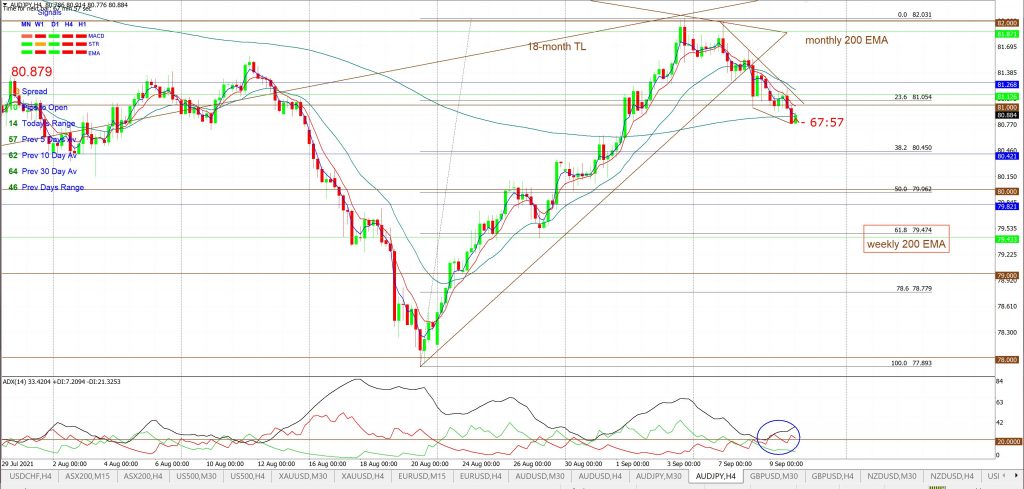

AUD/JPY 4hr: lower but watch TL and 81 for any new b/o:

NZD/USD 4hr: watch TL, 0.71 and 18-month TL for any new b/o:

GBP/USD 4hr: watch the 18-month TL for any new b/o:

USD/JPY:

USD/JPY 4hr: lower so watch for any push to 109:

USD/JPY 30 min: note that this weakness could have been caught by range-breakout traders:

GBP/JPY 4hr: watch TL for any new b/o: