Last week: US stock indices closed higher again last week despite the continued economic challenge faced with Covid-19. I often hear and see the phrase ‘never fight the Fed‘ and this seems increasingly relevant at the moment. I’ve noted my surprise over the last few weeks with these paradoxical moves across stock markets amid the ongoing Coronavirus pandemic but recent commentary from the US Federal Reserve Chair, Jerome Powell, highlights the lengths being considered to deal with the economic uncertainty. One high value investor commented that the ‘artificially supported markets will fail when Fed aid slows’ but, the big question is, when will this aid slow? The S&P500 index made a significant weekly close above a key Fibonacci resistance level but the whole-number 3,000 remains just ahead. A weekly close above this psychological level would support the theory of this bullish move being a V-shaped recovery rather than a dead cat bounce. This bullish S&P500 move though continues on low trading Volume and Momentum suggesting that traders need to exercise some caution, at a minimum, if trading these moves. The Fear Index, VIX, remains near a ‘sitting on the fence‘ level of 30. The DXY hold below 100 helped to trigger a few decent Forex trend line breakout trades last week and helped the open trend line breakout trade on Oil.

Technical Analysis: As noted over recent weeks, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts and TC signals: Articles published during the week can be found here, here, and here:

- S&P500: a TL b/o for 100 points.

- ASX-200: a TL b/o for 170 points.

- EUR/USD: a TL b/o for 110 pips.

- AUD/USD: a TL b/o for 120 pips.

- NZD/USD: a TL b/o for 130 pips.

- Oil: the trend line breakout from last week is now up around $7.50:

Oil weekly: weekly chart from the previous week when price was $26 prior to b/o:

Oil weekly: current chart with price near $33.50: a b/o worth $7.50:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bearish-coloured indecision-style Inside weekly candle but remains range-bound on low momentum just under the key 100 level:

DXY weekly:

-

- AusBiz.com.au: I was invited for a 10 minute discussion on an Australian online business / finance channel during the week and this was my first time participating in such an event. A copy of the interview on their site is available through this link.

-

- Monday: is a holiday in the USA so it might be a slow start to the trading week.

-

- S&P500: Keep the bigger picture in perspective with this recent pullback:

S&P500 yearly: keep this latest move in perspective:

-

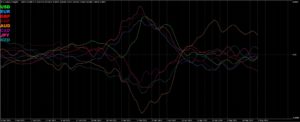

- Currency Strength Indicator: still looks rather indecisive here with daily chart bunching being evident:

Currency Strength Indicator (daily):

-

- Gold: I have been warning about the bigger picture chart pattern shaping up on the weekly chart of an Inverse H&S. Price action is still near the $1,750 S/R level so watch for any push to the $1,800 ‘neck line’ breakout level of this pattern.

-

- Market Phases: I think it is timely to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might lead to Participation Down:

S&P500 monthly: watch for any Distribution type activity:

-

- DJIA weekly: The DJIA closed with a bullish weekly candle and above the 50% Fibonacci so watch for any push to the 61.8% Fibonacci region:

DJIA weekly:

-

- NASDAQ composite: The NASDAQ Composite Index also closed with a bullish weekly candle so watch for any push to the previous all-time High, circa 10,000:

NASDAQ weekly:

-

- DAX weekly: The DAX closed with a bullish weekly candle and above the 50% Fibonacci level so watch for any push to the 61.8% Fibonacci region:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks. The index closed with a bullish weekly candle and up above the 50 % fib so watch for any push to the 61.8% Fibonacci region:

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish-coloured Spinning Top style weekly candle. However, note the pullback that is still being suggested by the Elliott Wave indicator; any further dip here might parallel a continued move higher with stocks:

TLT weekly:

-

- VIX: the Fear index closed with a bearish weekly candle and just below the key 30 S/R level so watch this region for any new make or break:

VIX weekly: watch 30 S/R for any new make or break:

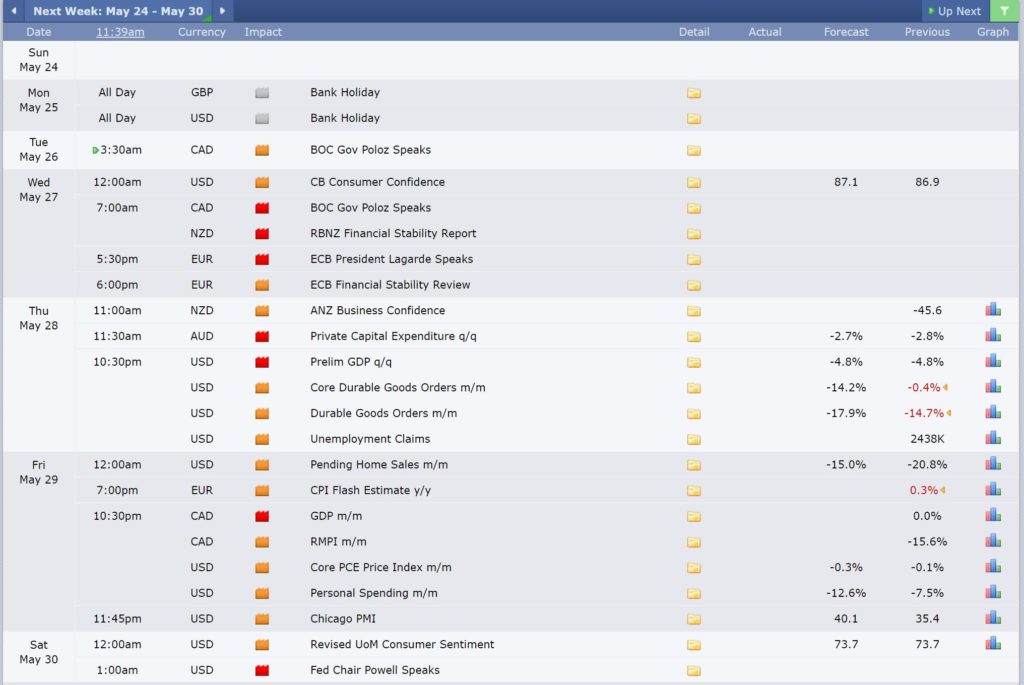

Calendar: Courtesy of Forex Factory:

Earnings: Courtesy of Earnings Whispers:

Market Analysis:

S&P500: The S&P500 closed with a bullish-coloured Spinning Top weekly candle BUT above the weekly chart’s important 61.8% Fibonacci level. Does this mean the index is out of the Dead Cat Bounce woods? I’m not so sure given that weekly ADX momentum is trending down and the Bullish +DMI indicator is trading flat and below the 20 threshold level:

S&P500 weekly & Covid-19: there has now been a bullish weekly candle above the key 61.8% BUT note the declining momentum:

The other charting feature worth noting is that trading Volumes have been low and trending downwards. This makes me think there might be more FOMO rather than Institutional buying!

SPY daily: note how Volume is low and declining as price chops higher:

Both of these factors, low Momentum and low Volume, make me cautious about this continued move higher. I note that the whole-number 3,000 level is just above current price so a weekly and, more importantly, monthly close above this level would be an encouraging signal for S&P500 Bulls. However, I am on the lookout for any Distribution type activity that could lead to a roll-over and Participation Down.

I remain cautious because back in the GFC era, the S&P500 eventually moved much lower after a first bounce and test of the 61.8% Fibonacci as the following statistics and chart reveal:

- S&P 500 high: 1565.15, Oct. 9, 2007

- S&P 500 low: 682.55, March 5, 2009

- S&P 500 loss: 56.4 percent

- Duration: 17 months

S&P500 weekly & GFC: price action moved lower after the first bounce and test of the 61.8% fib with the GFC:

As mentioned over recent weeks:

- The big question remains: Will current price action mirror that seen during the GFC? No one can know for sure but the next couple of weekly candles remain critical to aid our understanding of what might be to follow. A weekly and monthly candle close above 3,000 would be a further bullish signal for the index.

- However, I am still watching for any broader pullback down to the 61.8% Fibonacci of the 2009-2020 swing High move and this level is down near 1,700 / 1,600. This is a region of some confluence as it is the previous upper level from the 2013 channel breakout. The 61.8% Fibonacci zone was also tested in the 1987 and GFC market pullbacks, as described in this post. For the moment though, the index has only pulled back to around 45% of this 2009-2020 swing High move so keep this move in perspective as technical theory would suggest the uptrend is intact until the 61.8% fib is broken!

- The upper resistance line in the sand for me with the S&P500 is the 3,000 whole-number and psychological level near this weekly 61.8% Fibonacci level: any weekly hold and close above this level would be bullish for the index.

There are revised triangle trend lines on the 4hr chart to monitor for any new breakout.

Bullish targets: any bullish 4hr chart triangle breakout above 3,000 would bring whole-numbers on the way back to the previous High, near 3,400, into focus.

Bearish targets: any bearish 4hr chart triangle breakout would bring the recently broken 11-yr support TL back into focus as this is also near the 4hr chart’s 61.8% fib and, after that, the recent Low, near 2,200.

- Watch for any momentum-based 4hr chart triangle breakout:

ASX-200: XJO: The ASX-200 closed with a small, bullish weekly candle under 5,600 and near the recently broken 11-year support trend line. The 5,450 level was broken last week but momentum remains on the decline and a new resistance zone of 5,600 looks to be the level to monitor for any new make or break.

Whilst the 5,450 level has been broken the broader picture remains such that the two scenarios, described over recent weeks, remain valid again this week:

- Bullish: any new momentum breakout and hold above 5,600 would support a V-shaped recovery.

- Bearish: the daily chart could still be viewed as a potential Bear Flag, although, this is becoming a bit over-extended. The Flag pole here would predict the index falling to down near 2,000 so let’s hope this pattern fails! However, the impact from the economic fallout due to Covid-19 is still uncertain but could take an enormous toll if the situation continues out to the end of the year. Recall though that the index continues to hold above the support from the weekly 61.8% fib; a key S/R region that was previously highlighted in articles here and here.

There is one important revision to note here this week though and this is the shift with the daily chart’s ADX. The ADX momentum line had been well below the 20 level for most of May but is now edging up towards this threshold level. The bullish momentum +DMI is still trading flat to lower but traders need to be on the lookout for any uptick of both the ADX and +DMI above 20 as this would support a bullish thesis for the index.

Momentum is on the decline on the 4hr chart though so watch the revised 4hr chart triangle trend lines to monitor for any new momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout above 5,600 would bring the daily chart’s 61.8% fib level, near the psychological and whole-number 6,000 level, into focus.

Bearish targets: Any bearish 4hr chart triangle breakdown would bring the 5,000 level into focus and, then, weekly chart’s 61.8% fib, near 4,600/4,700, followed by the recent Low, near 4,400.

- Watch for any new momentum-based 4hr chart triangle trend line breakout:

Gold: Gold closed with a bearish-coloured Spinning Top weekly candle reflecting indecision. The continued flow of funds into stocks, despite Covid-19 related recessionary fear, seems to have the precious metal as confused as us traders!

Price action remains just under $1,750 keeping this as the level to watch for any new make or break. There are revised 4hr chart triangle trend lines to monitor as well.

Weekly chart: As mentioned over recent weeks, the weekly chart has the look of a broad Inverse H&S pattern or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around $700 so it is a longer-term pattern worth monitoring. The upper breakout region for this pattern is $1,800 which is still a way off yet.

Bullish targets: any bullish 4hr chart triangle breakout above $1,750 would bring $1,800 S/R into focus.

Bearish targets: any bearish 4hr chart triangle breakout would bring $1,700, $1,650, $1,600 and, then, $1,550 into focus as the latter remains near the 4hr chart’s 61.8% Fibonacci level.

- Watch for any 4hr chart triangle breakout:

Oil: Oil closed with another bullish weekly candle and up under $34 continuing the bullish momentum breakout from the recent triangle pattern. This move has now given up to $7.50 but watch for any continuation up to the $41 / $43 region as this would fulfill a Gap Fill and it is also near the 61.8% fib of the recent swing Low move.

Note the bullish-reversal Morning Star pattern still shaping up on the monthly chart.

Bullish targets: any continued bullish daily chart triangle breakout above $34 would bring the $41 / $43 region into focus as this represents a Gap Fill region and is near the 61.8% fib of the recent swing Low move.

Bearish targets: any bearish retreat from $34 would bring $30 followed by $20 and, then, the recent Low, near $6.50, into focus.

- Watch the $34 level and for any continued daily chart triangle breakout:

EUR/USD: The EUR/USD closed with a bullish-coloured Inverted Hammer weekly candle but back below the 1.10 S/R level.

Price action is trading in a revised 4hr chart triangle giving traders trend lines to monitor for any momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.10 back into focus followed by whole-number levels on the way up to the recent High, near 1.15.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the recent Low, near 1.065, into focus.

- Watch for any 4hr chart triangle breakout:

AUD/USD: The Aussie closed with a bullish weekly candle but is still trapped between 0.65 and 0.66 making this the range to watch for any new breakout. Price action continues to snake higher though and the 4hr chart reveals the print of higher Highs and higher Lows which is the definition of an uptrend.

As mentioned last week: Traders need to keep an open mind here and keep an eye on the US$ index. Any developing weakness of the US$ index (DXY) at the key 100 level would underpin the Aussie. However, a risk-off equity shift could trigger a flight to safety move into the US$ which would likely punish this pair. Remember to trade what you see and not what you think! Recall, also, the monthly chart still shows a rather bullish pattern developing; that of a bullish-reversal Descending Wedge.

Bullish targets: Any bullish 4hr chart triangle trend line breakout above 0.66 would bring the recent High, near 0.67 S/R, into focus.

Bearish targets: Any bearish 4hr chart triangle trend line breakdown below 0.65 would bring 0.64 and 0.625 S/R into focus followed by whole-numbers on the way down to the recent Low, near 0.55 S/R.

- Watch for any 4hr triangle trend line breakout:

AUD/JPY: The AUD/JPY closed with a bullish, almost ‘engulfing’ weekly candle and just above the 70 S/R level keeping this the region to keep watch of for any new make or break.

I’m wondering if this close above 70 might be somewhat akin to the Lunar landing: ‘that’s one small step for man, one giant leap for mankind’? The 70 is a huge S/R value for the AUD/JPY and the monthly chart reveals just how significant this level is for the currency pair. As noted last week: price action may continue to chop around this region until there is a decisive new move across stock markets. Any continued stock market recovery would support the AUD/JPY moving above 70 but any stock sell-off would be bearish for this pair. A monthly close above the 70 level would be a bullish signal for this pair.

There are revised 4hr chart trend lines to monitor for any momentum breakout.

Bullish targets: Any bullish 4hr chart triangle trend line breakout would bring whole-number levels on the way up to 75 S/R into focus.

Bearish targets: Any bearish 4hr chart triangle trend line breakout would bring 65 S/R back into focus followed by 60 S/R.

- Watch for any 4hr chart trend line breakout:

NZD/USD: The Kiwi closed with a bullish weekly candle but this was almost an indecision-style Inside candle.

Price action is essentially weaving sideways though, mostly above the 0.60 level, but there are 4hr chart triangle trend lines to monitor for any new momentum breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 0.625 into focus followed by whole number levels on the way up to the recent High, near 0.64 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 0.57 S/R back into focus as this is still near the 4hr chart’s 61.8% fib.

- Watch for any 4hr triangle breakout:

GBP/USD: The GBP/USD closed with a bullish-reversal style Inverted Hammer weekly candle but below the 1.22 level. The 1.22 level had been the bottom of the previous 6-week trading channel so the close below this is somewhat bearish. As well, the 4hr chart still shows lower Highs being printed, which is also bearish, so watch the recent Low region, near 1.21, for any new make or break.

There are revised 4hr chart trend lines to monitor as well.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.24 S/R into focus, as this is near the 4hr chart’s 61.8% fib, followed by whole-number levels on the way back up to 1.265 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout below 1.21 would bring 1.20 followed by whole-number levels on the way down to the 2016 Low, near 1.145, into focus.

- Watch for any new 4hr chart triangle breakout:

USD/JPY: The USD/JPY closed with another bullish-coloured Spinning Top weekly candle and half way between 107 and 108 making this the range to watch for any new breakout.

There is a revised triangle pattern on the 4hr chart giving traders trend lines to watch for any new momentum breakout.

Bullish targets: Any bullish 4hr triangle breakout would bring 108, 108.5, 109 and, then, whole-numbers on the way to 112 into focus.

Bearish targets: Any bearish triangle breakout would bring 107 followed by 105 S/R into focus as the latter is near the 4hr chart’s 61.8% Fibonacci and the monthly 200 EMA.

- Watch for any 4hr chart triangle breakout: