Gold is up on risk-off flows but stocks were up on risk-on flows. It is a ‘go figure’ moment for sure with an escalating Covid situation in the US. The US$ index has printed a third consecutive indecision candle which kind of sums up things appropriately! The GBP/USD Descending Wedge is shaping up nicely so this might be one set up worth watching!

Data: watch today with lots of second tier PMI data and for ADP NFP.

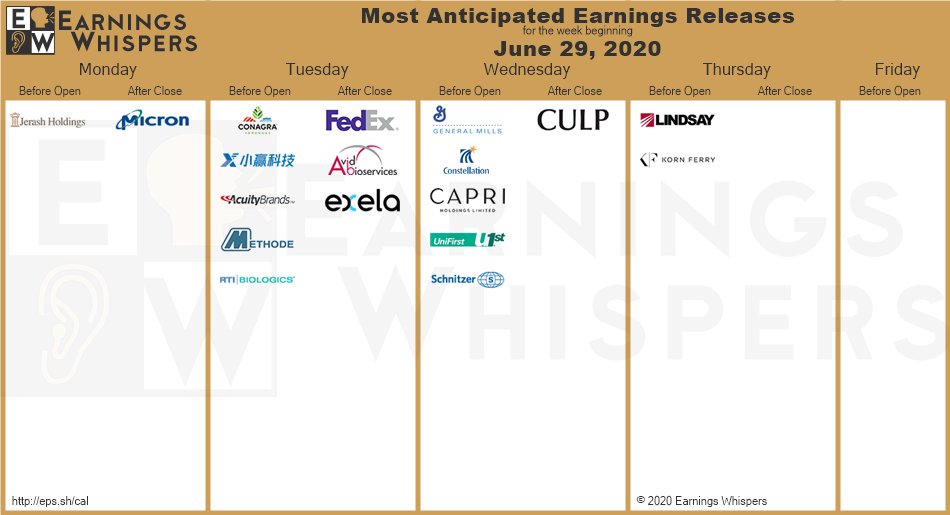

Earnings:

DXY daily: another indecision candle. Watch for any new breakout:

Trend line breakouts:

USD/JPY 4hr: this TL b/o is now at 70 pips so watch 108 for any new make or break. Recall that last week’s Descending Wedge here was a great clue about this move!

Other Markets:

S&P500 4hr: closed the month above 3,000 which is rather encouraging so watch for any new trend line breakout:

ASX-200 4hr: closed the month below 6,000 BUT watch for any new trend line breakout:

Gold 4hr: closed the month below $1,800 so watch this level for any new trend line breakout:

EUR/USD 4hr: watch for any new trend line breakout:

AUD/USD: this closed right at the monthly chart’s multi-year bear trend line.

AUD/USD 4hr: closed the month at 0.69 so watch for any new trend line breakout:

AUD/USD monthly: watch this major bear TL for any new make or break:

AUD/JPY 4hr: looking bullish:

NZD/USD 4hr: watch for any new trend line breakout:

GBP/USD 4hr: watch for any new Descending Wedge trend line breakout: