I’d mentioned last week that the FX Indices were aligned for LONG US$ and SHORT EUR$ and what a good ‘heads up’ that ended up being for you all! That alignment remains in place BUT the US$ is struggling a bit at resistance AND momentum remains low so watch for any shift here. As always, momentum-based breakouts remain the best clue for gauging directional movement.

DXY

DXY weekly: Note the revised lower weekly triangle trend line. The index will close with a bullish weekly candle BUT note how 99 S/R and the upper trend line are pegging price action for the time being. Momentum continues to decline and converge so watch this region for any momentum-based make or break:

DXY daily: a bearish-reversal style candle for Friday:

DXY 4hr: any pause or pullback would bring the 4hr chart’s 61.8% fib into focus and this is near 98 S/R:

EURX

EURX weekly: this will close with a large bearish weekly candle and bearish momentum is on the rise. However, the ADX remains below 20 but watch for any move above the threshold.

EURX daily: a bullish-reversal Inverted Hammer looks likely for Friday’s candle so watch for any pause or pullback here:

EURX 4hr: any pause or pullback would bring the 110 level back into focus:

FX Index Alignment: The FX Indices are still aligned for classic risk-off for the currencies BUT watch for any shift:

- EURX: is below the 4hr Cloud and below the daily Cloud so aligned for weak EUR$ price action.

- USDX: is above the 4hr Cloud and above the daily Cloud so aligned for strong US$ price action.

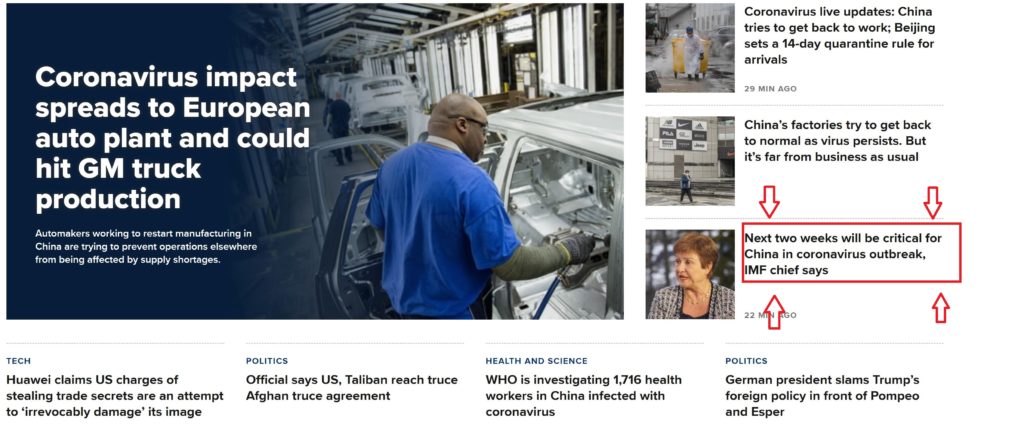

Calendar: I mentioned last week that the next few weeks will be critical for the West to understand the full extent of Coronavirus impact. With doubt about the data metrics coming out of China, markets will be wanting to see the impact of the virus in countries outside of China. It seems the IMF agrees: