The US$ enjoyed some Flight to Safety flows this week and has ended with a bullish weekly candle. The Covid-19 situation is still expanding in the US and Apple have flagged the closure again of some US stores. Major resistance from 98 lies just above for the DXY and will be the level to monitor in coming sessions. There are reversal patterns on the FX Index weekly charts suggesting more gains for the USDX versus the EURX BUT it is not all that cut and dried though with two different bullish patterns appearing on the lower time frame EURX charts! As always, keep an open mind and trade what you see and not what you think!

USDX

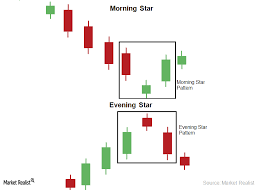

USDX weekly: a bullish weekly candle and note the formation of a bullish-reversal Morning Star style pattern. Any worsening of the US Covid-19 situation would be expected to underpin the US$:

USDX daily: watch the triangle trend lines and 98 for any new breakout:

USDX 4hr: back above the 4hr Cloud:

EURX

EURX weekly: a bearish weekly candle and note the look of a bearish-reversal Evening Star pattern:

EURX daily: However, there is the look of a bullish-reversal Cup’n’Handle pattern here so keep an open mind!

EURX 4hr: back in the 4hr Cloud BUT note the Bull Flag style pattern SO more reasons to keep an open mind:

FX Index Alignment:

- EURX: is in the 4hr Cloud but above the daily Cloud so not aligned and prone for potential choppy EUR$ price action.

- USDX: is above the 4hr Cloud but below the daily Cloud so currently not aligned and prone for potential choppy USD$ price action.

Calendar: Just one Central Bank update from the RBNZ but keep monitoring Covid-19 updates.