Last week: It was a bit quieter last week for trend line breakouts, following all of the recent volatility, and whether this was due to the wait for Friday’s NFP or due to the looming Easter break is not clear. This led to a vast number of indecision-style weekly candles being printed across many stock indices, Gold and nearly all of the Forex pairs that I review! The Christian concept of Easter is one built on faith and so it is rather appropriate that this coming Easter week is also one shaped by questions of faith around current stock market levels. A couple of such questions were considered by our on-line ATAA trading group yesterday and included questions about whether there was faith that an 11-year trend line would support the S&P500 and whether the 61.8% Fibonacci level of the 2009-2020 swing High would support the ASX-200. Traders need to be be prepared for another potential week of quiet and / or low liquidity due to the holiday period starting later this week.

Technical Analysis: As noted over recent weeks, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions. Coronavirus continues to be the dominant market theme and this can be seen from CNBC’s Saturday front page where all but one headline was related to the topic:

Trend line breakouts and TC signals: It was a rather quiet week with just a few breakout moves of any note. Articles published during the week can be found here, here, here and here:

- Gold: a TL b/o move for $35.

- Oil: a TL b/o move for $7.50.

- GBP/USD: a TL b/o move for 120 pips on Friday:

GBP/USD 4hr: chart from Thursday:

GBP/USD 4hr: chart after 120 pip b/o:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bullish-coloured Indecision-style Inside weekly candle:

DXY weekly:

-

- US Unemployment and NFP: there was a huge jump in US Weekly Unemployment Claims and the number of US Jobs Lost last week. The Weekly Unemployment Claims dwarfed those from the GFC but the Jobs Lost was nearly on par for that era as the two graphs below reveal. Watch for potential impact on market sentiment with any advance of these losses. The graphs below were sourced from tradingeconomics.com but labels edits are mine:

US Initial Jobless Claims: note the large spike at the right hand side of the graph.

US Non-Farm Payrolls: note the current Covid-19 spike is near that from the GFC:

-

- Great Depression on the Way?: There has been a bit of chatter about the current Covid-19 market impact, how this compares to other market pullbacks and whether a Great Depression might be on the way. I noticed this video commentary from Ryan Detrick during the week and think it is worth watching. Ryan offer four reasons why he doesn’t think we are on a path to a 1930s style Great Depression. He notes four erroneous decisions that were made back then and that likely won’t be repeated. These include:

-

-

- Monetary Policy: The Federal Reserve tightened monetary policy after the 1929 market crash.

- Fiscal Policy: The Government increased taxes on corporations and individuals AND cut spending by 25%.

- The Government increased regulation that hindered Small Business.

- There was a Global Trade War; far worse than the current US-China trade war.

-

-

- New Member-Only pages: Please remember to check out these new member-only pages to help with trying to catch trend line breakout trades off lower time frame charts. These two pages are linked below:

-

- Indecision weekly candles: there were lots of these printed last week:

- Spinning Top candles were printed on the S&P500, NASDAQ, DJIA (this was an Inside candle too) and Gold.

- Inside candles were printed on the DXY, EURX, Russell-2000, EUR/USD, AUD/USD, NZD/USD, GBP/USD, AUD/JPY, USD/JPY and GBP/JPY.

- Doji candles were printed on the DAX and TLT.

- Indecision weekly candles: there were lots of these printed last week:

-

- Bullish-reversal Morning Star patterns: have formed on the ASX-200 and Crude Oil.

-

- Gold: the weekly chart’s 61.8% Fibonacci level, near $1,600, has been in focus over recent months but there is a new chart phenomenon that emerged for me this week. All explained in the Market Review section below.

-

- S&P500: Keep the bigger picture in perspective with this pullback:

S&P500 yearly: keep this latest move lower in perspective:

-

- DJIA weekly: The DJIA closed with a bearish-coloured Spinning Top and Inside weekly candle but still above the 2009-2020 support trend line. The Index tested to down near the 50% Fibonacci of this swing High move BUT watch for any test of the 61.8% level.

DJIA weekly:

-

- NASDAQ composite: closed with a bearish-coloured Spinning Top weekly candle reflecting indecision. Note that the 2009-2020 trend line is still intact and that price has only retreated to about the 38.2% of this swing High move:

NASDAQ weekly:

-

- DAX weekly: The DAX closed with a bullish-coloured Doji weekly candle reflecting indecision. Note how price tested down below the 50% Fib of the 2009-2020 swing High move but has pulled back to recently broken 11-year trend line:

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks. The Index is still trading below the longer-term 2009-2020 support trend line and printed a bearish-coloured Inside weekly candle reflecting indecision. Price continues to hold near the 50% but watch for any push to the key 880 level, near the 61.8% fib, if weakness continues.

RUT weekly:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bullish-coloured Doji weekly candle reflecting indecision. Note the pullback being suggested by the Elliott Wave indicator:

TLT weekly:

-

- VIX: the Fear index closed with a large, bearish weekly candle.

VIX weekly: note how the Elliott Wave tool on my software is suggesting a pullback here too!

Calendar: Courtesy of Forex Factory: Note that Friday is Good Friday and a holiday in many countries.

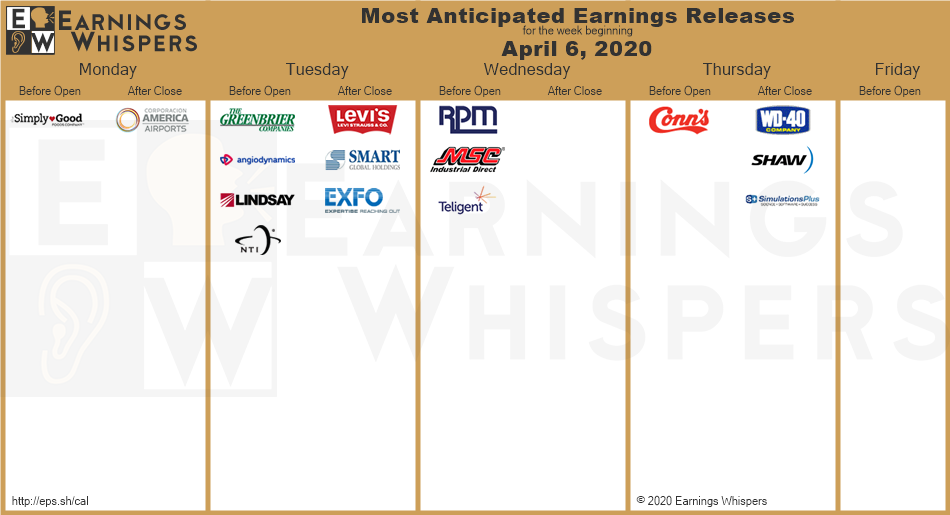

Earnings: Courtesy of Earnings Whispers: another quiet week:

Market Analysis:

S&P500: SPX: The S&P500 closed with a bearish-coloured Spinning Top candle reflecting indecision and price action closed for the week right on top of the recently broken 2009-2020 support trend line.

However, there is still a recently formed consolidation pattern in play on both the daily and 4hr charts leading to two differing interpretations:

- Bullish: any breakout to the upside above 2,650 would support a broader-styled V-shaped recovery. This seems unlikely but that is what the chart would then reflect.

- Bearish: These trend lines could also be viewed as shaping up in a Bear Flag so keep an open mind for any breakout: up or down! The Flag pole here predicts the index falling to down near 1,300 so let’s hope this pattern fails! However, the impact from the economic fallout due to Covid-19 is still uncertain but could take an enormous toll if the situation continues to worsen.

As mentioned over recent weeks: I am still watching for any pullback to the 61.8% Fibonacci of this 2009-2020 swing High move and this level is down near 1,700 / 1,600. This is a region of some confluence as it is the previous upper level from the 2013 channel breakout; a region noted on the yearly and monthly charts. The 61.8% Fibonacci zone was also tested in the 1987 and GFC market pullbacks, as described in this post. For the moment though, the index has only pulled back to around 45% of this 2009-2020 swing High move so keep this move in perspective as technical theory would suggest the uptrend is intact until the 61.8% fib is broken!

Bullish targets: any bullish 4hr chart Flag breakout above 2,650 would bring 3,000 into focus as this is near the 4hr chart’s 61.8% fib. Note the Gap Fill level on the daily chart as well and this is near 2,900 so may be a target as well.

Bearish targets: any bearish 4hr chart Flag breakout would bring the recent Low, near 2,200 into focus followed by whole-numbers on the way down to 1,700 / 1,600 S/R.

- Watch for any 4hr chart Flag breakout:

ASX-200: XJO: The ASX-200 chopped sideways to higher last week and managed to carve out a bullish weekly candle. There are two things to note with this price action:

- The bullish weekly candle helped to shape up a three-candle bullish-reversal Morning Star pattern.

- The weekly 61.8% fib of the 2009-2020 swing High has held as support thus far; as warned about numerous times and in this article.

The 4hr and daily charts still show a channel around recent price action and this could be a possible Bear Flag but some could also see an Inverse H&S pattern here, so, watch trend lines for clues as to which evolves. I still struggle to see a bullish-recovery evolving at this early stage of Covid-19 in Australia but the health outcomes are looking increasingly positive and so I am keeping an open mind.

The chart patterns on the 4hr and daily chart this week and are rather similar to last week and so the analysis remains the same. That is, being viewed in either of two ways:

- Bullish: any breakout to the upside from the channel pattern would support a V-shaped recovery and would endorse the bullish-reversal Inverse H&S pattern. This seems unlikely but that is what the chart would reflect.

- Bearish: these trend lines are also shaping up in a Bear Flag so keep an open mind for any breakout: up or down! The Flag pole here is large and would predict the index falling to down near 2,000 so let’s hope this pattern fails! However, the impact from the economic fallout due to Covid-19 is still uncertain but could take an enormous toll if the situation continues out to the end of the year.

Bullish targets: Any bullish 4hr chart Channel breakout would bring the 4hr chart’s 61.8% fib level, near 6,125, into focus.

Bearish targets: Any bearish 4hr chart Channel breakout would bring the recent Low, near 4,400, into focus followed by 4,000 and, after that, the GFC Low near 3,120.

- Watch for any 4hr chart Channel breakout:

Gold: Gold closed with a bullish-coloured Spinning Top / Doji style weekly candle with both reflecting indecision.

Price action on the 4hr chart looks to be making a new bullish breakout so watch for any continuation.

Weekly chart: The weekly chart is starting to take on a new chart pattern for me. That of a broad Inverse H&S pattern or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around $700 so it is a longer-term pattern worth monitoring. The upper breakout region for this pattern is $1,800 which is still a way off yet.

Bullish targets: any continued bullish 4hr triangle breakout would bring $1,650 S/R into focus followed by the recent High, near $1,700.

Bearish targets: any bearish retreat from current levels would bring $1,600, and, then, $1,550 into focus as the latter is near the 4hr chart’s 50% Fibonacci level.

- Watch for any continued 4hr chart trend line breakout:

Oil: Oil closed with a large bullish, essentially Engulfing, weekly candle on the back of news about China’s interest to purchase and potential production cuts.

Price action shaped up into a bullish-reversal descending wedge last Tuesday, a fact that I Tweeted about as well, and there was a bullish breakout from this wedge on Friday for up to $7.50. The target for this wedge breakout is up near $41 / 41.50 so this is a work in progress:

Oil 4hr: chart from Tuesday before the wedge b/o:

Oil 4hr: chart following the wedge b/o:

The other point worth noting about the Oil charts this week is the print of a bullish-reversal Morning Star on the weekly chart; adding further support to this bullish activity seen on the 4hr chart.

Bullish targets: any continued bullish 4hr wedge breakout would bring $30 S/R into focus followed by the $41 / $41.50 region as the latter represents a Gap Fill from a previous weekly close and is near the 61.8% fib of the recent swing Low move.

Bearish targets: any bearish retreat from current levels would bring $25 back into focus.

- Watch for any continued 4hr Descending Wedge breakout:

EUR/USD: The EUR/USD closed with a bearish-coloured Inside weekly candle suggesting indecision.

Price action retreated back to a 20-yr support trend line so watch this, and the new 4hr chart bear trend line above, for any momentum-based breakout.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 1.10 back into focus as this is near the 4hr chart’s 61.8% fib. After that, watch the 1.11 level, near the daily 200 EMA.

Bearish targets: Any bearish break of the 20-year support trend line would bring the recent Low, near 1.065, into focus.

- Watch for any new trend line breakout:

AUD/USD: The Aussie closed with a small, bearish-coloured, almost Inside, weekly candle suggesting indecision.

Price action chopped sideways and lower generating a Flag pattern giving traders trend lines to watch for any new breakout. The Aussie closed the week just below 0.60 making this the S/R level to watch for any new make or break.

Bullish targets: Any bullish Flag breakout would bring 0.61, 0.62 and 0.625 S/R back into focus.

Bearish targets: Any bearish Flag breakout would bring 0.58 S/R into focus followed by 0.55 S/R.

- Watch 0.60 and for any 4hr chart Flag trend line breakout:

AUD/JPY: The AUD/JPY closed with a small, bearish-coloured, almost Inside, weekly candle suggesting further indecision.

Price action chopped around last week, again primarily under the 67 whole-number S/R level, but only managed to hold out the week above 65 S/R making this the level to watch for any new make or break.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 70 S/R into focus, as this would complete a Gap Fill, followed by 71 and 72 S/R.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 60 S/R back into focus.

- Watch 65 S/R and for any 4hr chart triangle breakout:

NZD/USD: The Kiwi closed with a bearish-coloured, essentially Inside, weekly candle suggesting indecision.

Price action drifted a bit lower leading to revised trend lines to watch for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 0.60 followed 0.625 into focus as the latter is near the previously broken 20-yr trend line.

Bearish targets: Any bearish triangle breakout would bring 0.57 S/R back into focus followed by 0.55.

- Watch for any 4hr chart triangle breakout:

GBP/USD: The GBP/USD closed with a small, bearish-coloured, almost Inside, weekly candle suggesting indecision.

Price action chopped sideways for much of the week in a range boarded by 1.25 above and 1.22 below making this the main region to watch for any new breakout.

Bullish targets: Any bullish 4hr chart channel breakout above 1.25 would bring whole-numbers on the way to 1.32 into focus.

Bearish targets: Any bearish 4hr chart channel breakout would bring 1.20 S/R back into focus and, after that, the 2016 Low, near 1.145.

- Watch for any 4hr chart channel breakout:

USD/JPY: The USD/JPY closed with a small, bullish-coloured, essentially Inside, weekly candle suggesting indecision.

Price action chopped sideways for much of the week in a range boarded by 108.5 above and 107 below making this the main region to watch for any new breakout. Although, there is a larger 4hr triangle in play as well giving other trend lines to monitor for any momentum-based breakout.

Bullish targets: Any bullish 4hr triangle breakout would bring 109 and, then, whole-numbers on the way to 112 into focus.

Bearish targets: Any bearish triangle breakout would bring 107 and, then, 105 S/R back into focus as the latter is near the 4hr chart’s 61.8% Fibonacci and the monthly 200 EMA.

- Watch for any triangle breakout:

GBP/JPY: The GBP/JPY closed with a small, bearish-coloured, almost Inside, weekly candle suggesting indecision.

Like with the cable, price action chopped sideways for much of the week in a range boarded by 135 above and 132.50 below making this the main region to watch for any new breakout.

Bullish targets: Any bullish 4hr chart channel breakout above 135 would bring whole-numbers on the way to 140 and 150 into focus.

Bearish targets: Any bearish 4hr chart channel breakout below 132.50 would bring 130 S/R back into focus and, after that, the key 125 level.

- Watch for any 4hr chart channel breakout: