The US$ edged lower after US CPI came in better than expected. This may seem counter intuitive, from a fundamental perspective, but it fits in rather neatly with the current technical landscape: there is considerable resistance ahead for the US$ and there was the look of a bullish-reversal descending wedge on the EUR/USD. This US$ weakness helped to develop the EUR/USD wedge and, also, trigger a breakout on Gold.

PayPal: I am still having issues with PayPal so will keep posts as open-access until these matters are sorted. Please just access the website directly, without trying to login to the member area, to avoid any issues.

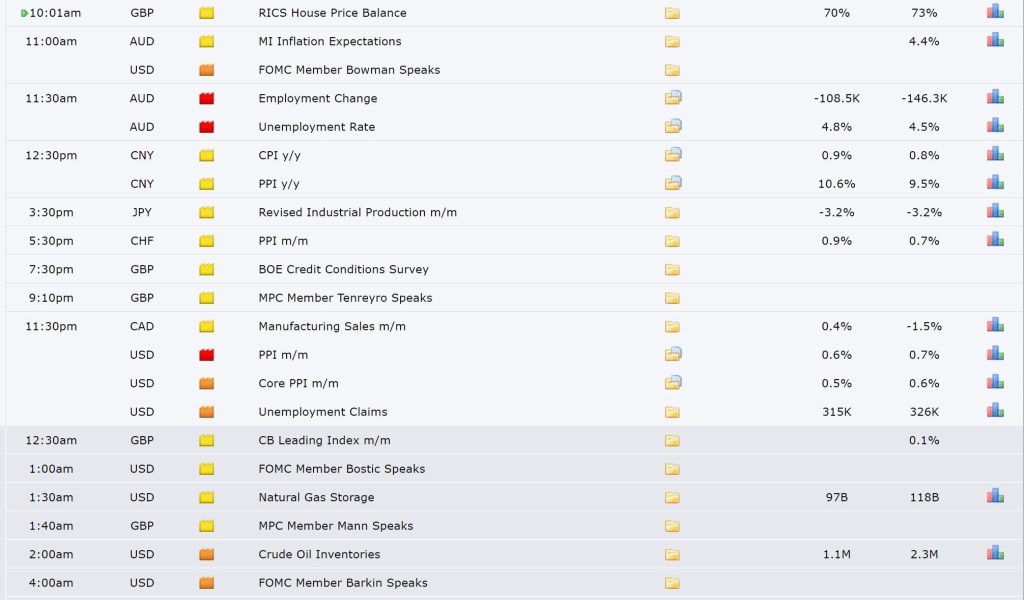

Data: Watch for any impact from AUD Employment data:

DXY weekly: lower after CPI so watch today’s US PPI and keep in mind that there is considerable technical resistance ahead:

Trend line breakouts:

EUR/USD: this wedge has evolved following the recent US$ weakness.

EUR/USD 4hr: chart prior to CPI:

EUR/USD 4hr: chart today with a TL b/o for 35 pips:

Gold: this triangle b/o evolved following the recent US$ weakness.

Gold 4hr: chart prior to CPI:

Gold 4hr: chart after CPI for a $25 TL b/o:

AUD/JPY 4hr: this TL b/o has stalled at 140 pips BUT watch 84 for any new make or break:

USD/JPY 4hr: this TL b/o has stalled at 140 pips BUT watch 114 for any new make or break:

GBP/JPY 4hr: this TL b/o has stalled at 190 pips BUT watch 155 for any new make or break:

Other markets:

ASX-200 4hr: watch 7,300 for any new make or break AND monitor for any impact from AUD Employment data

S&P500 4hr: still drifting on low momentum:

AUD/USD 4hr: a bit higher, albeit very choppy, but watch 0.74 for any new make or break AND monitor for any impact from AUD Employment data:

NZD/USD 4hr: also a bit higher, albeit very choppy, but watch 0.70 for any new make or break:

GBP/USD 4hr: a bit higher here too, albeit very choppy, but watch 1.37 for any new make or break: