The high print for US CPI has driven the US$ up and US stocks down. There were sharp moves across Forex pairs but watch key S/R levels once this dust settles.

NB: there won’t be any update on Friday of this week.

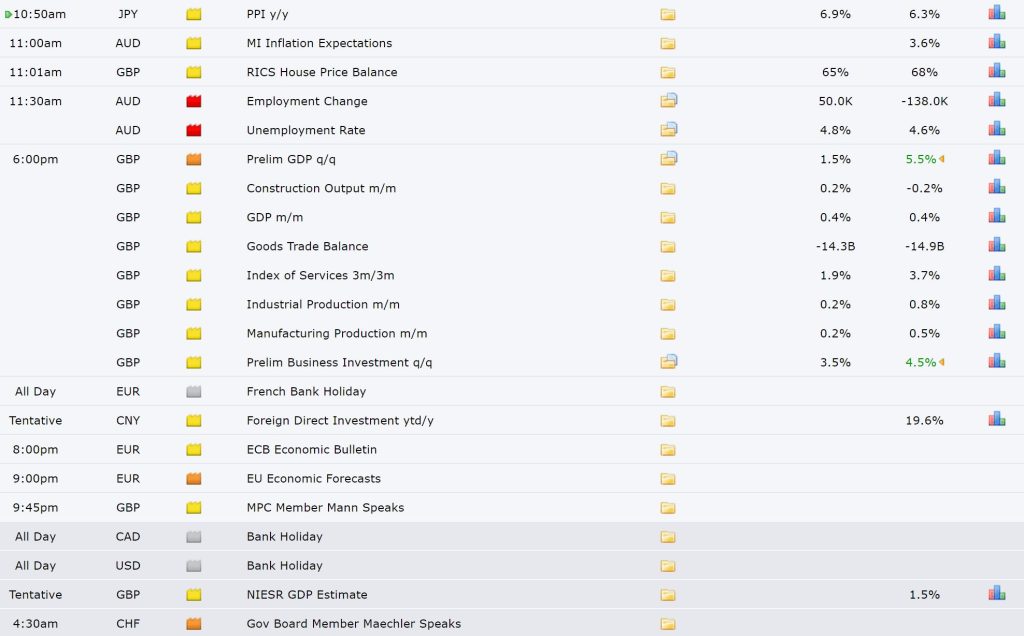

Data: watch today with AUD Employment data:

DXY daily: higher after CPI so watch 95 for any new make or break:

Trend line breakouts: there have been a few after CPI but these are the main ones of note.

EUR/USD: sharply lower.

EUR/USD 4hr: watch the bottom trend line for any new make or break:

EUR/USD 30 min: note the decent low risk range b/o that was on offer here:

GBP/USD: also sharply lower.

GBP/USD 4hr: watch the weekly 200 EMA for any new make or break:

GBP/USD 30 min: note the decent low risk range b/o that was on offer here as well:

Gold 4hr: watch $1,850 for any new make or break:

S&P500 4hr: lower after CPI BUT watch 4,650 for any new make or break:

ASX-200 4hr: lower BUT watch 7,400 for any new make or break; especially with today’s with AUD Employment data:

Other markets:

AUD/USD 4hr: lower after CPI BUT watch 0.73 for any new make or break; especially with today’s with AUD Employment data:

AUD/JPY 4hr: watch trend lines for any new b/o; especially with today’s with AUD Employment data:

NZD/USD 4hr: lower after CPI BUT watch 0.70 for any new make or break:

USD/JPY 4hr: higher after CPI BUT watch 114 for any new make or break:

GBP/JPY 4hr: watch 153 for any new make or break: