US CPI was softer than expected and this resulted in a risk-off shift into the US$ and Yen and out of stocks. The Kiwi continues to hold up relatively well though which I think is worth keeping in mind. Market top periods of ‘Distribution’ are renown for being choppy so I do wonder if this is what we are witnessing?

Data:

DXY weekly: still range bound for the time being:

CSI 4hr: note the move higher for the Yen and lower for the AUD:

Trend line breakout:

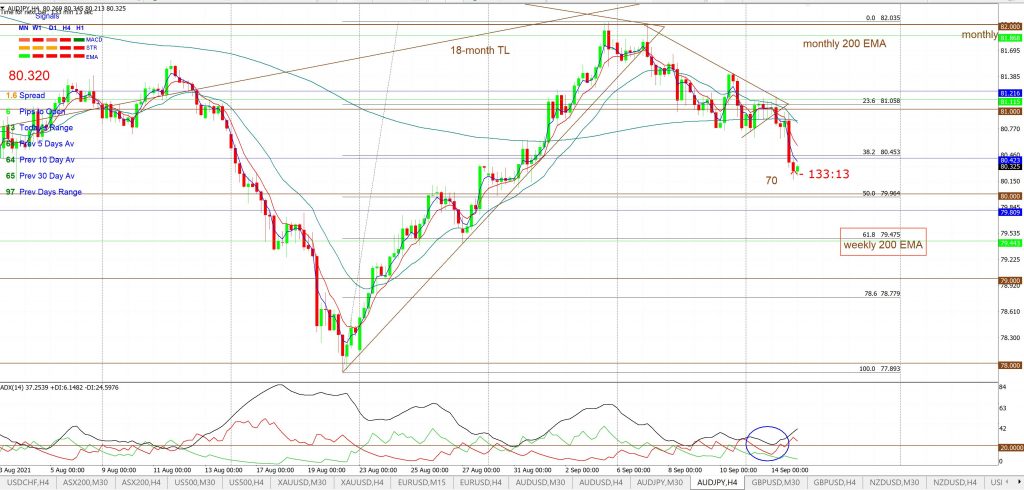

AUD/JPY: moving in sync with the S&P500 today.

A/J 4hr: a TL b/o for up to 70 pips:

A/J 30 min: a decent range b/o opportunity was on offer here:

Gold 4hr: also higher despite the stronger US$:

S&P500 4hr: lower but choppy. Watch the 4,450 level:

Other markets:

ASX-200 4hr: watch for any new TL b/o:

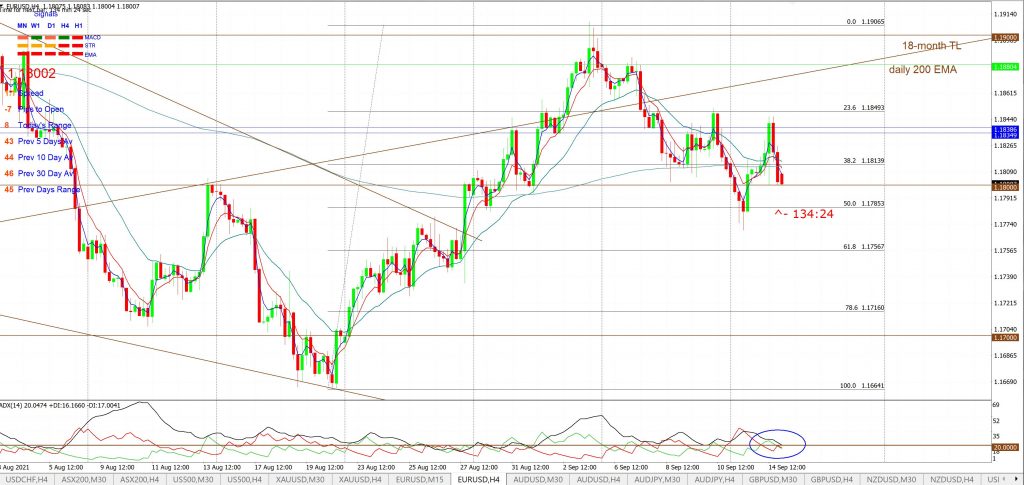

EUR/USD 4hr: watch the 1.18 level:

AUD/USD 4hr: watch the 0.73 level:

NZD/USD 4hr: holding up relatively well, all things considered, BUT watch the 0.70 level:

GBP/USD 4hr: watch the 1.38 level; especially with today’s GBP CPI data:

USD/JPY 4hr: rather messy and not seeing much on which to anchor a lookout value:

GBP/JPY 4hr: watch the 151 level; especially with today’s GBP CPI data: