Last week: The British Prime Minister, Harold Wilson, in the 1960s once claimed that ‘a week was a long time in politics’ and how true that was last week! The week started with US$ weakness, helping to support some great trend line breakouts, but was then followed by the choppiness and uncertainty stemming from the disastrous first US Presidential debate and the Covid-19 diagnosis for the US President, the First Lady and many White House officials. Despite this developing chaos, there has been little flight to safety movement into the US$, Bonds, Gold or the Yen; that may still come but it isn’t a defining feature just yet. There were many indecision-style weekly candles printed again last week which is hardly surprising. This week brings the US Vice President’s Debate into focus as well as the health status of the US President, First Lady and associates. As noted over recent weeks, October is historically weak for stock markets so I do wonder if this choppy price action might drift on until the November 3rd US Presidential Election?

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts summary: US$ weakness triggered some great trend-line breakout trade opportunities last week. Articles published during the week can be found here, here, here, and here:

- S&P500: a TL b/o from for 50 points.

- AUD/USD: a TL b/o from for 150 pips. Note how the 61.8% fib target worked a treat here again!

- AUD/JPY: a TL b/o from for 130 pips:

- NZD/USD: a TL b/o for 100 pips:

- GBP/USD: a TL b/o for 130 pips.

- GBP/JPY: a TL b/o for 150 pips.

- ASX-200: a TL b/o from for 80 points.

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The index closed with a bearish-coloured Inside weekly candle reflecting indecision. I have to admit, I was rather surprised to find the index close this low BUT price action struggled within the resistance of the daily Ichimoku Cloud all week. I had thought there might be some decent flight to safety shift given the situation with the US President but this has not evolved as yet:

DXY weekly: watch for any new trend line breakout:

-

- Schedule for weekend Market Update posts: The Weekly Market update has, to date, been posted on a Sunday, Australian time. I am looking to delay the release of this update to a Monday, Australian time, which is still a Sunday in many other parts of the world. My analysis takes a full day to complete and I am attempting to shift this load away from my weekend time.

-

- Indecision-style weekly candles: indecision-style weekly candles were printed on many instruments again last week: the DXY, EURX, S&P500, NASDAQ, DAX, Emerging Markets EEM, Gold, Copper, VIX, EUR/USD, AUD/USD, AUD/JPY, NZD/USD, GBP/USD, USD/JPY and USD/CAD.

-

- Risk events: As noted above, the main risk events this week include updates about the health of the US President, the debate between the US Vice Presidents and the US stimulus debate.

-

- Multi-year trend lines: As noted recently and the caution remains valid: multi-year trend lines have been tested / broken on a number of instruments: The FX Indices (DXY and EURX) and the EUR/USD, AUD/USD, NZD/USD, AUD/JPY, GBP/USD and GBP/JPY. Caution is still required here though as trend lines of such duration are often not given up easily so traders should watch for any potential choppiness / consolidation as these levels are negotiated. Many of these levels are still back being tested.

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 has pulled back from its latest all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed with a bearish-coloured Long Legged Doji weekly candle, reflecting indecision, and still below the 3 level. However, price action continues holding above the 10-year bear trend line for the time being:

Copper weekly: still below the 3 level;

-

- Emerging Markets: The Emerging market ETF, EEM, has closed with a bullish-coloured Spinning Top weekly candle, reflecting indecision, BUT there is still the look of a potential Bull Flag:

EEM weekly: still below the 45 level BUT watch for any Bull Flag activity:

-

- DJIA: The DJIA closed with a bullish weekly candle supporting the potential weekly Bull Flag. Watch for any continuation here:

DJIA weekly: watch for any continued Bull Flag:

-

- NASDAQ composite: The NASDAQ Composite Index gapped higher to start the week but ended up closing with a bearish-coloured Doji weekly candle reflecting indecision. Any break below 10,000 would suggest, to me at least, that there could be more bearish activity and I’d then be looking down to the weekly 61.8% Fibonacci, near 8,800. Remember that technical theory would suggest that the 61.8% Fib level could be tested as part of the zig and zag of any overall bullish continuation move.

NASDAQ weekly: watch for any potential Bull Flag activity:

-

- DAX weekly: The DAX closed with a bullish-coloured Inside weekly candle, reflecting indecision.

DAX weekly:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and closed with a bullish weekly candle and still within a potential Bull Flag. The horizontal 1,460 level remains as one ‘line in the sand’ level to monitor:

RUT weekly: watch 1,460 and for any Bull Flag:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bearish weekly candle with no ‘flight to safety‘ activity here just yet. The Elliott Wave indicator is still suggesting an uptrend from here and any renewed sell-off with stocks would likely underpin this Bond ETF:

TLT weekly: really just chopping sideways with no momentum:

-

- VIX: the Fear index closed, again somewhat surprisingly, with a bullish-coloured Spinning Top weekly candle, reflecting indecision, and remains below the key 30 level. I am surprised that it didn’t close higher given the uncertainty surrounding the US President’s health. Any sell off with stocks would likely help to underpin the index:

VIX weekly: watch the 30 level for any new make or break:

Calendar: Courtesy of Forex Factory: Note there is also the US Vice Presidential debate on Wednesday Oct 7th.

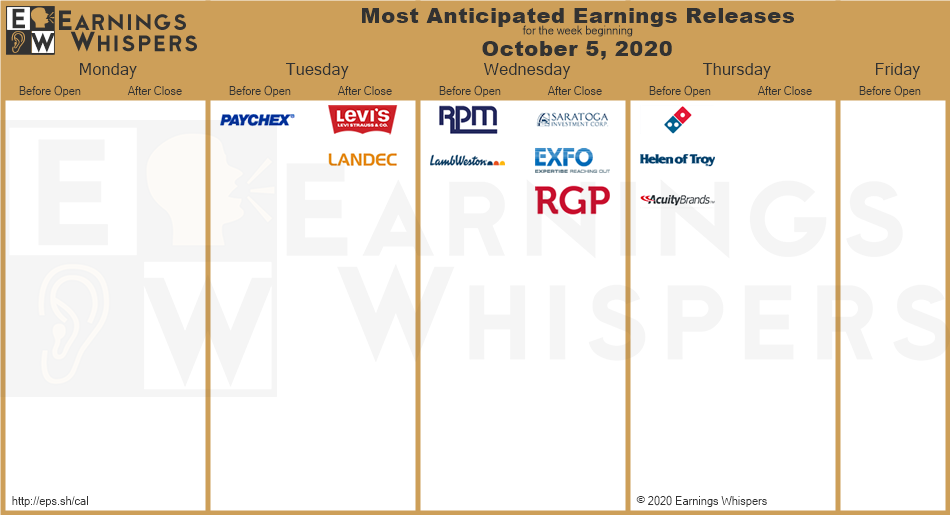

Earnings: Courtesy of Earnings Whispers: very little this week:

Market Analysis:

S&P500: The S&P500 index closed with a bullish-coloured Spinning Top weekly candle, reflecting indecision, but continues to set up within a potential weekly chart Bull Flag. Trading volume remains below the 200 SMA so watch for any volume spike to help confirm a Flag trend line breakout; either up or down:

S&P500 ETF: SPY weekly: Watch for any spike with Volume that might help confirm a Bull Flag b/o:

Price action on the S&P500 is consolidating in a triangle on the 4hr chart so watch these revised trend lines for any new breakout.

As noted recently: The weekly S&P500 chart below shows that the 61.8% Fibonacci level of this recent swing-High move (March 2020- September 2020) is down near the 2,700 region. Technical analysts would suggest that a pullback to this 61.8% level would be in order; even if there is to be ultimate bullish continuation. Trends do not travel in straight lines unabated so traders should be aware of this zig-zag potential.

Bullish targets: any bullish 4hr chart trend line breakout would bring 3,400 & 3,500 S/R into focus.

Bearish targets: any bearish 4hr chart trend line breakout would bring the 3,300 level back into focus followed by whole number levels on the way down to the weekly chart’s 61.8% Fibonacci, near 2,700.

- Watch the 4hr chart’s triangle trend lines for any new breakout:

ASX-200: XJO: The ASX-200 closed with a bearish, almost ‘engulfing‘ weekly candle. Trading volume has not peaked though and remains just near the trend line and moving average for the time being.

XJO weekly: trading volume is just holding above the trend line and moving average for now:

Price action is still consolidating below the psychological 6,000 level, and currently just under 5,900 S/R, and note how the index continues to hold above the previously broken 11-yr support trend line (see daily and weekly charts). These two regions will be in focus in the coming week. There are also revised 4hr chart trend lines to monitor for any new momentum breakout.

Bullish targets: Any bullish 4hr chart trend line breakout above 5,900 will bring the upper 4hr chart trend line into focus. After that, watch for any push to the psychological 6,000. Any break above 6,000 would then bring the recent High, near 6,200, followed by whole number levels on the way back to the previous all time High, circa 7,200, into focus.

Bearish targets: Any bearish 4hr chart trend line breakout below 5,800 would bring the previously broken 11-yr trend line into focus.

- Watch 5,900 S/R and for any new 4hr chart trend line breakout:

Gold: Gold closed with a bullish-coloured Inside weekly candle reflecting indecision in the wake of last week’s events: the disturbing first US Presidential debate followed by the Covid-19 infection of the US President and First Lady as well as many other White House officials.

The metal scraped back above the key $1,900 level for the close on Friday but closed below this key S/R level with the monthly September candle. Note how the last three candles on the monthly chart have formed up into a bearish-reversal Evening Star style pattern.

The $1,900 remains in focus as this marks the region of the potential Inverse H&S or Cupping pattern; as described again below:

As mentioned over recent weeks: the weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is trading above this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any hold above $1,900 would support the Cup pattern thesis.

- Any new move move back below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming days / weeks especially as the US$ index hovers near the recently broken 10-year support trend line:

- any US$ move and hold back below this multi-year support trend line could help send Gold higher.

- any US$ hold back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

There is still the look of a potential Bull Flag on the daily chart but momentum is now declining on this time frame.

There are revised 4hr chart triangle trend lines to monitor for any new momentum breakout.

Bullish targets: any bullish 4hr chart triangle breakout would bring the daily chart’s upper Flag trend line into focus followed by $2,000.

Bearish targets: any bearish 4hr chart triangle breakout would bring the daily chart’s lower Flag trend line into focus followed by $1800.

- Watch for any new momentum-based 4hr chart triangle breakout:

EUR/USD: The EUR/USD closed with bullish-coloured Inside weekly candle reflecting indecision but continues to hold above the recently broken 13-year bear trend line making this the region to keep watch for any new significant make or break.

As mentioned last week: I have been warning for weeks that these major trend lines are not given up easily and so traders need to watch this region closely in coming sessions in case this trend line ends up forming support.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring the 1.18 and 1.19 into focus followed by whole-number levels on the way up to the previous weekly chart High, circa 1.26.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 13-year bear trend line into focus.

- Watch for any 4hr chart triangle breakout:

AUD/USD: The Aussie closed with a bullish-coloured Inside weekly candle reflecting indecision. The surprise here, though, is the look of a Bull Flag on the weekly chart! There are revised 4hr chart triangle trend lines to monitor for any new momentum-based Bull Flag breakout.

Keep in mind, though, that price action continues to hold above the recently broken upper trend line of the multi-year bullish-reversal Descending Wedge.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 0.72 into focus as this remains near the 4hr chart’s 61.8% fib, the 4hr chart’s 200 EMA and weekly 200 EMA. Any break and hold above 0.72 would bring 0.73 and 0.74 into focus.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 0.71, 0.70 and, then, the recently broken 9-11 year bear trend line into focus.

- Watch for any new 4hr chart trend line breakout:

AUD/JPY: Like with the AUD/USD, the AUD/JPY closed with a bullish-coloured Inside weekly candle reflecting indecision but is holding above 75 S/R for now. The surprise here, too, is the look of a Bull Flag on the weekly chart. There are revised 4hr chart triangle trend lines to monitor for any new momentum -based Bull Flag breakout.

Bullish targets: Any bullish 4hr chart trend line breakout would bring 76 S/R followed by the the 7-yr bear trend line into focus as the latter is still near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr chart trend line breakout below 75 would bring the recent Low, near 74, into focus followed by whole-numbers on the way down to 65 S/R.

- Watch for any new 4hr chart trend line breakout;

NZD/USD: Like the Aussie, the Kiwi closed with a bullish-coloured Inside weekly candle reflecting indecision but is holding above the recently broken 7-yr trend line for now.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr trend line breakout would bring 0.67 into focus as this is near the 4hr chart’s 61.8% fib level.

Bearish targets: Any bearish 4hr chart trend line breakout, below 0.66, would bring the 7-yr TL, into focus followed whole number levels on the way down to 0.625 S/R.

- Watch for any 4hr chart trend line breakout:

GBP/USD: The Cable closed with a bearish-coloured Spinning Top weekly candle reflecting ongoing indecision.

The weekly chart shows continued declining momentum so the 7-month support trend line has been adjusted.

There are revised 4hr chart trend lines so watch for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.30 and 1.31 into focus on the way to 1.32 as the latter remains near the 4hr chart’s 61.8% Fibonacci. After that, the recent High, near 1.35, would come back into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring the 7-month support trend line into focus followed by whole number levels on the way down to 1.22 as this is near the weekly chart’s 61.8% fib.

- Watch for any new 4hr chart triangle breakout:

USD/JPY: The USD/JPY closed with a bearish-coloured Spinning Top weekly candle reflecting indecision but managed to hold above the 105 level.

There are revised 4hr chart trend lines to monitor for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 106 into focus followed by whole-number levels on the way up to the recent High, near 112.

Bearish targets: Any bearish 4hr trend line breakout, below 105, would bring 104 into focus followed by whole-number levels on the way down to 100 S/R.

- Watch for any new 4hr chart triangle breakout:

GBP/JPY: The GBP/JPY closed with a bullish weekly candle following three bearish weeks. There are revised triangle trend lines on the 4hr chart to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle triangle would still bring whole-numbers on the way to 139 into focus as this is near the 4hr chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr triangle breakout, below 135, would bring whole-numbers on the way down to 130 S/R into focus.

- Watch for any 4hr chart triangle breakout:

USD/CAD: The USD/CAD closed with bearish-coloured Inside weekly candle reflecting indecision but is holding above the 1.327 S/R level, noted 2 weeks ago as potential S/R, for the time being.

The bullish breakout from the bullish-reversal Descending Wedge may still progress so watch the revised 4hr chart trend lines for any new breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.34 into focus on the way up to 1.40 as the latter is near the weekly chart’s 61.8% Fibonacci.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 1.327 followed by whole-number levels on the way back down to 1.30 into focus.

- Watch for any new 4hr chart trend line breakout: