Last week: It was a rather slow week for trend line breakout trades. This wasn’t too surprising given all the indecision-style weekly candles printed in the previous week and as traders patiently waited for news about a US stimulus package and post-Brexit trade negotiations to guide their trading. All four of the major US stock indices, the S&P500, NASDAQ, DJIA and Russell-2000, edged up to test new all-time High levels throughout the week and all but the DJIA closed at new weekly Highs. The DAX, Copper and Emerging Markets also performed well last week. This all seems hard to square with the sobering reality that there is now one US Covid-related death every 33 seconds and, hence, why I always urge traders to ‘trade what you see and not what you think‘. It is likely to be another quiet week for trading given that Christmas Day falls on Friday but keep an eye out for any developing news regarding US stimulus and Brexit trade talks as this might impact stocks and GBP currency pairs respectively.

Updates over Christmas and New Year: updates will be less frequent and, at times, less detailed during the holiday period.

Technical Analysis: As noted over recent months, it is important to keep in mind that this analysis is Technical and chart-based but that any major Fundamental news items, as recently seen with Coronavirus, have the potential to quickly undermine identified chart patterns. This is why it is critical that traders appropriately manage their trade exposure and risk per trade during these volatile market conditions.

Trend line breakouts summary: It was a rather slow week for trend line breakout trades with just two on offer. Articles published during the week can be found here, here, here, and here:

- Gold: a triangle TL b/o for $45. Note how the 61.8% Fibonacci target was reached here before price action eased:

- BTC/USD: a Bull Flag b/o for $4,500 from the chart pattern posted on December 11th:

This Week: (click on images to enlarge):

-

- DXY: US$ Index: The US$ index closed with a bearish weekly candle but as price action continues to consolidate within a bullish-reversal Descending Wedge. The next major horizontal support level is near the whole-number 88 so watch this region for any new make or break if the bottom wedge trend line fails.

DXY weekly: watch for any Descending Wedge mean-reversion activity:

-

- Schedule for weekend Market Update posts: The Weekly Market update has, to date, been posted on a Sunday, Australian time. I am looking to delay the release of this update to a Monday, Australian time, which is still a Sunday in many other parts of the world. My analysis takes a full day to complete and I am attempting to shift this load away from my weekend time.

-

- Stocks above their 200 Day Moving Average: The percentage of stocks above their 200 Day Moving Average remains above the 85% region and edging higher. The chart below gives a perspective of this current level and shows how there often tends to be some mean-reversion once such lofty levels are reached. Thus, it might be prudent to keep watch for any pause or pullback with US stocks given their recent bullish run:

% of US Stocks above the 200 Day Moving Average:

-

- Covid-related lock-downs and measures: news in this space keeps evolving so watch for further updates as this has the potential to impact market sentiment. New rules have been released for London / parts of England, Scotland, Germany, parts of Australia, Italy, Morocco and Sweden.

-

- S&P500: Keep the bigger picture in perspective with the recent moves:

S&P500 yearly: keep this latest move in perspective:

-

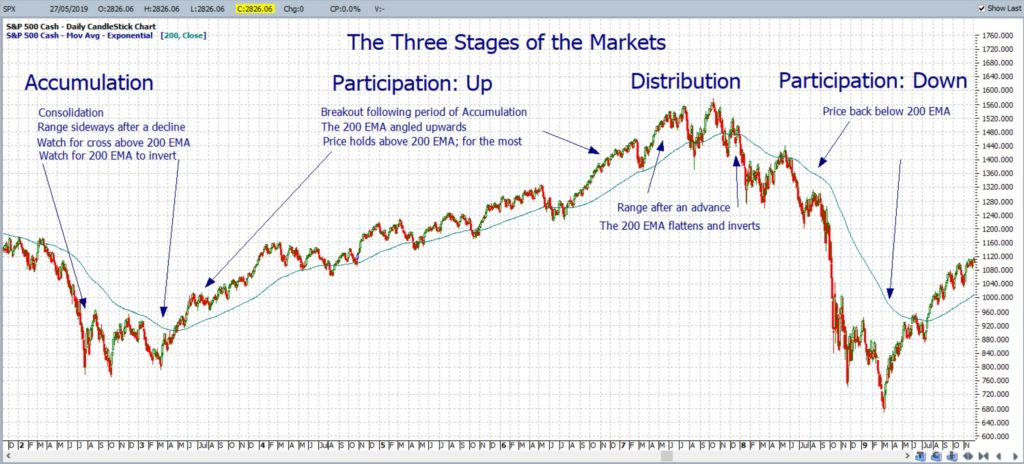

- Market Phases: It is important to recall the three main types of market phases: Accumulation, Participation (Up and Down) and Distribution. Traders should monitor the chart of the S&P500 chart for any Distribution type activity that might eventually lead to Participation Down; especially as the S&P500 trades up at an all-time High. The chart below shows how the S&P500 evolved in the years leading up to, and during, the Global Financial Crisis (GFC). Note how the Distribution phase evolved over a period of many months and there was a double test of the all-time High region. Keep this in mind with the current market action on the S&P500.

S&P500 market phases: Global Financial Crisis 2007-2009:

S&P500: keep watch for any Distribution type of activity:

-

- Copper: Copper is often viewed as one metric of economic health and closed with a bullish weekly candle and right on the weekly 61.8% Fibonacci. Watch this level for any new make or break and for any push to the whole-number 4 level:

Copper weekly: watch for any push past the weekly chart’s 61.8% Fib level, circa 3.6, up to the 4 level:

-

- Emerging Markets: The Emerging market ETF, EEM, closed with a bullish weekly candle so watch for any push to the previous High, near 52.

EEM weekly: watch for any push to the 52 level:

-

- DJIA: The DJIA closed with a bullish-coloured Spinning Top weekly candle after, yet again, printing a new all-time High during the week. Watch for any ascending triangle-style breakout move from this psychological 30,000 level.

DJIA weekly: holding above the psychological 30,000:

-

- NASDAQ composite: The NASDAQ Composite Index closed with a bullish weekly candle and at a new all-time High.

NASDAQ weekly: a new all-time High last week:

-

- DAX weekly: The DAX closed with a large, bullish weekly candle as it trades just under the all-time High. Watch for any ascending triangle-style breakout.

DAX weekly: a bullish weekly candle:

-

- Commodities: The Commodity ETF, DBC, has made a bullish breakout from the bullish-reversal Descending Wedge that I have been monitoring for some months. The ADX has still not broken above the threshold 20 level yet so watch this for any uptick and for any close above the $15 resistance level:

DBC weekly: a descending wedge b/o looks to have started:

-

- Russell-2000: The Russell-2000 is often viewed as the ‘Canary in the Coal Mine’ for US stocks and the index closed with a bullish weekly candle and at a new all-time High. Note how the 61.8% Fibonacci extension of the Covid-induced Swing Low is up near 2,200 and this would be one target for any continuation move.

RUT weekly: another new all-time High:

-

- Russell-2000 versus S&P500: The Russell-2000 small-caps index has been leading the charge against the S&P500 but note how this relationship is now near the 61.8% Fibonacci. Watch this region for any new make or break and for clues about how each index might keep moving:

-

- Bonds / TLT: The Bond ETF, TLT, closed with a bearish-coloured, almost Inside, weekly candle reflecting ongoing indecision. The Elliott Wave indicator is still suggesting an uptrend from here:

TLT weekly:

-

- VIX: the Fear index closed with a small, bearish-coloured weekly candle having a long upper shadow.

VIX weekly: watch the 30 level for any new make or break:

Calendar: Courtesy of Forex Factory: fairly quiet with Christmas this week:

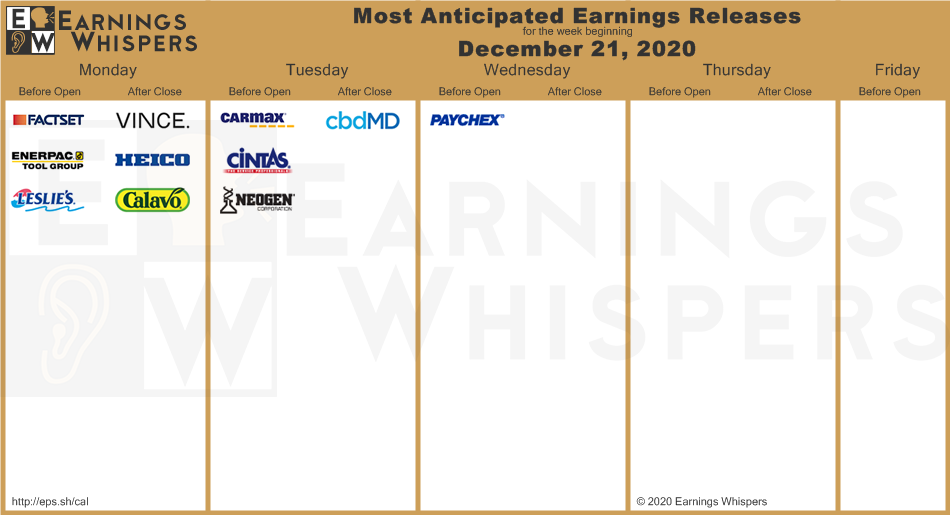

Earnings: Courtesy of Earnings Whispers: not much on for Christmas week:

Market Analysis:

S&P500: The S&P500 closed with a bullish-coloured Spinning Top weekly candle reflecting ongoing indecision as price tepidly carves out new territory and new all-time Highs.

Trading volume was a bit higher last week and popped above the bear trend line BUT remains below the 200 daily Moving Average so keep watch for any new breakout.

S&P500 ETF: SPY weekly: Watch for any Volume pop above the 200 Day Moving Average:

There are revised 4hr chart trend lines to monitor for any new breakout BUT note the declining momentum here. The mantra remains the same: watch for any momentum-based trend line breakout: up or down!

Note, also, on the weekly chart, how the 61.8% Fibonacci extension of the Covid-induced Swing Low is up near 4,150. This would be one target for any bullish continuation move.

Bullish targets: any bullish 4hr chart trend line hold above 3,700 would bring 3,800 into focus.

Bearish targets: any bearish 4hr chart support trend line trend line breakdown below 3,700 would bring 3,600 and whole-number levels on the way down to 3,200 into focus. The 3,400 level is still near the 4hr chart’s 61.8% Fibonacci so that would be a key level to monitor if weakness sets in at all.

- Watch 3,700 and for any 4hr chart trend line trend line breakout:

ASX-200: XJO: The ASX-200 closed with a bullish-coloured Spinning Top style weekly candle after, again, testing 6,700 during the week. There was a longer upper shadow to this weekly candle again reflecting some failed buying, but, there have now been 7-consecutive bullish coloured candles printed so that is rather supportive.

The index closed below 6,700 keeping this as the next major resistance zone to monitor.

As mentioned over recent weeks: The GFC High of 6,851.50 and 2020 High of 6,893.70 loom large and ahead of current price action and will also be the resistance levels to negotiate in coming sessions.

Trading volume was higher last week and peaked above the 200 Day Moving Average and the bear trend line so watch for any continuation:

XJO weekly: a bullish signal with a new trend line & MA breakout:

Keep in mind, too, that the recent Golden Cross remains valid. This is a bullish signal where the 50 SMA crosses above the 200 SMA. Such crosses are often, but not always, followed by a decent bullish run so these crosses are worth noting:

XJO daily: the recent Golden Cross remains valid:

There are revised trend lines on the 4hr chart to monitor for any new momentum breakout.

Traders need to be mindful of the developing Covid outbreak in New South Wales as this could impact market sentiment over coming sessions.

Bullish targets: Any bullish 4hr chart trend line breakout above 6,700 would bring 6,800 into focus followed by the GFC High of 6,851.50 and, then, the 2020 High of 6,893.70.

Bearish targets: Any bearish 4hr chart trend line breakout would bring 6,600 followed by whole-numbers on the way down to 6,000 into focus. Note how 6,200 is still near the daily chart’s 61.8% Fibonacci so that would be in focus as well.

- Watch 6,700 and for any 4hr chart trend line breakout:

Gold: Gold closed with a bullish weekly candle after reaching up to the 4hr chart’s 61.8% Fibonacci target and to just below the $1,900 S/R.

The $1,900 level remains in keen focus as it is the neck line of the multi-week bullish chart pattern that has been monitored here for some time.

As mentioned over recent weeks: the weekly chart still has the look of a broad Inverse H&S pattern; or some may see this as a broad Cupping style pattern. Both are rather similar though as they are bullish patterns and suggest follow-through to the order of magnitude of the depth of the Cup / height of Head. In this case, that move is of around either $800. Keep watch of $1,900 now that price action is back trading below this neckline region!

$1,900 remains the region in focus for any bullish Cup or Inverse H&S breakout:

- Any new move back above $1,900 would support the Cup pattern thesis.

- Any hold below $1,900 would support the Inverse H&S pattern thesis.

Traders need to watch this $1,900 level over the coming days / weeks especially as the US$ index is still below the recently broken 10-year support trend line:

- any US$ hold below the multi-year support trend line could help send Gold higher.

- any US$ move back above this support trend line could keep Gold range-bound. This would help to further develop the Inverse H&S pattern.

There are revised 4hr chart Bull Flag style trend lines to monitor for any new breakout as price hovers below $1,900.

The expanded view of the weekly chart below still shows a possible Bull Flag on this longer time frame as well.

Bullish targets: any bullish 4hr chart Flag breakout would bring $1,900 back into focus followed by the weekly chart’s upper Flag trend line.

Bearish targets: any bearish 4hr chart Flag breakout would bring a support trend line followed by $1,850 into focus and, then, $1,800 and the recent Low, near $1,770.

- Watch for any new 4hr chart Flag trend line breakout:

EUR/USD: The EUR/USD closed with a bullish weekly candle and above 1.22 S/R.

Price action is consolidating in a 4hr chart triangle under 1.23 so watch for any new momentum-based trend line breakout.

Note that the longer-term target for any continued bullish movement, following the break of the 13-yr trend line, is the monthly 61.8% Fibonacci, near 1.40.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 1.23 followed by whole-numbers on the way up to a previous weekly chart High, circa 1.26, into focus. After that, watch for any continued push up 1.40.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 1.22 into focus followed by a support trend line and, then, 1.21, 1.20 and 1.19. The latter 1.19 is near the 4hr chart’s 61.8% Fibonacci.

- Watch the 4hr chart triangle trend lines for any new breakout:

AUD/USD: The Aussie closed with a bullish weekly candle and just above 0.76 making this the support level to watch for any new make or break.

There are revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout and take special note of the declining momentum on the 4hr chart. The bullish run has gone on here for 7 weeks and so a pause or pullback would not surprise.

NB: Keep in mind that price action continues to hold above the recently broken upper trend line of the multi-year bullish-reversal Descending Wedge.

Bullish targets: Any bullish 4hr chart triangle trend line breakout would bring 0.77 followed by whole-number levels on the way up to the weekly chart’s Descending Wedge breakout target of 0.90 into focus.

Bearish targets: Any bearish 4hr chart triangle trend line breakout below 0.76 would bring a support trend line into focus followed by whole numbers on the way down to 0.72 as the latter still lies near the 4hr chart’s 61.8% Fibonacci.

- Watch 0.76 and for any new 4hr chart triangle trend line breakout;

AUD/JPY: The AUD/JPY closed with a small, bullish weekly candle, still above a 7-yr bear trend line and now just below 79 S/R making this the level to watch for any new make or break.

The 79 is a major S/R zone for the AUD/JPY as the monthly chart below reveals. As with the AUD/USD, the bullish run here has gone on for 7 weeks and so a pause or pullback under this major resistance zone would not surprise.

There are revised 4hr chart trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart trend line breakout above 79 would bring 80 into focus.

Bearish targets: Any bearish 4hr chart support trend line breakdown would bring 78, 77.5 and, then, the 77 and 7-yr trend line region into focus.

- Watch 79 S/R and for any new 4hr chart momentum trend line breakout;

NZD/USD: The Kiwi closed with yet another bullish-coloured Spinning Top weekly candle but, now, just above the 0.71 level.

There are revised trend lines on the 4hr chart so watch these for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 0.72 followed by whole-number levels on the way up to 0.75 into focus as this is the next major horizontal S/R zone.

Bearish targets: Any bearish 4hr chart triangle breakout below 0.71 would bring 0.70 and 0.69 back into focus.

- Watch the triangle trend lines and 0.71 for any new breakout:

GBP/USD: The Cable closed with a bullish weekly candle and just above the 1.35 S/R level and above the 14-year bear trend line making this the region to watch for any new make or break.

The longer-term target for any bullish breakout and continuation above the 40-yr trend line is the 61.8% Fibonacci, near 1.75 (see monthly chart).

As mentioned earlier, post-Brexit trade negotiations continue to be a vexed issue so GBP traders should keep abreast of news updates in this space.

There are revised trend lines on the 4hr chart so watch these for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart hold trend line breakout would bring whole-number levels on the way up to 1.40 into focus followed by further whole-number levels on the way up to 1.75.

Bearish targets: Any bearish 4hr chart retreat from 1.35 would bring 1.34, the 14-year bear trend line and 1.33 followed by the 7-month support trend line into focus.

- Watch the 4hr chart triangle trend lines for any new momentum breakout:

USD/JPY: The USD/JPY closed with a bearish weekly candle after testing down near 103 S/R during the week. This is the new support level to watch in coming sessions for any new make or break.

There are also revised 4hr chart triangle trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart triangle breakout would bring 104 followed by the 4-month bear trend line into focus.

Bearish targets: Any bearish 4hr chart triangle breakout would bring 103 into focus.

- Watch for any 4hr chart triangle breakout:

GBP/JPY: The GBP/JPY closed with a bullish-coloured, almost ‘Inside’, weekly candle reflecting indecision as price action, once again, navigates near the 40-yr bear trend line.

The longer-term target for any bullish breakout and continuation above the 40-yr trend line is the 61.8% Fibonacci, near 170.

The GBP/JPY closed just under 140 S/R making this the level to watch for any new make or break.

There are revised 4hr chart wedge trend lines to monitor for any new momentum-based breakout.

Bullish targets: Any bullish 4hr chart wedge breakout would bring the 40-yr trend line and 140 S/R into focus. The longer-term target for any bullish breakout and continuation above the 40-yr trend line is the 61.8% Fibonacci, near 170.

Bearish targets: Any bearish 4hr chart wedge breakout would bring whole-numbers on the way down to the weekly chart’s support trend line into focus.

- Watch the 4hr chart’s wedge trend lines for any new breakout.