The release of private US jobs data last session triggered a bit of market movement and could be a window into what might be ahead for Friday’s US NFP release. The private ADP jobs report revealed fewer jobs were gained which, rather surprisingly, helped to lift the US$. I would have thought this would weaken the US$ dollar as thoughts and/or talk of early stimulus tapering might subside but, I am certainly no economist. Today brings the BoE rate update so watch the GBP pairs for any reaction.

ADP result: The ADP Jobs report: weaker than expected:

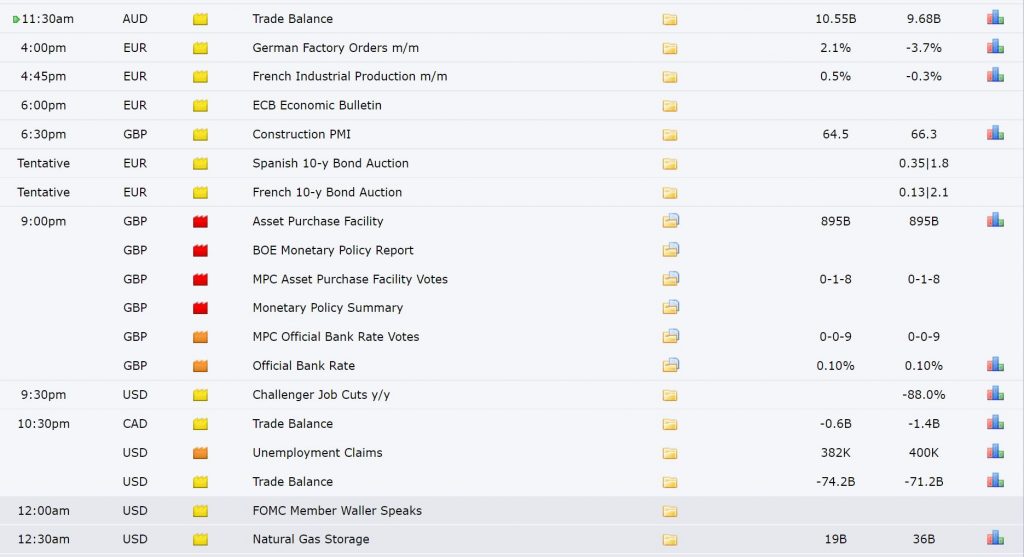

Data:

DXY weekly: now showing green but no new b/o as yet:

Trend line breakouts:

EUR/USD 4hr: still in an uptrend for now following the recent wedge b/o:

NZD/USD 4hr: stalled at the 0.71 level following the recent wedge b/o:

Other markets:

S&P500 4hr: still consolidating around the 4,400 level:

ASX-200 4hr: still consolidating under the 7,500 level:

Gold 4hr: choppy BUT still still consolidating within the triangle:

AUD/USD 4hr: still consolidating under the 0.74 level:

AUD/JPY 4hr: consolidating under the 81 level:

GBP/USD 4hr: consolidating near the 1.39 level, on low momentum, ahead of today’s BoE update:

USD/JPY 4hr: a new wedge brewing here:

GBP/JPY 4hr: still consolidating ahead of today’s BoE update: