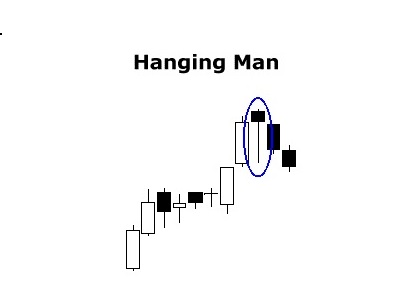

The four major US stock indices, S&P500, DJIA, NASDAQ and Russell-2000, closed the month of February by printing bearish-reversal Hanging Man style candles. The four indices are holding above two-year support trend lines for now but some healthy respect, at a minimum, would be prudent given the print of these bearish monthly candles. In this post I […]

We had an exciting morning at the beach today with a shark alarm and Pol-Air chopper search. The rest of the morning and day has been by the pool and then a fun hour or so picking Aussie stocks to trade in the coming week. This is Hog Heaven for me! The following ASX stocks […]

US Stocks have been experiencing some wild moves of late so I thought I’d take a look at the charts to put these moves into greater perspective. Whilst the point moves on the indices sound rather large and extreme the charts paint a slightly different picture.

The recent activity and discussion with Bond prices and Interest Rates motivated me to look back over my charts of TMV. I wrote an article about this ETF around this time last year and it can be found through the following link. It has been a long wait to see any sign of a decent upward […]

The significant resistance level of $1,400 looms large ahead for Gold and this is the key level to watch for any new make or break on the precious metal in coming sessions. This resistance zone is being reflected in the price action across some Gold stocks as well and so I thought I’d share the […]