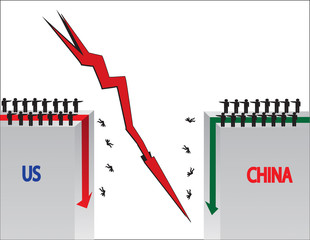

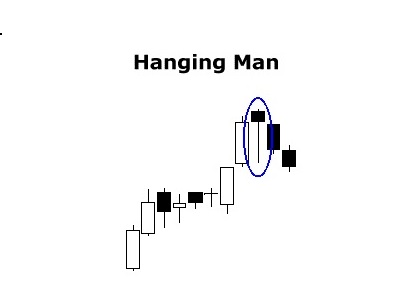

The S&P500 printed a bearish-reversal ‘Hanging Man’ candle for February and there has been bearish follow-through so far this March. The fear of a China – US tariff war has undermined stock market confidence over recent sessions but, when one looks over some charts, and especially the illustrious FANG charts, it seems a bit of a […]

I’ve been charting and posting about Bitcoin over recent months and suggesting that any hold above a key support level would help to carve out credibility for the cryptocurrency space. So far so good and here is a charting update following the bullish February candle close for Bitcoin.

The four major US stock indices, S&P500, DJIA, NASDAQ and Russell-2000, closed the month of February by printing bearish-reversal Hanging Man style candles. The four indices are holding above two-year support trend lines for now but some healthy respect, at a minimum, would be prudent given the print of these bearish monthly candles. In this post I […]

The stronger US$ has driven some trend line breakout moves but watch again today with another Fed Chair Powell testimony in case this shifts US$ sentiment at all. There is also GBP Manufacturing PMI data to navigate. And, by the way, Bitcoin has printed a bullish-reversal candle for February!

We had an exciting morning at the beach today with a shark alarm and Pol-Air chopper search. The rest of the morning and day has been by the pool and then a fun hour or so picking Aussie stocks to trade in the coming week. This is Hog Heaven for me! The following ASX stocks […]