This is an example of where the ADX was a better warning than Volume on the SPY ETF. I Tweeted this warning during the late Asian session on Thursday 25th June 2020 and the this proved to be sound advice!

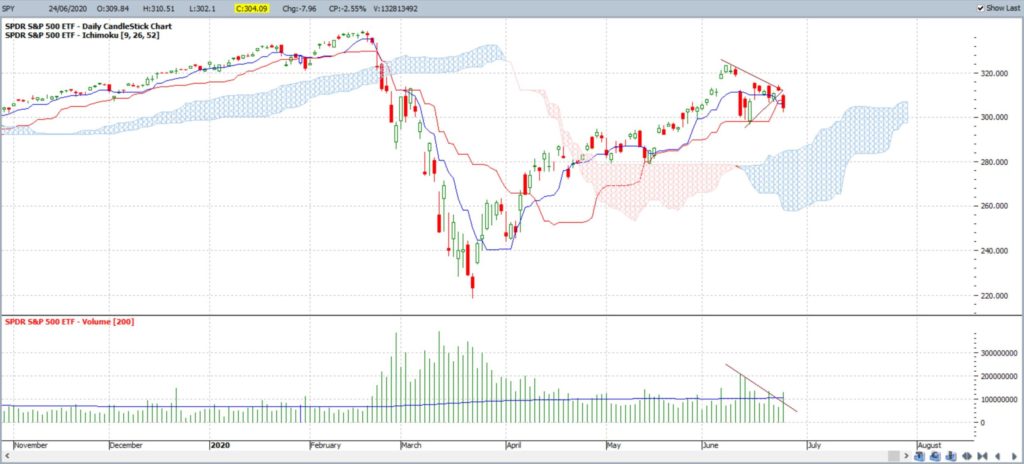

SPY daily + Volume: this triangle pattern had been mapped out prior to the breakout that triggered on June 24th 2020. Note how there was a Volume spike with this breakout. This, alone, may have drawn some traders into shorting stocks.

SPY daily + ADX: However, note how the ADX remained below the 20 threshold for this breakout. This was the reason I suggested some caution might be needed here:

The next day:

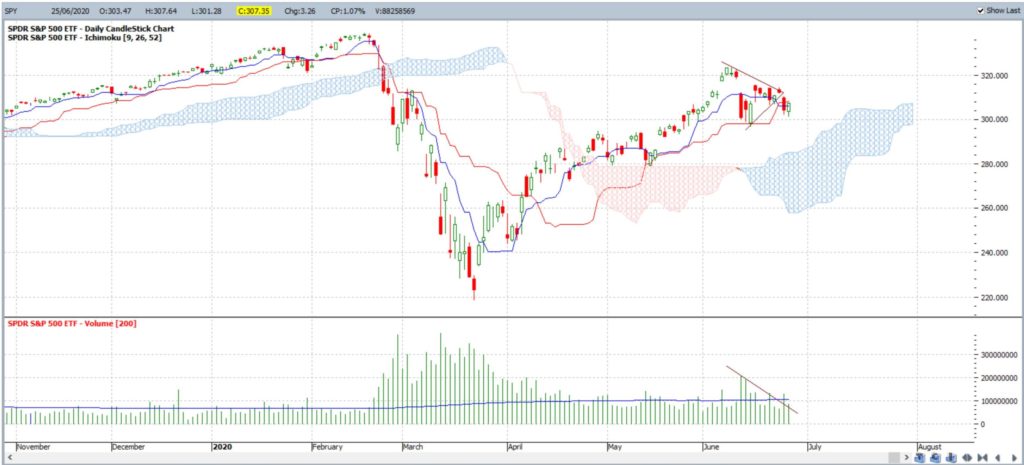

SPY daily + Volume: the next trading day was one of buying; albeit on lower Volume:

SPY daily + ADX: the ADX is still below the 20 level and is of little surprise really as the major index, S&P500, tries to hold above the 3,000 level for the next few days until the end of month, quarter and half:

Final word: I urge all traders to consider ADX momentum as well as Volume when making any trading decision based on trend line breakouts.