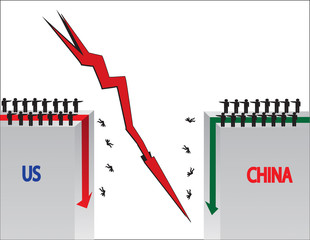

A previous instance of Trade Tariffs was parodied in the movie Ferris Bueller’s Day Off and some might recall the example from the…’anyone, anyone‘ scene. However, the parallel to the current tariff situation cannot be ignored and was the topic of my morning walk podcast which I highly encourage you listen to.

Gold: Gold has been the major beneficiary of the recent trade war situation and the precious metal has traded higher printing a large, essentially, bullish engulfing candle for the week. Any continued trade war tension would help to underpin this move in Gold which could then flow through to Gold stocks, especially if Gold breaks up […]

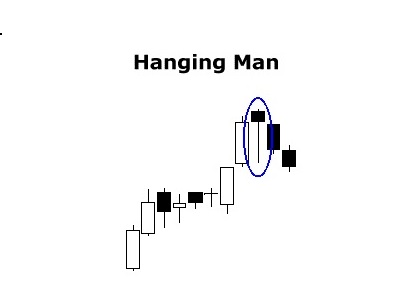

The S&P500 printed a bearish-reversal ‘Hanging Man’ candle for February and there has been bearish follow-through so far this March. The fear of a China – US tariff war has undermined stock market confidence over recent sessions but, when one looks over some charts, and especially the illustrious FANG charts, it seems a bit of a […]

I’ve been charting and posting about Bitcoin over recent months and suggesting that any hold above a key support level would help to carve out credibility for the cryptocurrency space. So far so good and here is a charting update following the bullish February candle close for Bitcoin.

The four major US stock indices, S&P500, DJIA, NASDAQ and Russell-2000, closed the month of February by printing bearish-reversal Hanging Man style candles. The four indices are holding above two-year support trend lines for now but some healthy respect, at a minimum, would be prudent given the print of these bearish monthly candles. In this post I […]